Earn up to 3.20% p.a.1 GUARANTEED return.

That's S$8,5291 after 5 years on your S$50,000 savings!

Dash PET 2 by Etiqa Insurance, is Singapore's top-rated insurance savings plan

that lets you save and protect yourself better with 100% capital guaranteed!

How does Dash PET 2

take care of

you?

Protect

• Each plan comes with FREE Life Protection of 105% account value

• Add on MORE protection from just 2 cents a day

Earn

• Save from just S$50 with 100% capital guaranteed and earn up to 17.06% returns upon maturity

• Stack bonus returns of up to 0.75%^ p.a. with add-on protections

• Interest is accrued daily and credited monthly

Transact

• No restrictions on how you can use your basic account. Use it to pay premiums for your insurance protection or for everyday expenses.

Sign-up Perks

With the flexible basic plan, choose to add on

1/3/5-year fixed plan riders to your base plan as per your savings goal:

Flexible basic plan

No restrictions on withdrawals,

minimum account balance of S$1.

Use it to transact everyday expenses

Earn up to

S$497

(Based on S$50,000 savings)

Crediting rate

1.0%* p.a.

Min. deposit: S$50 to maintain interest. Max. savings: S$50,000.

Interest is accrued on the first S$50,000 for Dash PET 2

The longer you save, the MORE the returns!

1-year fixed plan

Ideal for those new to saving

S$1,4002

(Based on S$50,000 savings)2.80% p.a.

Total 2.80% maturity returns

#Min. deposit: $S1,000. Max. savings S$200,000.

Not sure if you can commit to long-term disciplined saving? Test it out with a 1-year fixed plan

first.

3-year fixed plan

Ideal for seeking short-term guarantees

S$4,6363

(Based on S$50,000 savings)3.00% p.a.

Total 9.27% maturity returns

#Min. deposit: $S1,000. Max. savings S$200,000.

The current interest rates hike may not continue indefinitely. Lock in your guaranteed returns for

the next 3 years now.

5-year fixed plan

Ideal for seeking mid-term high returns

S$8,5291

(Based on S$50,000 savings)3.20% p.a.

Total 17.06% maturity returns

#Min. deposit: $S1,000. Max. savings S$200,000.

Let your idle cash earn a better interest for a longer time. Grab your guaranteed returns for the

next 5 years now.

Calculate your potential returns and

watch your PET grow based on your savings!

Please note that the calculator is just for your own understanding and is not based on actual system calculation.

Actual returns may differ.

Your PET can protect you

Dash PET comes with FREE Life Protection of 105% account value.

Enjoy up to 0.75%^ p.a. additional interest

on your Dash PET 2 savings when you add more coverage:

Major Cancer

From S$0.03/day^^

• Covers critical stage cancers, including leukemia, lymphoma and sarcoma

• Complements existing Critical Illness plans

Death & Total and Permanent Disability

From S$0.03/day^^

• Lump sum payment in the event of death or inability to perform 3 out of 6 Activities of Daily Living

Accidental Death

From S$0.02/day^^

• Lump sum payment in the event of accidental death

Get Dash PET here.

Download the App to get started.

Sign up and let Dash PET 2 take care of you.

Frequently Asked Questions

What is Dash PET ?

Dash PET is an insurance savings plan that offers savings at high returns, with capital guaranteed and flexibility of funds. Grow your Dash PET while it takes care of your financial health.

Dash PET life insureds are also covered for life protection.

The policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

What are the benefits of Dash PET ?

As a Dash PET life insured, you enjoy:

- High returns, capital guaranteed - Find out more on the crediting rates you enjoy here

- Easy requirement: Start saving from just S$50 up to S$50,000

- Flexibility for partial withdrawals (Refer to your Policy documents for more details)

- Wealth accumulation with guaranteed returns for the 1/3/5-year fixed plans

- Affordable add-on protection: Life coverage from as low as 2 cents a day with additional returns on your savings

- Investment opportunities with Dash PET Plus, our investment-linked plan, designed to earn you potential higher returns.

Dash PET is a yearly renewable policy. What does this mean ?

This is a yearly renewable plan and the policy term is 1 year. At the end of 1 year policy term, this policy will be renewed automatically for another 1 year at the same conditions on the expiry date before renewal, so long as the following conditions are met:

- this policy is in force on the expiry date before the renewal; and

- you (life insured) have not reached age 100 at the renewal date.

Etiqa Insurance reserves the right to terminate this policy by giving 90 days’ notice. Upon termination, Etiqa will refund the account value, less any amounts owing to Etiqa.

What are the returns for Dash PET and how are they calculated ?

