Why you should try

Dash EasyEarn

Higher returns

Earn 1.8%2 p.a. for the first year

from just S$2,000.

100% capital guaranteed

Get back the capital anytime

you need the funds.

Life protection

Be automatically covered with

a death benefit of 105% of your

Account Value.

What’s more, you enjoy:

No hidden

requirements

No monthly transactions, or

jumping through hoops.

No lock-in

period

Top up or withdraw anytime, and

get the same rates of returns.

Simply maintain your average daily

balance at the policy minimum value.

No penalties

Receive 100% of your capital

anytime you change your mind.

How much return can you potentially earn?

Scroll to see estimated returns by months

Disclaimers:

- The illustration above is based on guaranteed 1.5% p.a. and bonus 0.3% p.a. for the first year.

- Calculation of the monthly interests earned from top ups assumes maximum interests earned for the month based on total top-ups paid.

- The monthly interest amount above are computed as the full month interest within the month.

- The interest amount above are for illustration purpose only, there could be some rounding difference as compared to the actual computation.

Ready to take your savings higher?

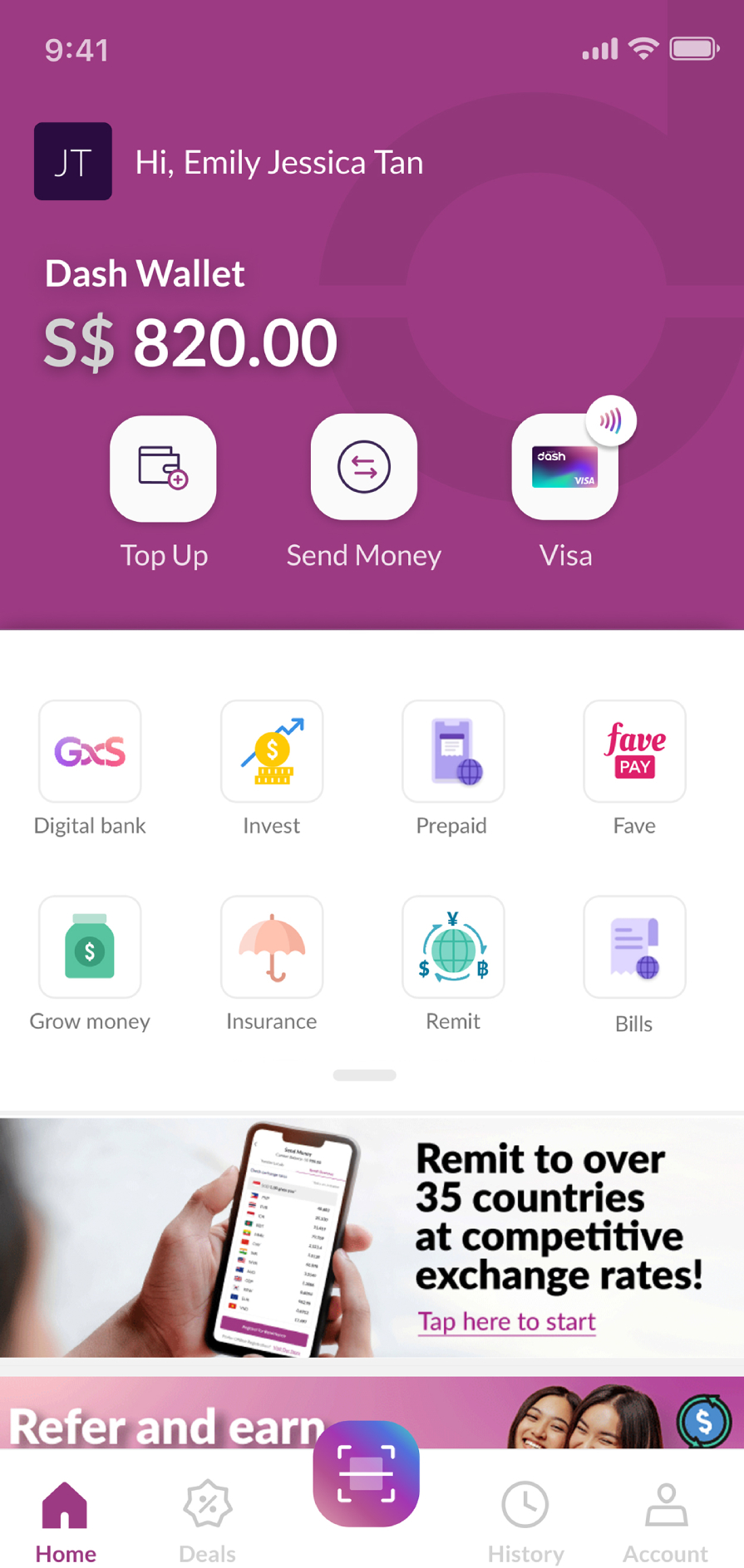

Download the latest Singtel Dash app to sign up today!

