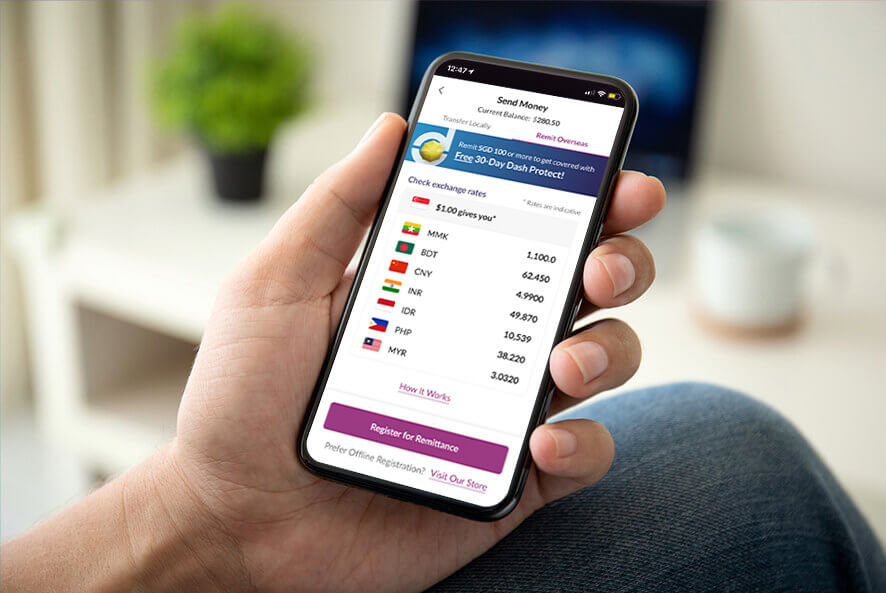

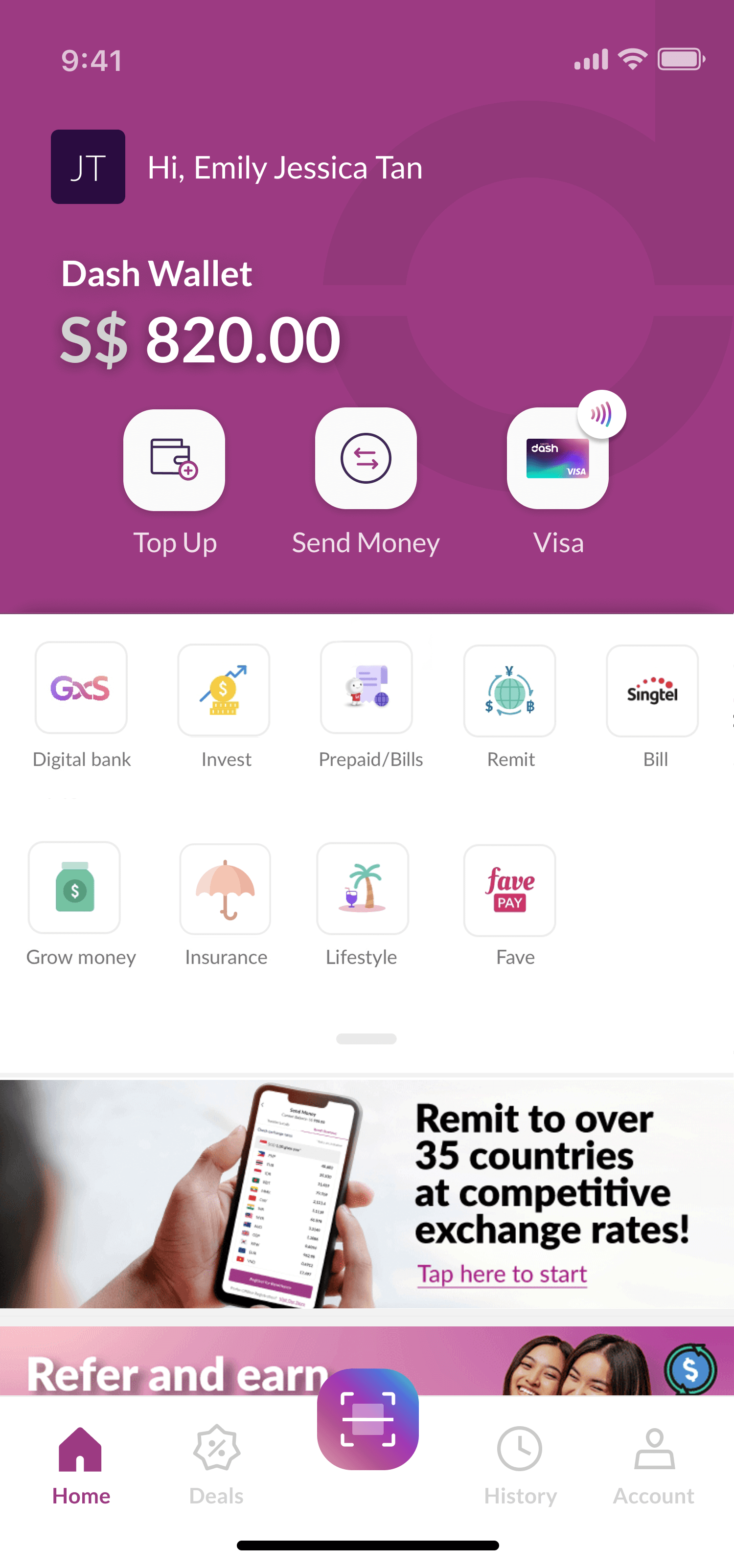

Use Dash Remit for overseas money transfers

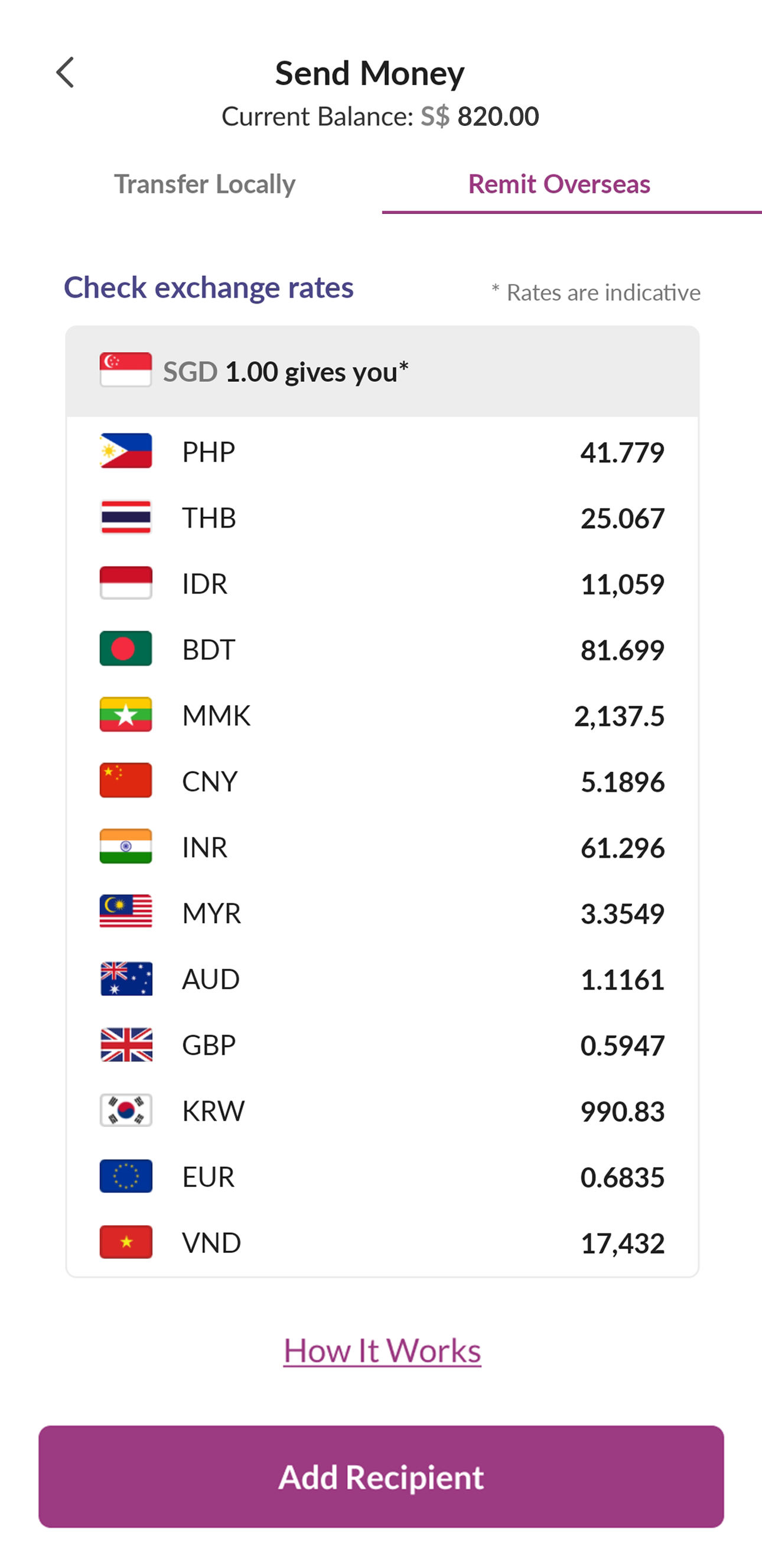

Our mobile remittance service is secure, provides competitive rates and enables you to transfer to over 35 countries in 12 currencies.

Check fees for

Featured Deals

Dash Remit: Enjoy fast transfers to more Indonesia e-wallets at SGD2.50 only

Only SGD5 to remit to WeChat

Dash Remit: More places to remit to, over 35 countries in 12 currencies!

Dash Remit: Get preferential exchange rates when you remit more!

Dash Remit: Up to SGD8 cashback when you remit to China

Open to all

local telcos

All you need is a local number

and a simple self-registration.

Safe and

worry-free

Track your remittance history through

the Singtel Dash app. The service is provided by SingCash Pte Ltd, licensed by Monetary Authority of Singapore and a subsidiary of Singtel.

Anytime,

anywhere

No queues, no hassle. We make

it easier for you to send money.

Remit anytime, anywhere

with your phone

Safe. Convenient. No hidden fees.

Remit money home to your loved ones in over 35 countries such as Australia, India, Indonesia, Malaysia, the Philippines, the United Kingdom, Vietnam and more—anytime, anywhere.

To remit overseas, simply download Singtel Dash and complete the simple

digital self-registration

through the app. You will need to take a photo of

your NRIC, Work Permit, S-Pass or Employment Pass,

and also take a selfie.

Alternatively, you can also visit us at Lucky Plaza #02-18/21. Click here for more information on our store address and operating

hours.

Remit anytime, anywhere

with your phone

Safe. Convenient. No hidden fees.

Remit money home to your loved ones

in Australia, Bangladesh, China, India, Indonesia, Malaysia,

Myanmar, the Philippines, Thailand and

the United Kingdom—anytime, anywhere.

To remit overseas, simply download Singtel Dash and complete the simple

digital self-registration

through the app. You will need to take a photo of

your NRIC, Work Permit, S-Pass or Employment Pass, and

also take a selfie.

Alternatively, you can also visit us at Lucky Plaza #02-18/21. Click here for more information on our store address and operating hours.

Stay home, stay safe

Remit anywhere with Dash!

Employers of Foreign Domestic

Workers/Workers

How to:

Working in Singapore

(SP WP EP LOC)

How to:

How do I use Dash to transfer money ?

For employers of Foreign Domestic Workers/Workers

Download Singtel Dash

Download Singtel Dash from the App Store, Google Play store or

HUAWEI AppGallery.

Once download is complete, sign up for a Singtel Dash account.

