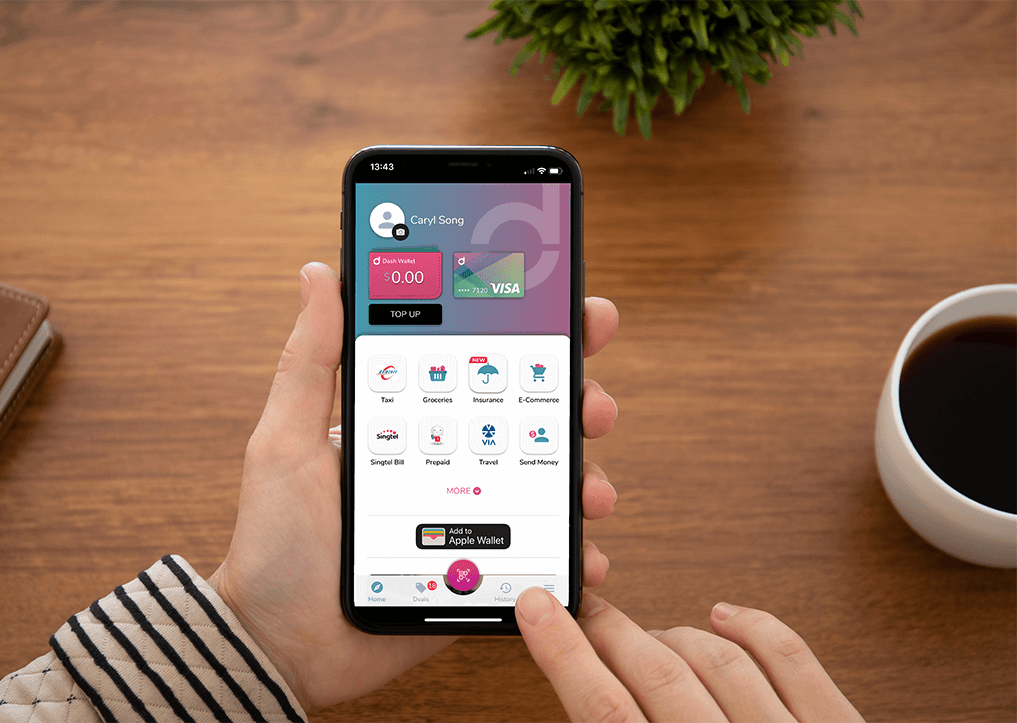

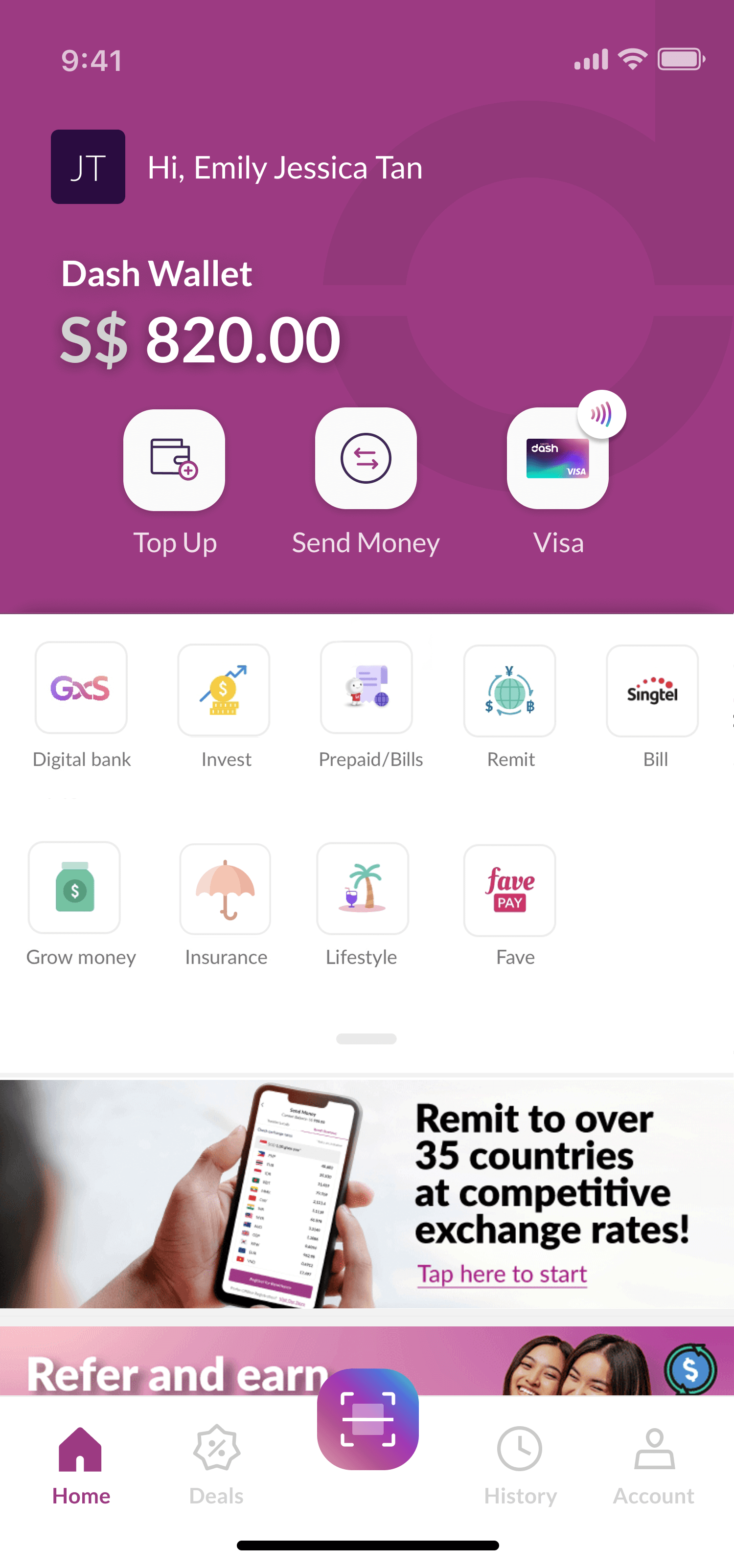

Shop and dine with

Dash Visa Virtual Card

Dash anywhere with your

Dash Visa Virtual Card

Dash is seamlessly integrated with Visa. Simply tap and pay wherever Visa Contactless is accepted. All you need is a compatible iOS or NFC-enabled Android phone*.

Want to shop online? Key in your unique 16-digit Dash Visa Virtual Card number when you checkout your cart.

*The Visa Virtual Card is unavailable from 2 November 2022 (from version 6.0.0) on Huawei devices not equipped with Google Mobile Services.

How can I use my Dash Visa Virtual Card to pay?

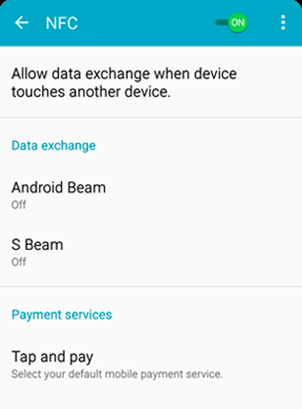

Set up Default Tap & Pay

Ensure that ‘Tap & Pay’ has been activated in

your Android device before you make purchases at merchants

that accept contactless payment.

Pay with Visa Contactless

Set Dash as your default payment app or launch the Dash app to tap and pay at Visa Contactless terminals.

