Fast, easy and safe international money transfers

As provided by Dash Remit

Get competitive exchange rates and fast transfers when you use Dash Remit for international fund transfers.

Preferential exchange rates

Check our rates and fees easily on our app.

Fast and easy

Real-time approval when you register for remittance with Singpass* and receive your funds transfer in less than a day^.

Safe and worry-free

The service is provided by SingCash Pte Ltd, licensed by Monetary Authority of Singapore and a subsidiary of Singtel.

Multiple support touchpoints

Need help? Reach us on WhatsApp, our hotline, email or at our Lucky Plaza retail shop.

*Manual registration will take up to 2 working days for approval if all information are

submitted accurately. Kindly contact our support team if you encounter any issues.

^Applicable for bank transfers to United Kingdom, South Korea and banks on instant transfer scheme in Europe, as well as to New Payment Platform enabled accounts to Australia.

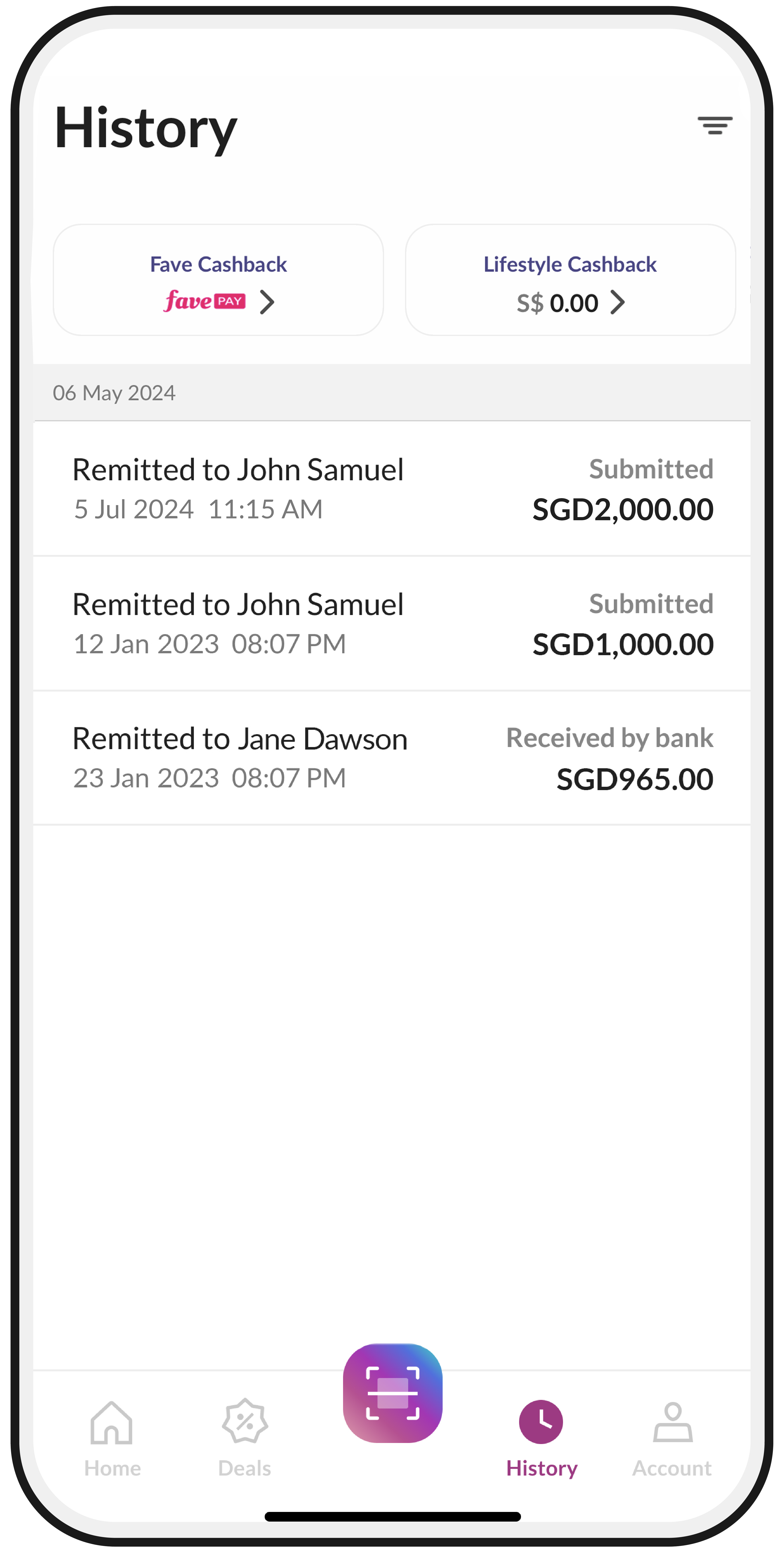

Remit in 4 easy steps

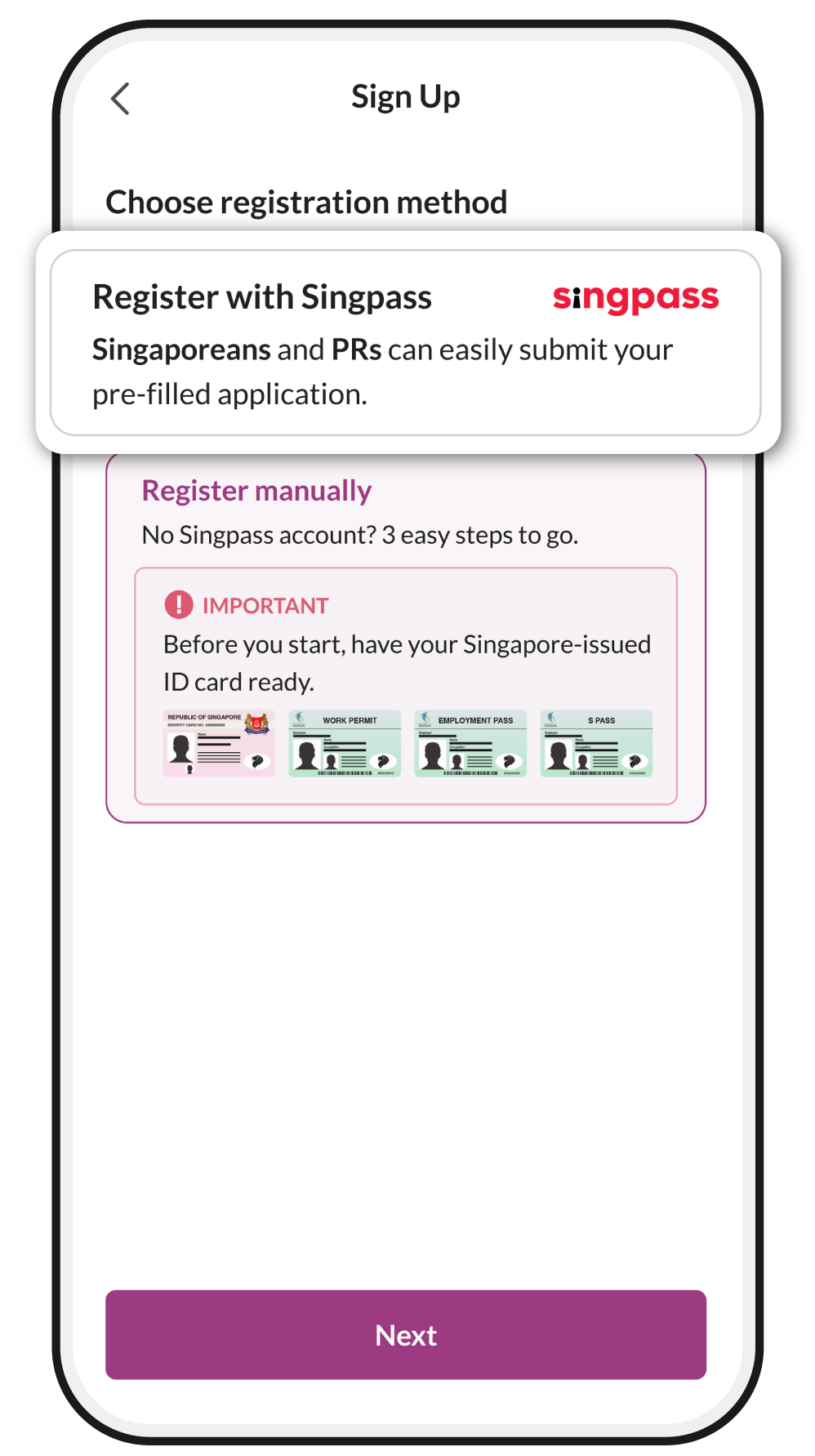

Step 1

Complete your registration process after downloading the Dash app

Step 2

Select ‘Remit’ on your Dash app homepage > Add recipient by keying in your beneficiary’s details once your account is approved