Dash PET life insureds will earn interest on the account value for the first policy

year. Find out more on the crediting rates you enjoy here

The minimum average daily account value balance is S$50 to be eligible for interests and

other policy benefits.

Receive up to 0.25% p.a. on the first S$10,000 of your Dash PET account value, for each active

add-on protection.

The returns are calculated daily based on the crediting rate. Returns will be credited on the

1st of every calendar month.

What is Dash PET insurance coverage ?

In the event of death during the policy term, 105% of your account value will be paid as the death

benefit and the policy ends. Please refer to your Policy Terms and Conditions for details.

All Dash PET users may add up to three add-on protection plans to their existing Dash PET policy.

Who can sign up for Dash PET ?

Dash PET is applicable for eligible Singtel Dash users aged between 17 to 75 (at next birthday) with

a valid Singapore NRIC or Singapore residency/work pass. Sign up or log in to Singtel Dash app to

check your eligibility.

Please note that all applications are subjected to the acceptance by Etiqa Insurance Pte. Ltd..

Only one Dash PET policy per individual is allowed at any point in time, regardless whether your

policy is active or inactive. This policy is subject to Eligibility Rules. For more information on

Eligibility Rules, please refer to https://www.tiq.com.sg/Eligibility-rules.pdf.

I already have Dash EasyEarn. Can I sign up for Dash PET ?

Yes you may! Dash EasyEarn and Dash PET are different policies, so you can save with both plans and enjoy the respective high rates of return. You are allowed to hold one Dash EasyEarn and one Dash PET policy at any time.

Can I re-activate my policy if I free-look or surrender the policy ?

Once you request for a freelook or surrender on your policy, you will not be able to make another purchase of this policy within a certain period. Refer to your Policy Terms and Conditions for more details.

How do I manage my account ?