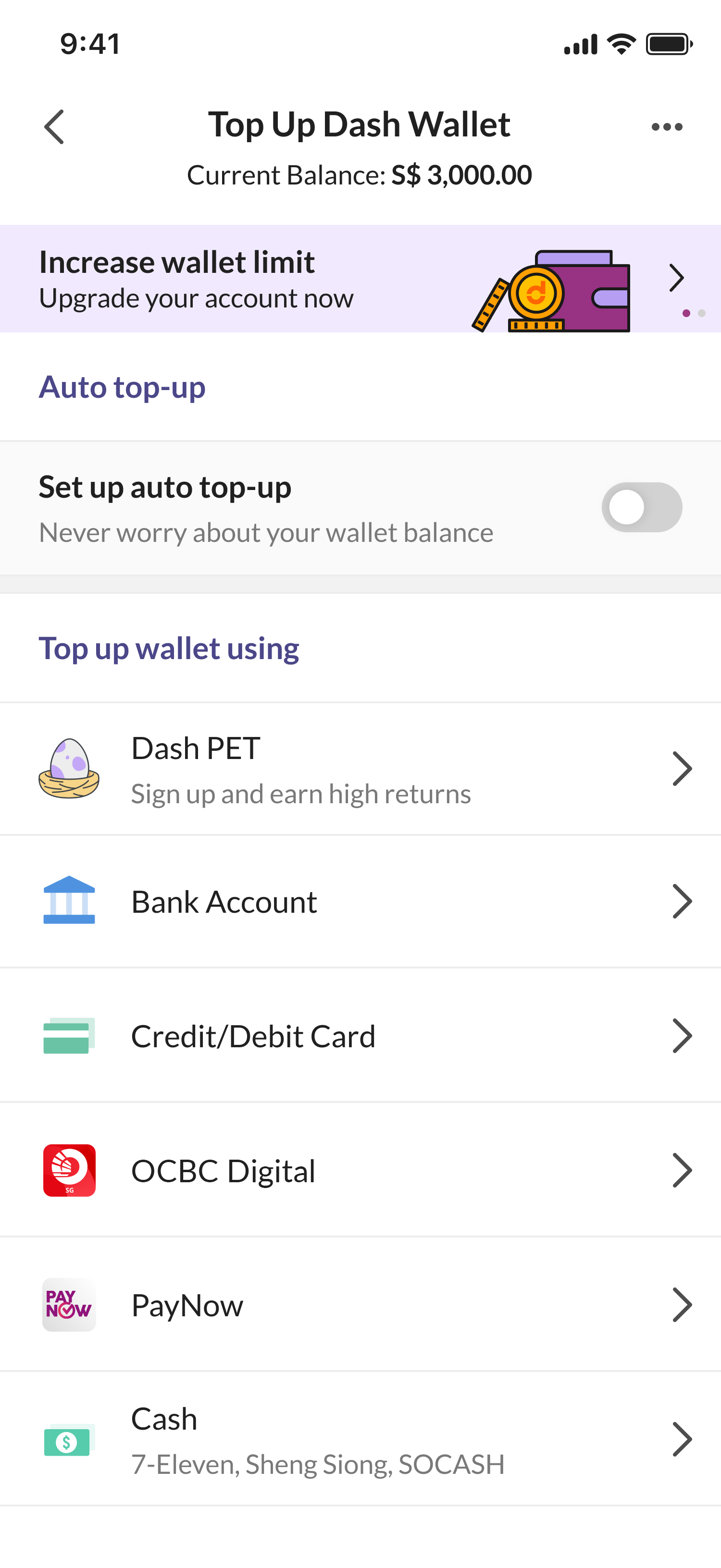

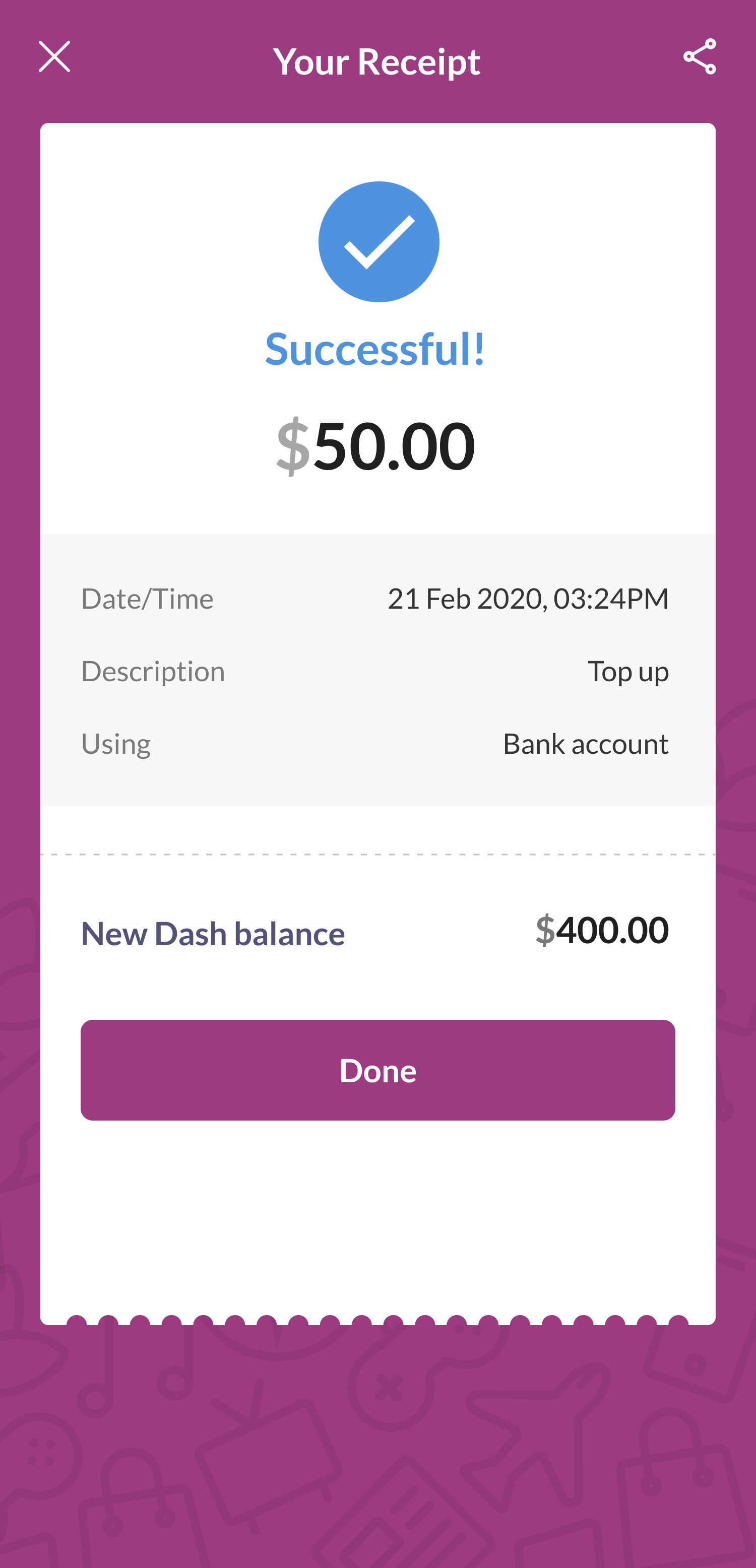

Top up Dash

You can top up your Dash balance directly from your Dash app or at

7-Eleven, AXS machine, Sheng Siong $TMs (Simple Teller Machines), Singtel shops, Singtel Exclusive Retailers and Singtel Prepaid Retailers.

To top up your Dash balance directly within the app, select TOP UP.

Select any of these preferred

top up method:

- Dash PET

- Bank Account

- OCBC Pay Anyone

- PayNow

- Cash-in QR

And you're done! You can now transfer money to your foreign domestic worker or worker.