Step 3

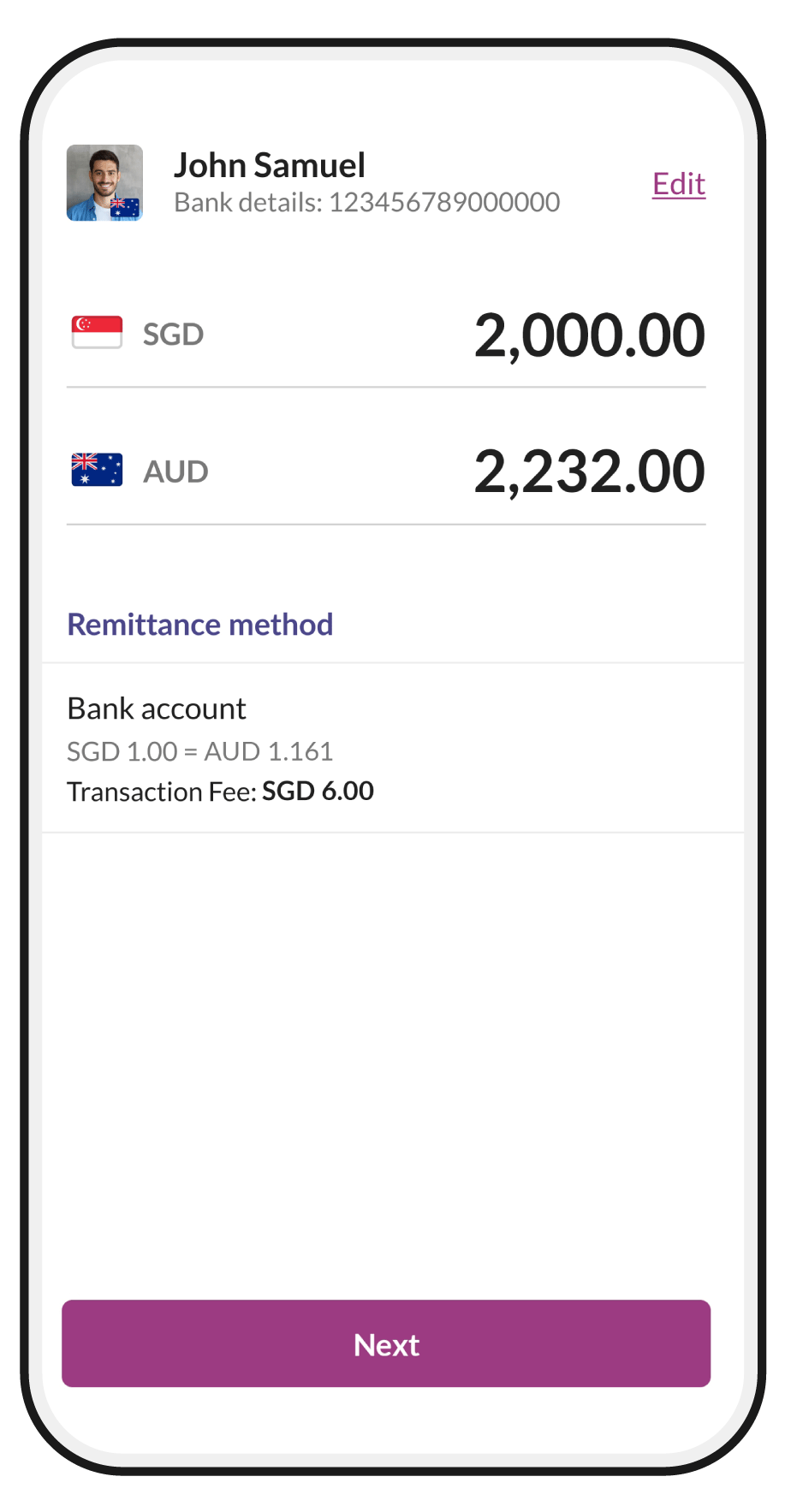

Select your recipient and indicate the amount you wish to transfer

Step 4

Tap on ‘History’ to check your transfer status

Send to these countries with Dash Remit today

Australia (AUD - Australian Dollar)

Austria (EUR - Euro)

Belgium (EUR - Euro)

Bulgaria (EUR - Euro)

Czech Republic (EUR - Euro)

Denmark (EUR - Euro)

Estonia (EUR - Euro)

Finland (EUR - Euro)

France (EUR - Euro)

Germany (EUR - Euro)

Greece (EUR - Euro)

Hungary (EUR - Euro)

Ireland (EUR - Euro)

Italy (EUR - Euro)

Latvia (EUR - Euro)

Lithuania (EUR - Euro)

Luxembourg (EUR - Euro)

Norway (EUR - Euro)

Poland (EUR - Euro)

Portugal (EUR - Euro)

Romania (EUR - Euro)

Slovakia (EUR - Euro)

Slovenia (EUR - Euro)

Spain (EUR - Euro)

South Korea (KRW – South Korean Won)

Sweden (EUR - Euro)

Switzerland (EUR - Euro)

United Kingdom (GBP – Pound Sterling)

Do more with Dash,

the all-in-one mobile wallet

Go cashless with Dash!

Pay effortlessly online or in physical shops with the Dash app! Simply tap and pay via Visa Contactless or key in your 16-digit Dash Visa Virtual card number.

Pay your overseas bills

Have the assurance that your family's important bills are paid on time at zero transaction fees, no matter where you are.

Stay connected all day

Using a Singtel prepaid mobile line instead? Top it up easily right from the Dash app.

Frequently Asked Questions (FAQ)

How do I start remitting with Dash?

To start remitting on Dash, you will have to register for a remittance account by verifying your

account using Singpass or keying in the required details manually. Simply tap on ‘Account’ > Your