Launch your Dash app

Dash EasyEarn is exclusively available on Singtel Dash app.

To sign up, download and launch Dash > tap Grow Money

Sign up for Dash EasyEarn

It only takes 5 minutes to sign up! Get your

Photo ID ready and start applying.

Top up your plan and grow your savings!

You’ve set up your plan. Now top up and start earning high returns!

We’re featured here too!

MoneySmart

Here’s an Easy Way for Anyone to Grow Their Savings – Capital Guaranteed

If you’ve been following the news, you’ll know that amid the Covid-19 outbreak and economic slowdown, we’re in a global recession.

The Woke Salaryman

For the last time, don’t put everything in the stock market

Insurance Savings Plans are another option to park your money to get higher interest for the short term.

The Simple Sum

Protect your holiday fund

Till things return to normal, it’s tempting to make your holiday fund work for you.

Have Questions?

What is Dash EasyEarn?

Dash EasyEarn by Etiqa Insurance is an insurance savings plan open to eligible Dash users, to earn higher returns while enjoying the flexibility of anytime top-ups, withdrawals with no lock-in period or penalty. Dash EasyEarn life insured also enjoy insurance coverage in the event of death.

The policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K).

Who is Etiqa?

Etiqa (Etiqa Insurance Pte. Ltd.) is a licensed life and general insurance company registered in the Republic of Singapore and governed by the Insurance Act. It is an insurance arm of Maybank Group which is among Asia’s leading banking groups and South East Asia’s fourth largest bank by assets. To find out more, visit www.etiqa.com.sg.

Who can sign up for Dash EasyEarn?

Dash EasyEarn is applicable for eligible Singtel Dash users aged between 17 to 75 (at next birthday) with a valid Singapore NRIC or Singapore residency/work pass. Sign up or log in to Singtel Dash app to check your eligibility.

Please note that all applications are subjected to the acceptance by Etiqa Insurance Pte. Ltd

We only allow one Dash EasyEarn policy per individual at any point in time, regardless whether your policy is active or inactive.

How are my Dash EasyEarn returns calculated?

The returns are calculated daily based on the crediting rate. Returns will be credited after the policy month provided the policy maintains an average daily account value of S$2,000 for the policy month.

My Dash EasyEarn policy started before 24 September 2020. What is my rate of returns?

If your Dash EasyEarn policy's start date is 24 September 2020 and before, you will continue to enjoy 2%1 p.a. returns for the first year, starting from the policy start date. The rate of returns is applicable to subsequent top ups for the first year.

1Guaranteed at 1.5% p.a. + 0.5% p.a. bonus for the first policy year.

How is the Account Value calculated for Dash EasyEarn?

Account Value is calculated as:

(Starting premium + Top-ups + Accumulated interest) - (Partial withdrawal and withdrawal charges, if any)

Is there a minimum premium for Dash EasyEarn?

You can start saving from S$2,000 up to a maximum of S$20,000, in multiples of S$500.

To enjoy the returns and benefits, you would need to maintain at least S$2,000 average daily account value to be entitled for interest crediting.

What is the protection benefit?

In the event of death during the policy term, 105% of your Account value will be paid as the death benefit and the policy ends. There will be no payout for death from suicide within the first 12 months or 12 months following the last top-up made, whichever is later; and for any death due to pre-existing conditions throughout the policy term. Please refer to the Product Terms and Conditions for more details.

Is my Dash EasyEarn policy protected?

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you.

For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Etiqa Insurance Pte. Ltd. or visit SDIC websites (www.lia.org.sg or www.sdic.org.sg).

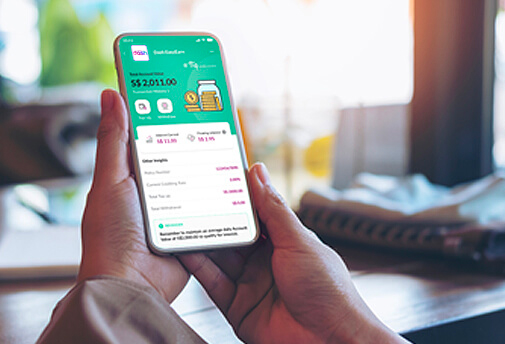

How do I manage my plan?