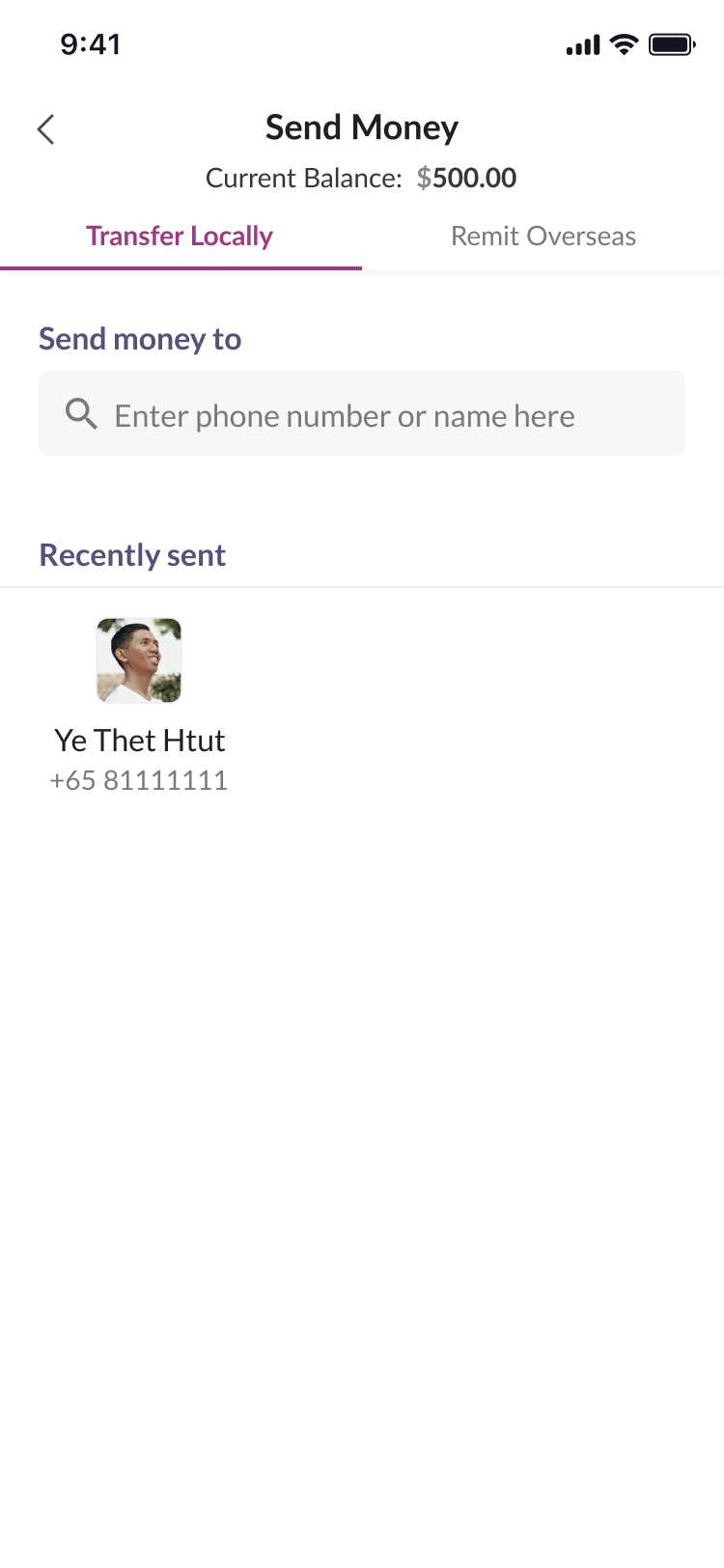

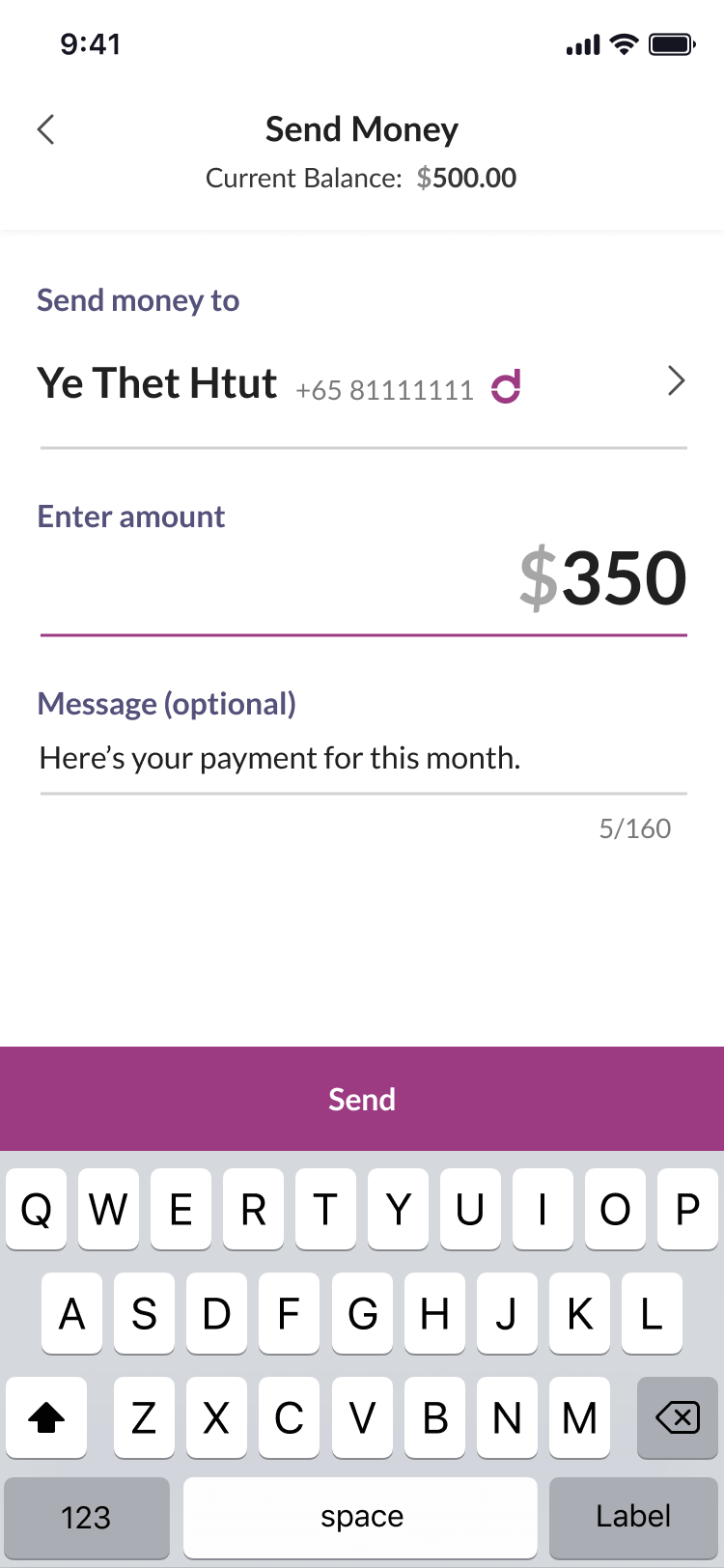

Transfer Money

Send money instantly to your foreign domestic workers or workers.

Transfer Locally > Select contact

Enter amount and message(optional).

Press "Send" to send money.

And you’re done!

Assist your worker

with remittance

How do I use Dash to send money home?

For those working in Singapore