name > ‘Update details’ OR ‘Remit’ > ‘Register for remittance’.

For manual verification, remember to have your work pass and proof of verification on hand.

Are there limits to how much I can send?

Upon verifying your Singtel Dash Mobile Remittance account, you may remit up to SGD5,000 a day and

SGD10,000 a month if you are not a Work Permit-holder with app versions 6.2.0 and above. If you are

a Work Permit-holder, you may remit up to SGD3,000 per day and per month.

The total Dash wallet debit transactions, including remittance, cannot exceed S$30,000 in a year.

What are the fees for overseas money transfer?

Remittance fees differ by destination. For transfers to Australia, supported European countries (including the United Kingdom) and South Korea, fee starts from SGD2. Visit dash.com.sg/remit#TAT for fees to other destinations.

What is the applicable exchange rate when I remit with Singtel Dash?

Our exchange rates are competitive so that you can get the best value. In addition, exchange rates

are subject to market fluctuations and the amount sent.

You will be able to see the applicable exchange rate when you key in the amount you wish to send to

your recipient on the Dash app. Enjoy preferential exchange rates when you send more.

How long does a remittance transfer take?

Transfers to South Korea and the United Kingdom are real-time and will arrive within 15 minutes to 2

hours.

Transfers to other supported European countries will arrive within 15 minutes if the receiving bank

is on an instant transfer scheme. Otherwise, the money transfer will arrive on the next 1 or 2

banking day of the receiving country, excluding bank holidays and weekends.