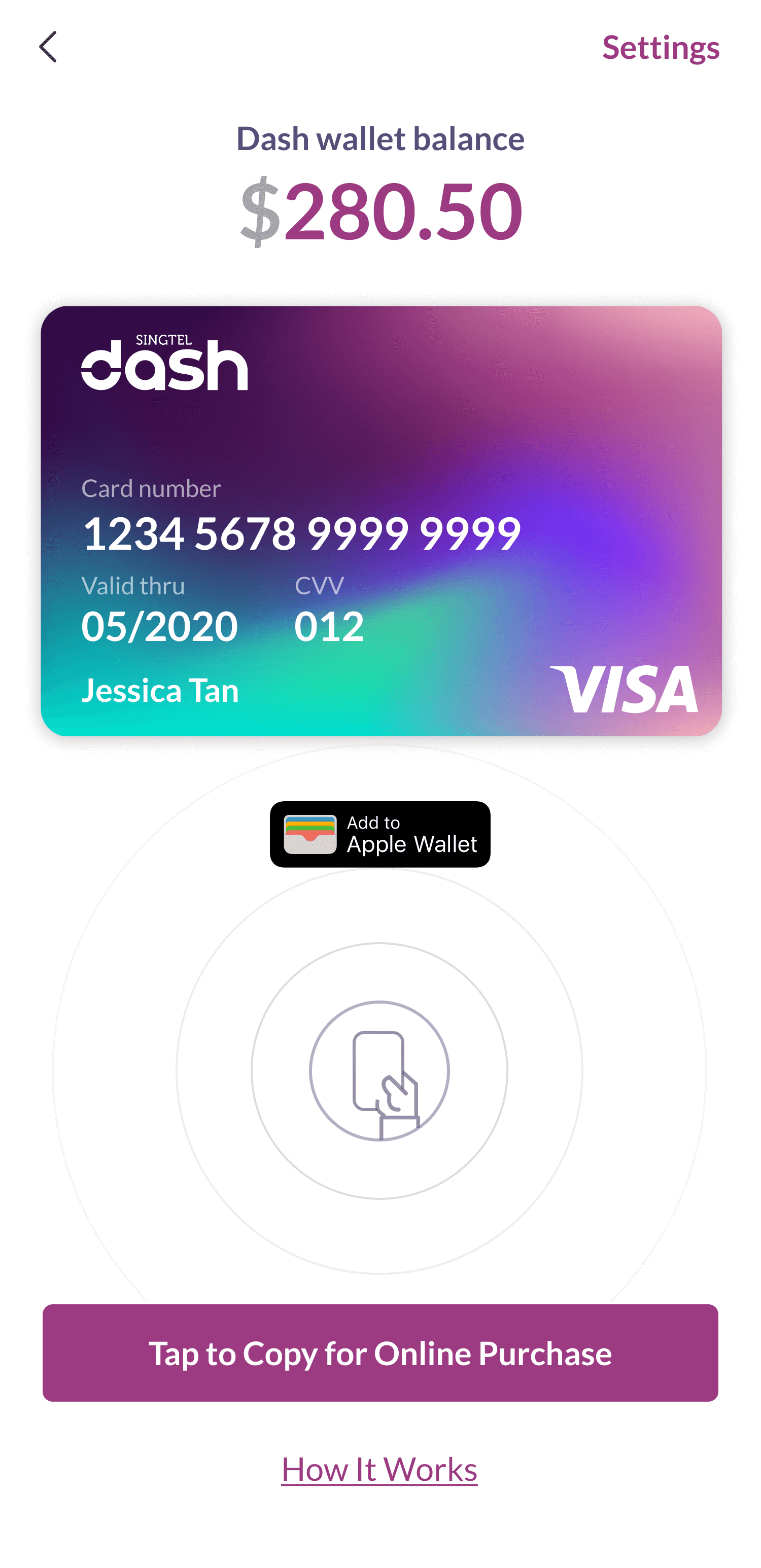

Link to your Apple Pay wallet

Add your Dash Visa Virtual Card details to

your Apple Wallet or Apple Watch

and enable payment.

Pay with Apple Pay

Hold your iPhone or Apple Watch close to the

contactless reader and authenticate to pay.

Featured Videos

Tap & Pay with Singtel Dash

Singtel Dash now lets you shop globally with your Dash Visa Virtual account!

Simply tap and pay wherever Visa Contactless is accepted.

Shop online with your Singtel Dash Visa Virtual account

Singtel Dash now lets you shop globally with your Dash Visa Virtual account!

Simply use your 16-digit Dash Visa Virtual card number when you check out online.

Have Questions?

This is a normal payment process. When your transaction is performed and approved, your Dash balance will be deducted with the transaction amount and your transaction will show "pending" until the merchant processes and completes the transaction backend. This will usually take 3 to 4 days (maximum 14 days) after your purchase, until it has been processed.

In some cases, when the merchant confirms the payment a few days after your transaction, the amount of the transaction can be adjusted to reflect the actual amount. This happens when some items of your total order are not available, and the final amount will be lesser than your amount paid. Your transaction history will show the previous transaction as "Cancelled" and a new transaction will be shown with the final amount. The difference will be debited or credited automatically to your Dash balance.