(work pass holders)

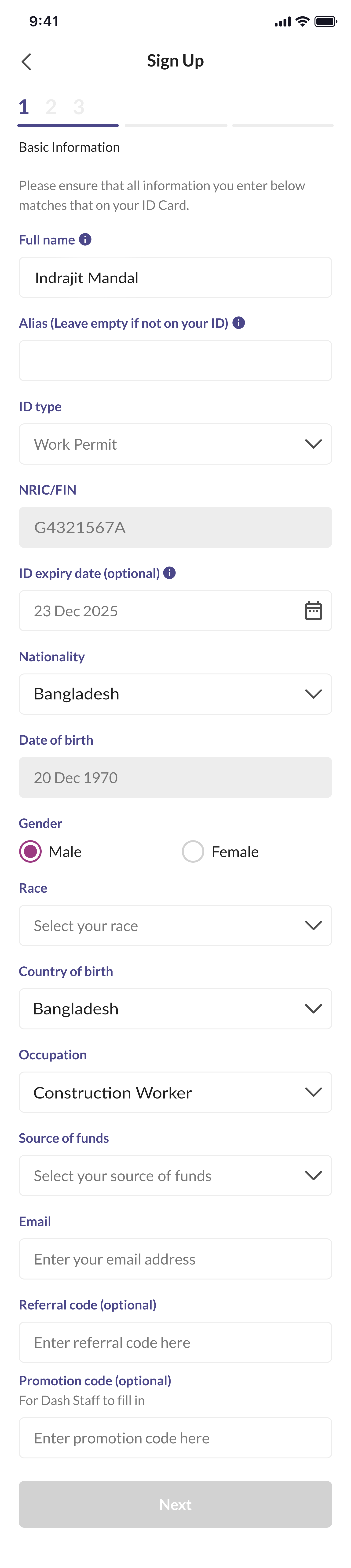

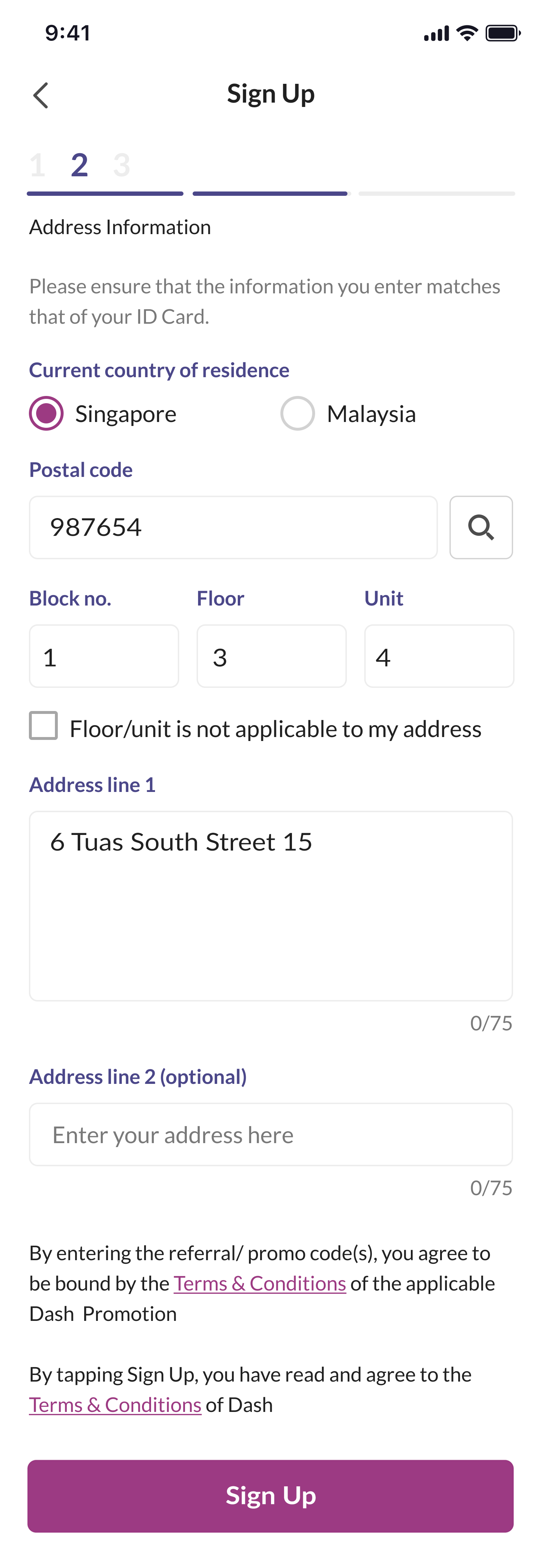

Register for remittance

by selecting ‘Register manually’ if you do not have Singpass.

Tips: Prepare your Singapore-issued ID card, proof of address (example: telco bill, bank statement, dormitory card, employment letter from MOM, water or electricity bill), and selfie

Enter your personal details.