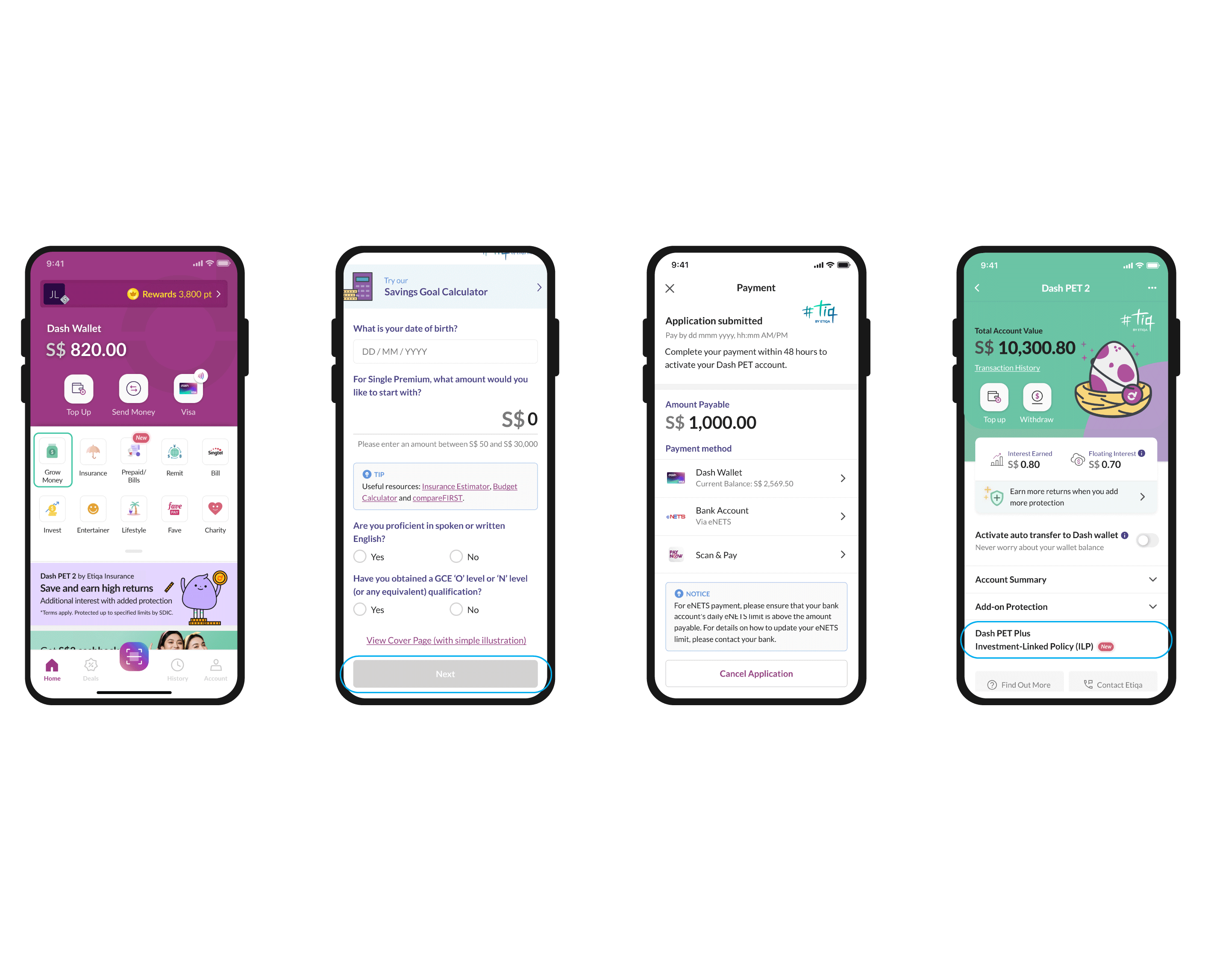

Everything’s on Singtel Dash app! Launch Dash > Home screen > ‘Grow Money’ tile to access and manage your account.

- View Dash PET policy details

- Top up your account

- Make transfers and withdrawals of funds

How do I grow my Dash PET ?

Grow your Dash PET by increasing your account value.

Manage your Dash PET on Singtel Dash app! Launch Dash > Home screen > ‘Grow

Money’ tile to access your Dash PET dashboard.

How do I top up my account ?

Select any of these options to top up your Dash PET account from S$1:

- Dash Wallet

- Bank Account via PayNow

- Bank Account via eNets (minimum S$50).

Ad-hoc top-up available for up to age 75 (age next birthday) only.

What are the ways to make a partial withdrawal ?

You may make partial withdrawals from as little as S$1.

- Transfer to Dash Wallet

- Bank account via PayNow (70 cents apply per transaction)

Maintain an average daily account value balance of at least S$50 to continue earning interests for that month and maintain at least S$1 of account value to keep your policy active.

How much can I withdraw ?

Dash PET offers flexibility of withdrawals. For policies purchased from 12 August 2022 to 27

February 2023 the maximum withdrawal amount is 10% of your Single Premium and Top-ups (excluding

insurance cover charge of the optional add-on protection) in the first policy year. There is no

withdrawal limit from the second year onwards. Please refer to Policy Terms and Conditions for full

details.

If you wish to make a full withdrawal, you will need to request to surrender your policy.

Please note that once your policy is surrendered, the add-on protection tagged to your

policy will also be terminated and you may not make another purchase of this policy within a certain

period.

We reserve the right to delay the payment of the withdrawal amount/surrender benefit for up

to a period of 6 months from the date of the withdrawal/surrender request. We will exercise this

right when there is a surge in withdrawals (partial/full) within the Portfolio during a very

short period of time.

What are the add-on protection plans available, and their benefits ?

Dash PET users may activate the following add-on protection from as low as 2 cents a day:

- Major Cancer

- Accidental Death

- Death & Total and Permanent Disability

For each add-on life protection, you may enjoy the following:

- Be covered from S$10,000 to S$100,000 sum assured

- Affordable premium from as low as 2 cents a day

- Seamless daily payment right from your Dash PET account

ADDITIONAL INTEREST ON YOUR SAVINGS:

Receive up to 0.25% p.a. on the first S$10,000 of your Dash PET account value for each active paid

add-on protection.

For more details of each of the available plans, click here.

How do I pay for the premiums for my add-on protection ?

For the add-on life protection. your premium will be paid on a daily basis via your Dash PET

account.

Keep a healthy minimum daily account balance of at least S$50 to ensure that your add-on

protection plans stay active and you continue enjoying earning your returns.

Can I change my add-on life protection coverage (sum assured) ?

Yes, the coverage (sum assured) amount for add-on live protection can be changed from S$10,000 to

S$100,000, in multiples of $1,000.

- Launch Dash app > Grow Money > Dash PET > “Add-on Protection” tab

- Select your add-on protection

- Update your sum assured and submit

The change will be effective within one working day. Waiting period, if any, will restart with each

change.

Important: An increase in sum assured will also increase the daily premium payable, do

ensure sufficient funds in your Dash PET account.

Am I eligible for the complimentary add-on protection plan ?

The complimentary add-on protection is only made available to Dash PET customers with policy start date from 27 April 2021 to 11 August 2022.

What if I change my mind ?

Dash PET has a 14-day free look period within which you may request to cancel the policy

when you access your Dash PET dashboard within Dash app.

While your policy is active and in force, you may withdraw your funds partially anytime up to

the maximum withdrawal limit. Do note that a policy surrender will terminate your account

and all add-on protection plans tagged to your Dash PET policy, where applicable.