Everything's on Singtel Dash app! Launch Dash > Home screen > 'Grow Money' icon to access and manage your account.

- View Dash EasyEarn policy details

- Top up your account

- Make withdrawals

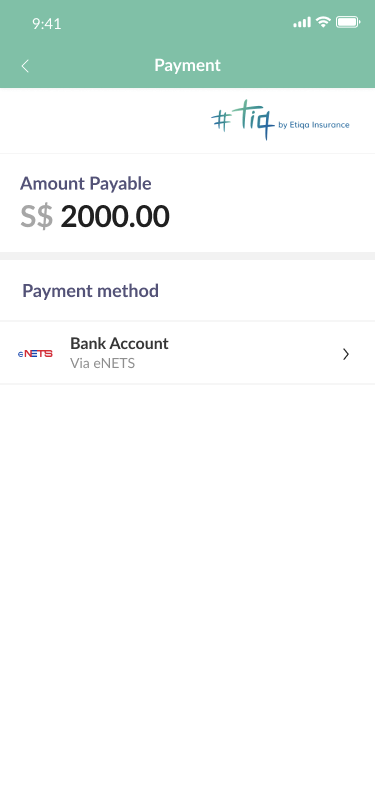

How do I pay premiums for my Dash EasyEarn plan?

All payment is made within Singtel Dash app by your bank account (via eNETS).

You'll be prompted to make your first top-up when you first sign up for Dash EasyEarn via Singtel Dash app. For subsequent top-ups, simply login to the app and manage your account.

The starting amount is S$2,000 and subsequent top-ups may be made in multiples of S$500. The maximum top-up amount is capped at S$20,000 (Top-ups - Withdrawal amount - Withdrawal charges).

Please ensure that your bank account's daily eNETS limit is set to enable your payment and top-up amounts to go through. For details on how to update your eNETS limit, please contact your bank:

Citibank: +65 6225 5225

DBS: 1800 111 1111

OCBC: 1800 363 3333

POSB: 1800 339 6666

Standard Chartered: +65 6747 7000

UOB: 1800 222 2121

What are the ways to make a partial withdrawal?

Manage your Dash EasyEarn plan via the Singtel Dash app. You can choose for your partial withdrawal to be transferred to:

(1) either your Singtel Dash account up to your Dash wallet account limit (no charge); or

(2) directly to your bank account via PayNow (S$0.70 per transaction, deducted from Dash EasyEarn plan)

Withdrawal amounts must be at least S$100, and in multiples of S$100 per withdrawal. Partial withdrawal will reduce the account value by the withdrawal amount (and withdrawal charges, if any).

Do note that you will only earn returns when you maintain a minimum of S$2,000 average daily account value.

In the event of an unexpected surge in withdrawals (partial or full) across Dash EasyEarn policyholders within a short period of time, Etiqa Insurance may take up to a period of 6 months from the date of your withdrawal application to process the payment.

What if I change my mind?

Dash EasyEarn has a 14-day free look period within which you may cancel the policy by contacting Etiqa Insurance.

While your policy is active and in force, you may withdraw your funds anytime via Singtel Dash app.

There are no surrender charges if you wish to surrender the policy. Do note that a policy surrender will terminate your account.

What happens if I want to surrender my Dash EasyEarn policy or file a death claim ?

You will need to contact Etiqa Insurance Pte. Ltd. at +65 6887 8777 or email customer.service@etiqa.com.sg to submit your request.

I have further queries on my Dash EasyEarn policy, who should I contact?

For general enquiries on Dash EasyEarn or EasyEarn Lite, click here https://bit.ly/Etiqa24x7LiveChatAssistance to start a live chat with Etiqa Insurance’s agents immediately.

For technical issues or enquiries on your existing Dash EasyEarn policy, please WhatsApp Etiqa Insurance’s customer care consultants at +65 6887 8777 from Mondays to Fridays, 8.45am to 5.30pm (closed on Saturdays, Sundays and Public Holidays).

I'd like to find out more about Dash EasyEarn Lite.

Please refer to the FAQs on Dash EasyEarn Lite here.

1 Effective for sign ups up to 24 September 2020 (date inclusive): Guaranteed at 1.5% p.a. + 0.5% p.a. bonus for the first policy year.

2 Effective for new sign ups from 25 September2020: Guaranteed at 1.5% p.a. + 0.3% p.a. bonus for the first policy year, available on a first come, first served basis.

This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Etiqa Insurance Pte. Ltd. or visit SDIC websites (www.lia.org.sg or www.sdic.org.sg).

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. The information contained on this product advertisement is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is accurate as at 24 September 2020. Other Singtel Dash terms apply.