Enter your address information.

Press ‘Upload documents’ to:

1. Take photo of back of work permit

2. Take a selfie

3. Take photo of your proof of address (example: telco bill, bank statement, dormitory card, employment letter from MOM, water or electricity bill)

Tap ‘Submit’ once completed.

Tick all the boxes to accept the terms and conditions, and select ‘Confirm’

You will receive an SMS in 1 -2 days, informing you if account verification is successful.

Top up Dash

You can top up your Dash balance directly from your Dash app or at

7-Eleven, AXS machine, Sheng Siong $TMs (Simple Teller Machines), Singtel shops, Singtel Exclusive Retailers and Singtel Prepaid Retailers.

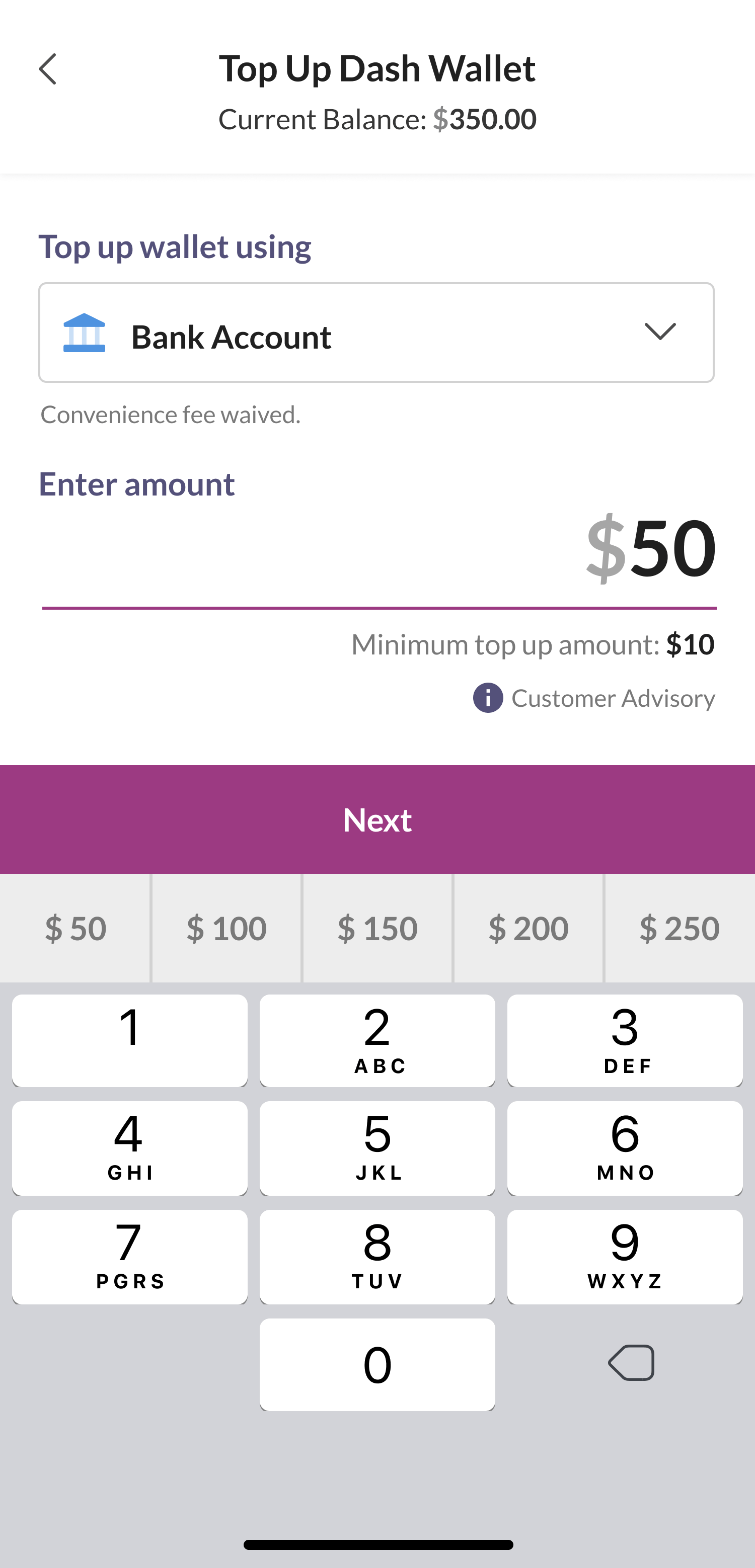

To top up your Dash balance directly within the app, select TOP UP.

Select any of these preferred

top up method:

- Dash PET

- Bank Account

- OCBC Pay Anyone

- PayNow

- Cash-in QR

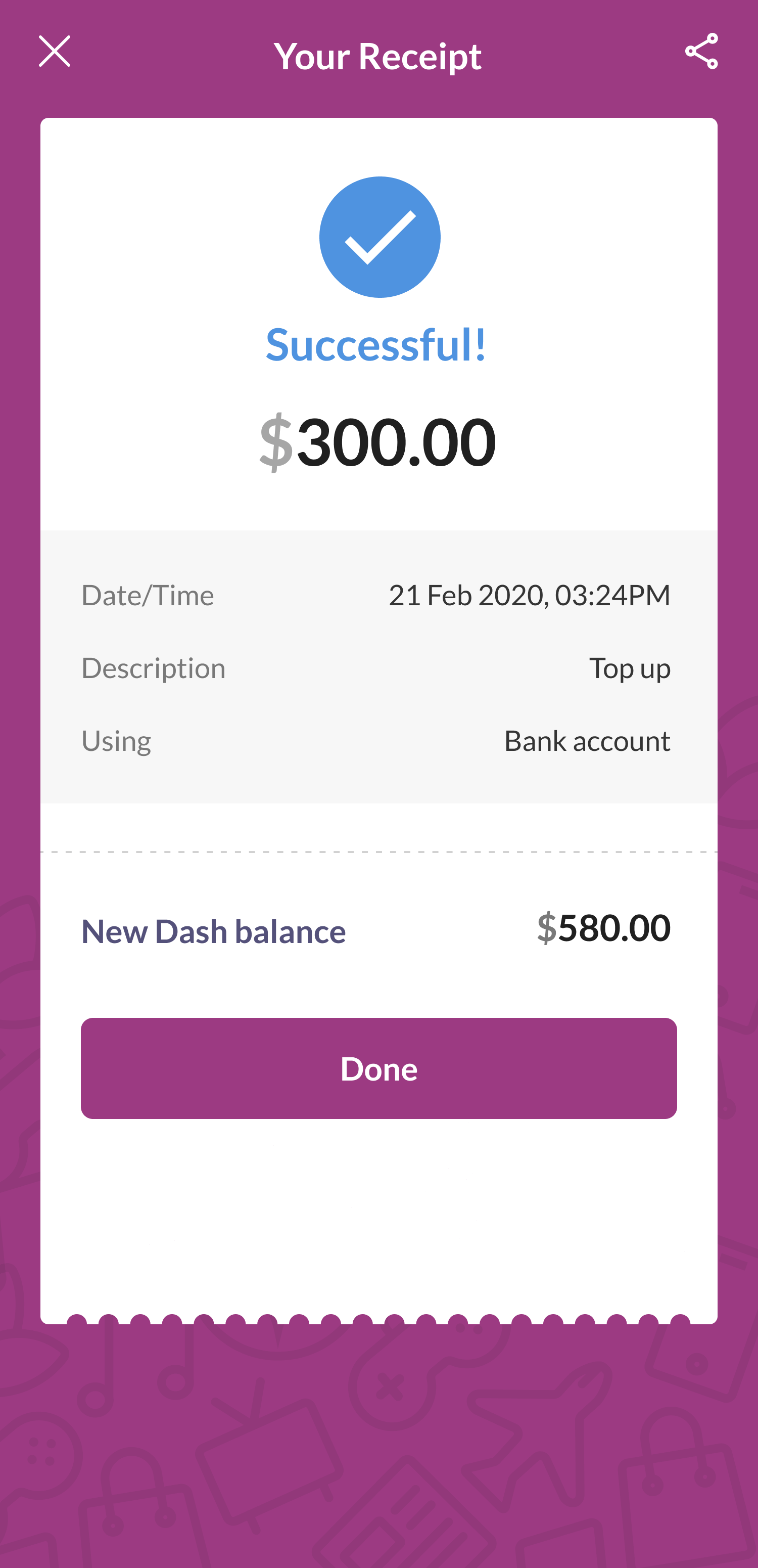

Here's how you can top up with your bank account:

Select Bank Account.