In some cases, when the merchant confirms the payment a few days after your transaction, the amount of the transaction can be adjusted to reflect the actual amount. This happens when some items of your total order are not available, and the final amount will be lesser than your amount paid. Your transaction history will show the previous transaction as "Cancelled" and a new transaction will be shown with the final amount. The difference will be debited or credited automatically to your Dash balance. For overseas payments, the foreign exchange rate provided by Visa may change between the day you made the transaction and the day the merchant completed it. Thus, transactions with foreign currency might be more subject to amount changes.

No, you are not required to sign-up for this service. For existing Singtel Dash customers, you will be able to access your Dash Visa Virtual Account when you log-in to Singtel Dash app v4.5. For new customers who signed-up from 20th July 2017, you will be able to access your Dash Visa Virtual Account after you successfully signed-up and login to Singtel Dash.

Your Dash Visa Virtual Account is a virtual prepaid account. All payments will be deducted from your Dash balance immediately. You will be required to have sufficient balance before making payments.

To prevent unauthorised transactions when making payments online, a one-time-password (OTP) may be sent to your registered Dash mobile number during an e-commerce transaction. The OTP has to be entered for verification within 3 minutes of its receipt, significantly reducing the risk of fraudulent use of your Dash Visa Virtual Account. Each OTP will expire after 3 minutes and is limited to one time use. After each payment you will receive a notification including your merchant name and the amount of the transaction to confirm your successful transaction. Please ensure that notifications are allowed for Singtel Dash in your Android OS settings. For more security, customer can disable payWave PINless mode in Dash Visa account settings. When PINless mode is disabled, you need to click on your Visa card to enter your PIN before payment on the payWave terminal.

Open your Singtel Dash app > History > Select the transaction with error > Need Help? Fill in the necessary details and we will be in touch with you to assist you on this.

Some merchants, especially e-commerce merchants such as Paypal, Fave.com, perform a card verification transaction the first time you add your Dash Visa card. In most of the cases, this transaction ($1 or $2 amount) is cancelled few minutes later and the amount is credited back to your account. If not, it will appear as a Visa Card Credit Adjustment in the next 10 working days.

In some cases, after your payment is completed, the merchant may adjust the amount to a higher value, i.e if you added a tip to your receipt or if the shipment fees are higher than expected. The difference between the purchase amount and the adjusted amount will be debited from your Dash balance and will be visible in your Dash Transaction History under Visa Card Debit Adjustment.

When you cancel your transaction or ask for refund, after the merchant process your request, your refund will be visible in your Dash Transaction History under Visa Card Credit Adjustment. In some cases, after your payment is completed, the merchant may adjust the amount to a lower value, i.e if one of the items you ordered is not available. The difference between the purchase amount and the adjusted amount will be refunded to your Dash balance and will be visible in your Dash Transaction History under Visa Card Credit Adjustment.

Yes.

No, cards on Apple Wallet and paired Apple Watch can be added and removed independently from each other.

No, deleted cards cannot be resumed. They need to be added again.

You can use iCloud settings menu to remove the Apple Pay cards on the lost/stolen iPhone, or contact Singtel Dash Customer Care who will suspend your Dash Card on the lost/stolen device.

You may have insufficient wallet balance or the merchant may not be supported on the Visa network.

If the transaction cannot be processed, no money will be deducted from your Dash wallet.

To make payment for local e-commerce stores, simply login to your Singtel Dash app, tap on the Dash Visa Virtual Card to retrieve your unique 16 digit account number, expiry date and security code. You can key in these details into the payment details on the e-commerce stores just like a credit/debit card payment.

No, the Dash Visa Virtual Account is accessed through the Singtel Dash app. You do not need to carry a physical card as the details are within the Singtel Dash app in your mobile phone.

There are no annual fees or finance charges for the Dash Visa Virtual Account.

The Dash Visa Virtual Account gives you a unique 16-digit card number and security code, that allows you to make online purchases at local e-commerce stores with Visa. With a compatible Android NFC-enabled phone equipped with Google Mobile Services or iOS device, you will also be able to make payments at Visa Contactless accepted retailers in Singapore.