For transfers to Australia, processing of the transaction will take place immediately, and you will

receive the final status of the transaction within 1 – 3 hours. Actual crediting of the remittance

funds by your chosen bank into your recipient’s bank account will take up to 7 – 14 hours.

What banks can I transfer to?

For the United Kingdom (UK), you can transfer money to all banks in the UK that are on Faster

Payments network.

For Australia, you can transfer to all available banks in Australia. For example, CBA, Westpac, ANZ,

NAB and Macquarie Bank

For other supported European countries, you can transfer money to all available banks in the

receiving countries.

For South Korea, you can transfer to a total of 18 banks. Including Hana Bank, Shinhan Bank, and

Woori Bank.

For the full list, visit dash.com.sg/remit#TAT or refer to the Dash app.

What information is required to set up my recipient in Dash?

For transfers to Australia, you will require the following information from your recipient:

- First and last name

- Mobile number

- Bank account number

- BSB code

- Date of birth

- Nationality

- Address (in Australia)

- Postal Code (in Australia)

For transfers to the United Kingdom (UK), you will require the following information from your recipient:

- Full name (as in their ID)

- Mobile number

- Either (a) Bank account number and sort code or (b) IBAN number

- Date of birth

- Nationality

- Address (in the UK)

For transfers to other supported European countries, please obtain the following information from your recipient:

- First and last name

- Mobile number

- Nationality

- IBAN number

- Date of birth

- Address (in Europe)

As for South Korea, you will need these information from your recipient:

- First and last name

- Bank name

- Bank account number

- Mobile number

- Date of birth

- Nationality

- Address

How do I check the transaction status of my remittance transfers?

Tap on ‘History’ to check the transaction status of your remittance transfers.

What documents can be used as proof of address?

- Singtel, M1, Starhub bill or any other telco bill

- Bank statement

- Water or Electricity bill

How can I top up my Dash balance?

For your convenience, we provide you with multiple options to top up your Dash balance.

If you choose to top up your Dash balance using your mobile phone, you can do so from the Singtel

Dash app, PayNow VPA / FAST/ PayNow QR, PayAnyone OCBC, Dash PET, or credit/debit*

cards.

Top up facility is also available at 7-Eleven* outlets, AXS machines, Sheng Siong $TM*, Singtel

Shops, Singtel Exclusive Retailers and Singtel Prepaid Retailers.

* Convenience fees applicable

What is Preferential FX rate?

You can enjoy better exchange (FX) rates when you send more money to Australia, supported countries in Europe (including the United Kingdom), South Korea or Vietnam.

What are the associated transaction fees?

Transaction fees range from SGD2 to SGD7 depending on the selected country, and according to the remittance amount which falls within the following ranges:

- Send amount: SGD 1 - 499.99

- Send amount: SGD 500 - 1,999.99

- Send amount: SGD 2,000 or more

To obtain the final transaction fee, launch your Dash app and select your recipient from any of these receiving destinations: Australia, Europe (including the United Kingdom), South Korea or Vietnam, and enter your send amount.

How do I find out the actual FX rate applied to my remittance transaction?

The exchange (FX) rates displayed on the remittance page of the Dash app are indicative rates and are subject to market fluctuations in the day. The final FX rate applied to your remittance transaction will be shown on the remittance confirmation page of the Dash app.

Do I need to update my Dash app to enjoy the preferential FX rate when I send money to Australia, countries in Europe, South Korea, the United Kingdom or Vietnam?

Do ensure your Dash app is updated to minimum app version 6.12, applicable for iOS and Android. To check your app version, launch your Dash app, go to “Account” and the app version is displayed at the bottom of the page.

How often do the FX rates change?

A live exchange (FX) rate is quoted when a remittance transaction is initiated. The FX rate may change according to market conditions. The final FX rate applied for a remittance transaction is displayed on the remittance confirmation page of the Dash app.

Can I cancel a remittance transaction after payment confirmation?

We provide real-time processing of every remittance request. Once a remittance transaction is processed, it cannot be cancelled.

Are there changes to the transaction or wallet limit?

No. The transaction and wallet limit remain the same.