Next, select your top up amount and press Next to proceed.

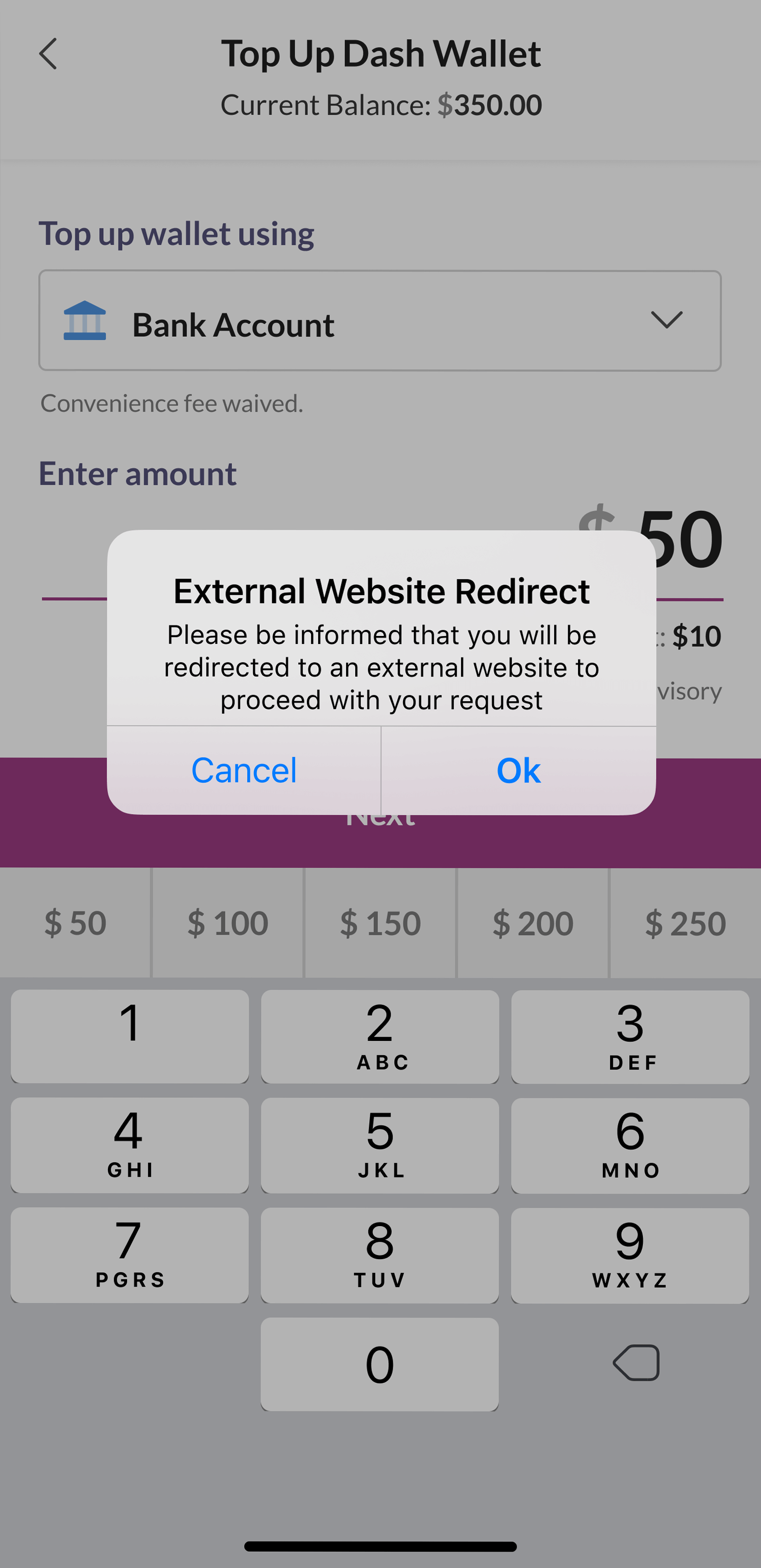

You will be redirected to the eNETS top up portal.

Select your preferred bank > enter your email address for eRECEIPT notification > press submit to proceed.

And you're done!

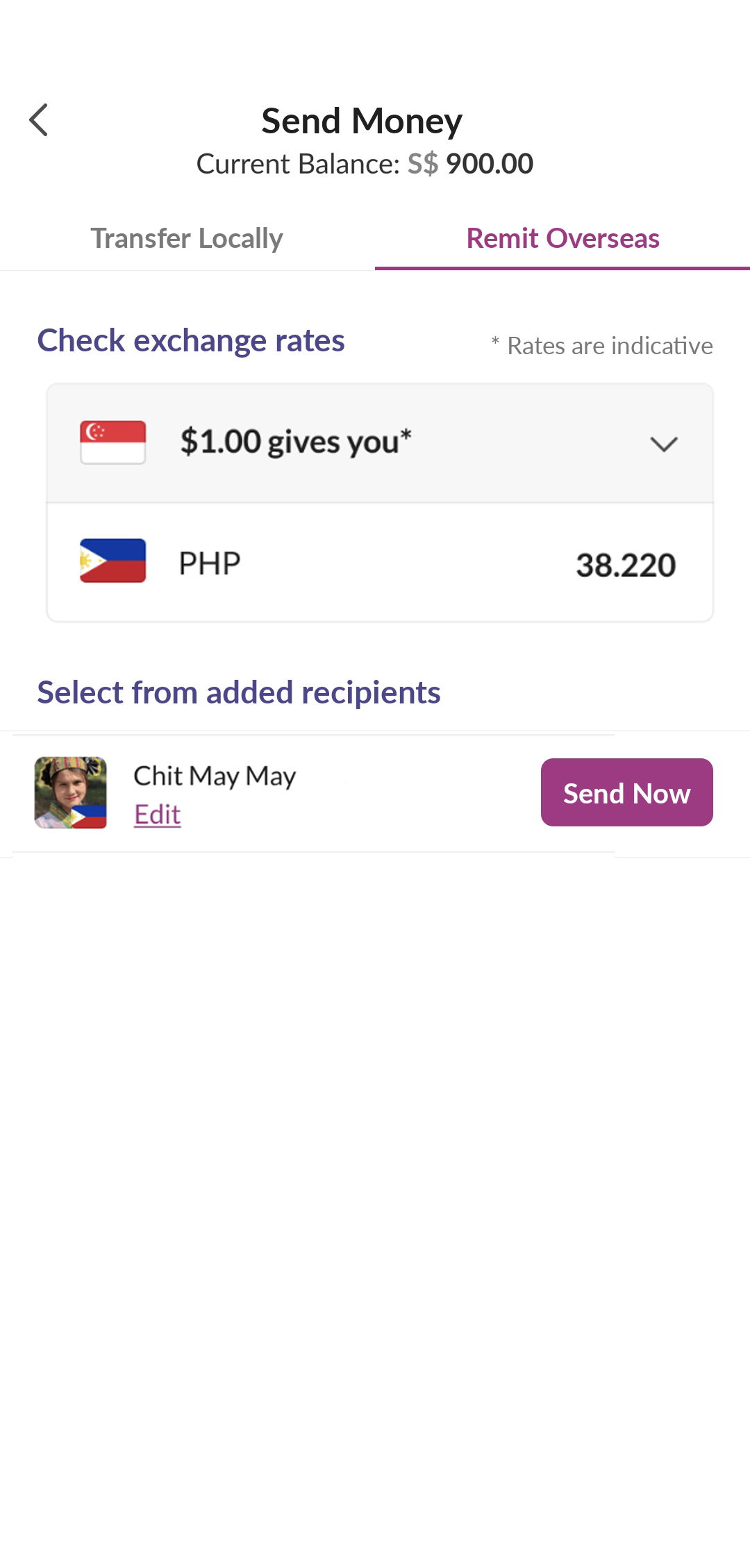

Add Beneficiary

To add a recipient who will receive your transfer, launch your Dash app, select Remit > Add a Recipient

Select Add Another Recipient

- Select the receiving country and preferred remittance service.