What happens if I want to surrender my policy or file a death claim ?

To surrender your policy, you may WhatsApp Etiqa’s Customer Care Consultants at +65 6887 8777 during

operating hours – Mondays to Fridays, 8.45am to 5.30pm (excluding public holidays). You may select

your payout option of PayNow (NRIC) or Direct Credit.If your policy is purchased from 12 August 2022

to 27 February 2023, surrender charges of 10% of your total Account value less partial withdrawal

limit (if any) apply for first policy year.

The add-on protection plans and fixed-year plans are tagged to your Dash PET policy. In the event

that you wish to surrender your Dash PET policy, the add-on protection plan(s) and fixed year

plan(s) will also be de-activated.

To file a claim, please WhatsApp Etiqa’s customer care consultants at +65 6887 8777 from Mondays to

Fridays (excluding Public Holidays), 8.45am to 5.30pm within 3 months of the occurrence of the claim

event.

Who is Etiqa Insurance ?

Etiqa Insurance Pte. Ltd. is a licensed life and general insurance company registered in the Republic of Singapore and governed by the Insurance Act. It is an insurance arm of Maybank Group which is among Asia’s leading banking groups and South East Asia’s fourth largest bank by assets. To know more about our corporate profile, visit our website at www.etiqa.com.sg.

I have further queries on my Dash PET policy, who should I contact ?

For general enquiries on Dash PET, visit https://direct.lc.chat/5701831/628 to start a live

chat with Etiqa Insurance’s agents immediately.

For enquiries on your existing Dash PET policy, please WhatsApp Etiqa's customer care

consultants at +65 6887 8777 from Mondays to Fridays, 8.45am to 5.30pm (excluding

public holidays).

Policy Terms and Conditions

(Issued before 12 August 2022): Dash PET

Policy Terms and Conditions

(Issued 12 August 2022 to 27 March 2023): Dash PET

Policy Terms and Conditions

(Issued 30 May 2023 and after): Dash PET 2

Policy Summary

(Issued before 12 August 2022): Dash PET

Policy Summary

(Issued 12 August 2022 to 27 March 2023): Dash PET

Policy Summary

(Issued 30 May 2023 and after): Dash PET 2

Terms and Conditions: 1-year fixed

plan | 3-year fixed plan |

5-year fixed plan

Product Summary: 1-year fixed plan | 3-year fixed plan | 5-year fixed plan

*Crediting rate for the basic plan is non-guaranteed.

1This is based on a 5-year fixed plan with S$50,000 savings, which earns a guaranteed return of

3.20% p.a. and matures after 5 years.

2This is based on a 1-year fixed plan with S$50,000 savings, which earns a guaranteed return of

2.80% p.a. and matures after 1 year.

3This based on a 3-year fixed plan with S$50,000 savings, which earns a guaranteed return of

3.00% p.a. and matures after 3 years.

#The minimum deposit per fixed plan is S$1,000 and the aggregate cap for all Dash PET and Dash PET 2 policies and fixed plan riders per Life Insured is S$500,000. Top-ups are not allowed.

Dash PET 2 is not a bank account or a fixed deposit. It is an insurance savings plan that earns a crediting

interest rate. Please visit https://tiq.com.sg/dash-plans-crediting-rates/ for the latest updates on the

prevailing crediting rates for your plans.

SingCash Pte. Ltd. Company Reg. No 201106360E (“Dash”) is the Group Policy owner of Dash PET 2.

These policies are underwritten by Etiqa Insurance Pte. Ltd. This content is for reference only and is not a

contract of insurance. Full details of policy terms and conditions can

be found in the policy contract. The information contained on this product advertisement is intended to be

valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision

of

any insurance product outside Singapore. As buying a life insurance policy is a long-term commitment, an

early

termination of the policy usually involves high costs and the surrender value, if any, that is payable to

you

may be zero or less than the total premiums paid. You are recommended to read the Policy

Illustration, Product Summary, Product Terms and Conditions and Frequently Asked Questions (where

applicable);

and seek advice from a financial adviser before deciding whether to purchase the product. If you choose not

to

seek advice, you should consider if the policy is suitable for you and meets your needs in light of your

objectives, financial situation and particular needs. For enquiries, please contact Etiqa Insurance.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore

Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is

required

from you. For more information on the types of benefits that are covered under the scheme as well as the

limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or

SDIC

websites (www.lia.org.sg or www.sdic.org.sg).

Information accurate as of 1 October 2023. This advertisement has not been reviewed by the Monetary Authority

of Singapore.

_Website_450x390.jpg)