Ensure that your NFC setting is turned ON. Check that your Visa Contactless service is ACTIVE by going to Settings / Update Preferences/Dash Visa Account/Status. Launch your Singtel Dash App and ensure your screen is ON when you tap on the Contactless terminal. If the previous steps didn’t work, uninstall then reinstall your Singtel Dash App.

Please also note that the Visa Virtual Card is unavailable from 2 November 2022 (from version 6.0.0)

on Huawei devices not equipped with Google Mobile Services.

From 1 July 2023, Dash QR payments will not be accepted at FairPrice, Cheers or Unity stores. Please switch to contactless payments via your Dash Visa Virtual Card for continued seamless payments.

Dash has an annual transaction limit of up to S$100,000 (or equivalent in other currencies). This limit applies to all payments and remittance made with Dash, and does not apply to the following types of transactions:

1. Incoming funds from top-ups, remittance or peer to peer transfer (P2P)

2. Payments that do NOT go through the Dash wallet (e.g. Payment made to Etiqa for Dash EasyEarn through eNets)

The annual limit resets yearly and will be reset on 1 January each year.

The various transaction limits are listed in this table and broadly classified into three account categories:

1) Non-verified account

2) Verified Work Permit (WP) Holder account

3) Verified non-WP Holder account

| Not Verified | Verified & WP Holders | Verified non-WP Holders | |

|---|---|---|---|

| Wallet Limit | S$999 | S$3,000 | S$5,000 |

| Daily Limit (Spend) | S$2,000 | S$3,000 | S$5,000 |

| Monthly Limit (Spend) | S$2,000 | S$10,000 | S$15,000 |

| Daily Limit (Remit) | Not applicable | S$3,000 | S$5,000 |

| Monthly Limit (Remit) | Not applicable | S$3,000 | S$25,000 |

| Cash Withdrawal to Bank | Not applicable | S$3,000 | S$5,000 |

| Annual Limits (Total Spend, Remit & CashOut) | S$20,000 | S$100,000 | S$100,000 |

Dash is regulated by the Monetary Authority of Singapore (MAS). To protect users and to minimise misuse, we are required to impose balance and transaction limits on Dash. To find out more about your current available transaction balance, you can call our customer hotline at 6438-3274 or fill in the enquiry form at dash.com.sg/contact.

Only iPhones that are Apple Pay enabled, or compatible NFC-enabled Android mobile phones will be able make to make payments at retailers accepting Visa Contactless payments. Currently Xiaomi, OnePlus, OPPO mobile devices and Huawei phone models not equipped with Google Mobile Services are not supported. To verify if your phone is compatible, please contact us at 6438-3274. To make payment, simply let cashier know that you would like to pay via Visa Contactless. For Android mobile phones, if you have chosen Singtel Dash as the default Tap and Pay service in your phone NFC settings, simply unlock your phone and tap on the Visa Contactless terminal while your screen is ON. If Singtel Dash is not your default Tap and Pay service, you need to launch Singtel Dash and Tap on the Visa Contactless terminal while your screen is ON. For iPhones, add your Dash Visa Virtual Account to your Apple Pay wallet and tap to pay.

Visa applies a processing fee for all transactions processed outside of Singapore but charged in Singapore Dollar (i.e., without any currency conversion, including refunds and reversals). Hence, a processing fee of 2.8% on the total transaction amount, which includes a 1% fee by Visa, is payable by you and deducted from your Dash account balance. This includes but is not limited to any transaction in Singapore Dollar on overseas-based websites and mobile applications.

The Tap and Pay function on Dash is supported on Android 11 and above for users on app version 6.23.0 and later. If you're using an Android 10 or lower device, Tap and Pay will not be available.

The Tap and Pay function depends on updated security and system features only available on Android 11 and higher. This ensures better performance and safety when making contactless payments.

Yes. If you already have the Dash app and are using Android 10 or below (minimum Android 6), you can continue to use Dash for most features such as remittance and Scan and Pay (QR code payments). However, Tap and Pay will only be available on devices running Android 11 and above. To enjoy the full Dash experience and to update to the latest app version, upgrade your device to Android 11 and above.