- Enter the Beneficiary's details as per indicated in the fields and select REGISTER to proceed.

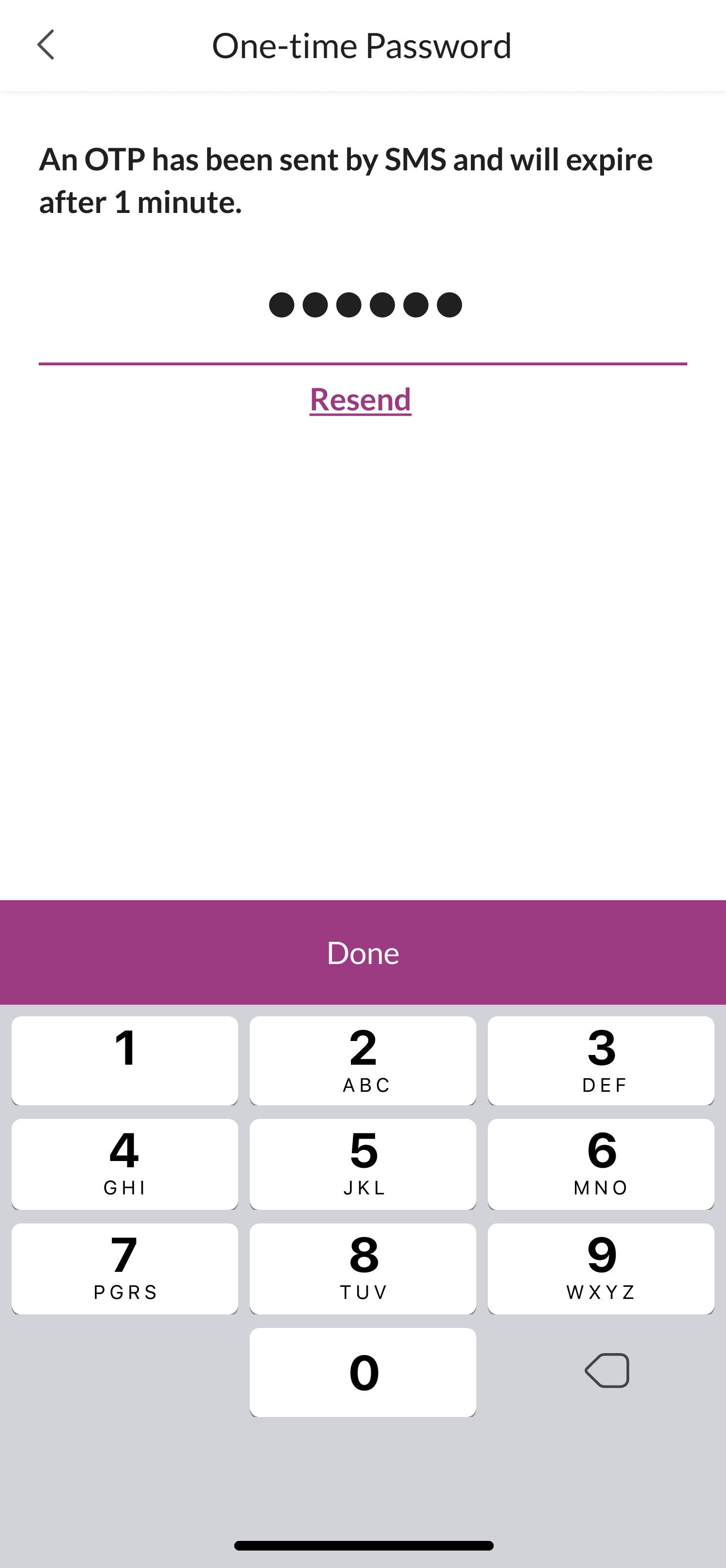

Enter the OTP sent to you via SMS.

And you're done!

Screenshot this screen to keep a record of your added beneficiary details.

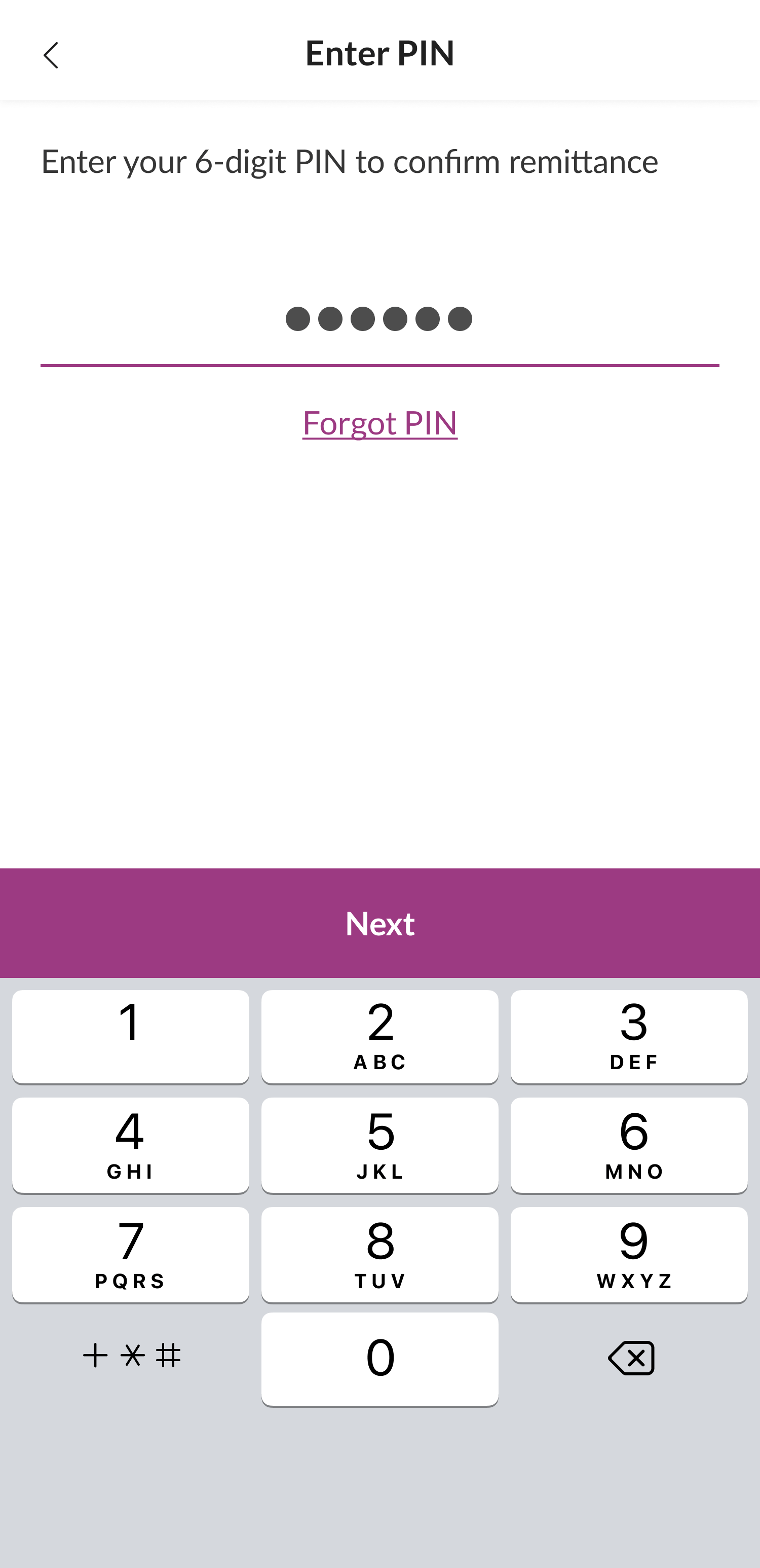

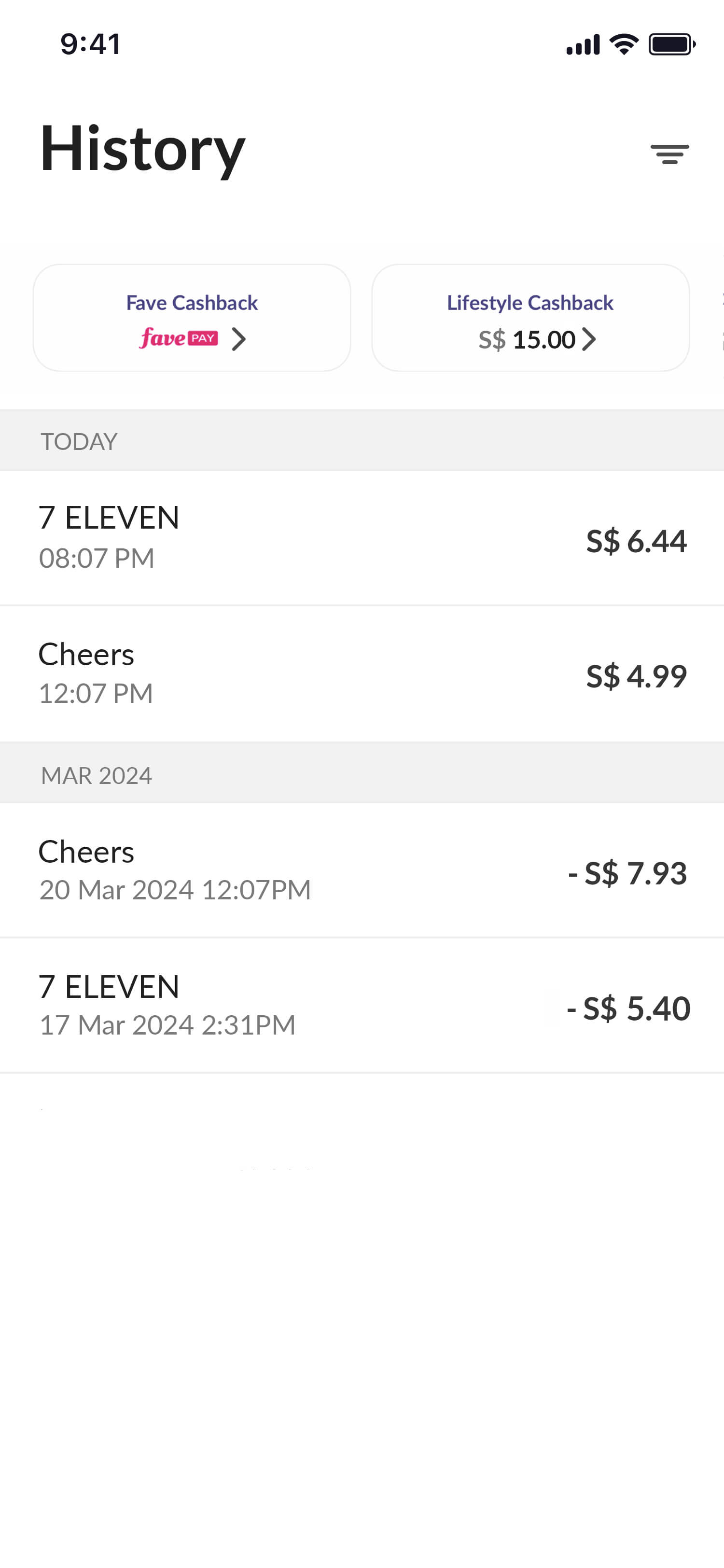

Start sending money home

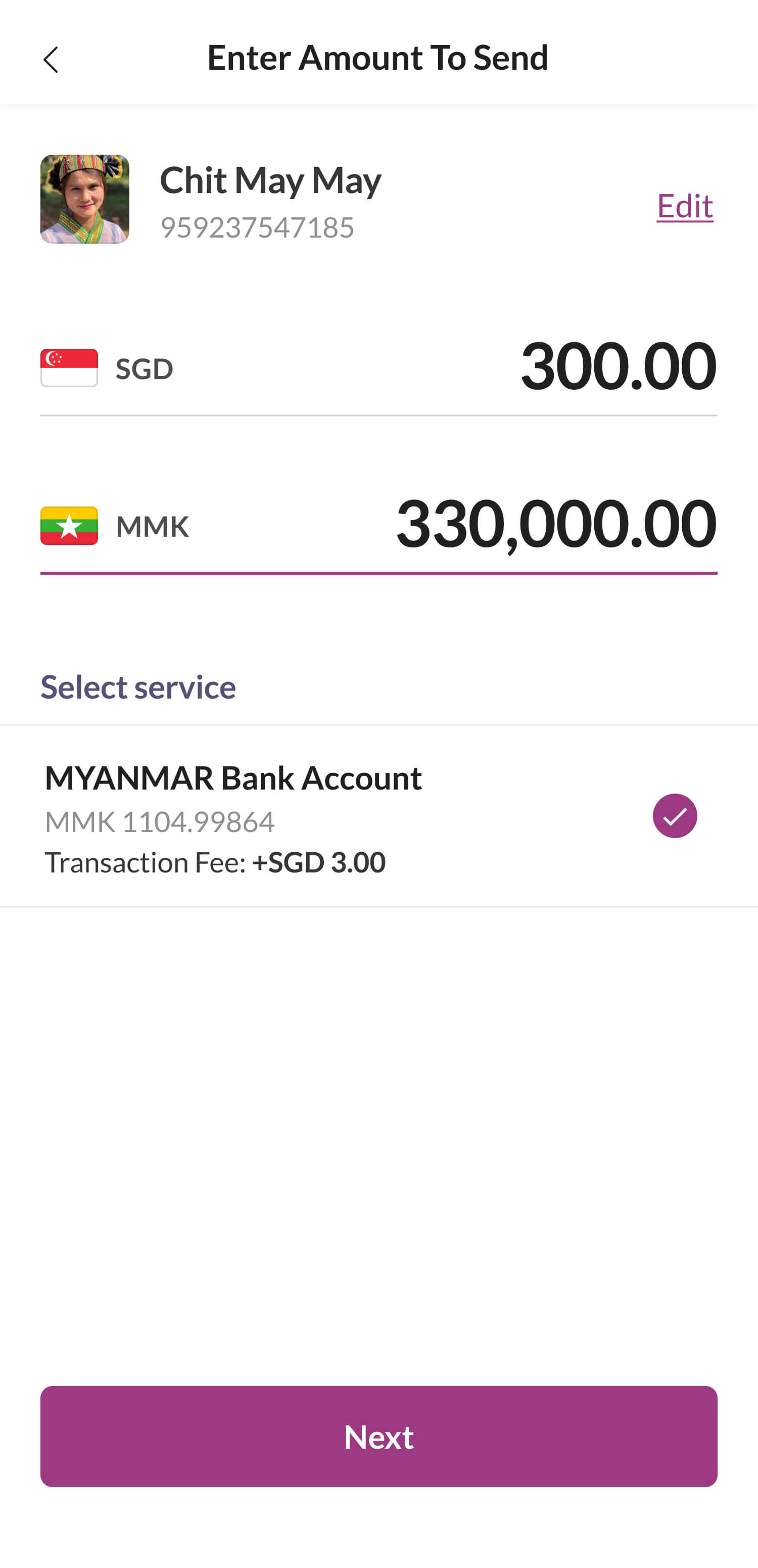

Select Remit > Select Recipient > Send Money .

Enter amount and select preferred service.

Enter your 6-digit pin to proceed.

And you're done! Your transaction amount will be displayed on the transaction history page.

Top up your Dash account from your phone,

or at locations near you

islandwide!