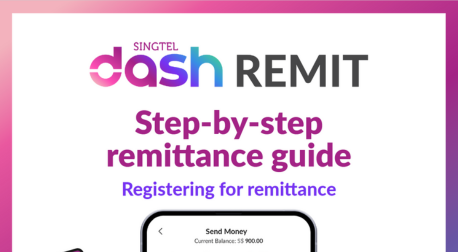

Dash Remit – a mobile remittance service on the Singtel Dash app that lets you transfer money to Bangladesh

at better exchange rates and low fixed fees.

This means you can send emergency funds to your family back home for cash pick-up, top up your Bangladesh

bank account or bKash wallet anytime, anywhere and be assured that your money will arrive safely!

Remit safely and securely

through our partners.

Trademarks, trade names and logos (“Trademarks”) displayed are registered trademarks of their respective owners. No affiliation or endorsement of Singtel Dash should be implied, nor shall the Trademarks of Singtel be used in connection with any company, product or service that does not belong to Singtel in any way that discredits Singtel or confuses the customers.

Agrani Bank

Bangladesh Krishi Bank

BRAC Bank

Dutch-Bangla Bank

Islami Bank

Jamuna Bank

Janata Bank

National Bank

NRB Global Bank

Prime Bank

Pubali Bank

Rupali Bank

Shahjalal Islami Bank

Sonali Bank

Uttara Bank

Why choose Dash?

No more standing in queues or worrying if the money you sent will reach your family.

Dash Remit enables you to send money securely using your mobile phone from any location and time convenient to

you,

even if it’s a weekday during your lunch break. Enjoy better exchange rates and low fixed fees for every transaction.

Pick from any of our 3 money collection options when you transfer. It’s fast, easy and safe!

Safe and secure.

Money-back guarantee.

Licensed and regulated by Monetary Authority of Singapore

Low fixed fees.

Better exchange rates.

No hidden costs. No surprises.

Fast money transfer

Receive your money in up to 15 minutes

For cash pick-up

Remit more. Save more.

Get competitive exchange rates for maximum savings.

*Note: Exchange rate listed here is on 14 August 2023. Refer to the Dash app for the latest exchange rate.

The details expressed on this website, including the exchange rates and amounts are for information purposes, and in no event shall Singtel guarantee the accuracy on any of the total remittance amounts and exchange rate. Singtel accepts no liability for any losses or damages suffered as a result of your reliance on the information contained on this website. Subject to real-time changes, you are advised to check the current exchange rate with the respective service providers for the most up-to-date information

Download Dash Now

Start remitting in a few easy steps

Download Singtel Dash

from the App Store, Google Play store, or HUAWEI AppGallery.

Sign up for a Singtel Dash account.

Register for Remittance.

Complete the registration process via Singpass or Manual Registration upon sign up

Or

Select Remit > Register for Remittance

Examples of proof of address:

- Singtel, M1, Starhub bill or any other telco bill

- Bank statement

- Dormitory card/pass

- Employment Letter with company letterhead and customer’s full name

- Tenancy agreement

- Letter from Singapore government agency (Eg. MOM)

- Water or Electricity bill

Add a Recipient.

Select Send Money >

Overseas > Add a Recipient

Top up your Dash Balance

From the Dash app, PayNow VPA / PayNow QR, bank account, or OCBC PayAnyone. Also at 7-Eleven, AXS machine, Sheng Siong $TM and Singtel Prepaid Retailer.

Remit

Select Send Money > Overseas

> Select Recipient

View your transaction records

Select ‘History’

Frequently Asked Questions (FAQs)

Where in Bangladesh can I remit money with Singtel Dash?

The bKash wallet is the most popular remittance channel for money transfers to Bangladesh. You, too, can conveniently send money using the bKash wallet.

If you prefer to remit money by cash, we are currently doing cash pick up for Agrani bank only.

You can also transfer to a bank account in the following banks:

- Agrani Bank

- Islami Bank

- Sonali Bank

- Bangladesh Krishi Bank

- BRAC Bank

- Dutch-Bangla Bank

- Jamuna Bank

- Janata Bank

- National Bank

- NRB Global Bank

- Prime Bank

- Pubali Bank

- Rupali Bank

- Shahjalal Islami Bank

- Uttara Bank

What is the transaction fee to remit money to Bangladesh with Singtel Dash?

Regardless of the amount being remitted, a nominal fee of SGD 2 is chargeable per transfer for bKash wallet, SGD 3.5 per transaction for cash pick-up, and SGD 3.5 per transaction for bank transfers.

What is the 2.5% government incentive on remittances to Bangladesh?

According to the initiative launched by the Government of

Bangladesh, every expatriate Bangladeshi is eligible to receive

an incentive of 2.5% on the money sent back home.

When you send money to your loved ones in Bangladesh, the

country’s government will add 2.5% of the total value of money

transferred, which will either be paid in cash or deposited in

the bank accounts of the recipients.

You can benefit from this initiative for all remittances made to

bKash, Cash Pick-ups, and bank account transfers in Bangladesh

from Singtel Dash in Singapore.

What is the applicable exchange rate when I remit to Bangladesh with Singtel Dash?

At Singtel Dash, we offer competitive exchange rates wherever possible. The SGD to BDT exchange rate is adjusted according to market conditions. You can know the real time exchange rate in your Singtel Dash app by selecting Send Money > Remit Overseas.

How long does it take for the amount to reach the recipient in Bangladesh?

Remittances made through bKash wallet arrive in recipients’

accounts in 20 minutes.

Cash pick-ups transfer remitted amounts in 15 minutes.

For remittances made through bank accounts, the money arrives in real-time (up to 15 minutes, except for Dutch-Bangla Bank, Uttara Bank).

How do I get started?

Money transfer with the Singtel Dash app on your mobile phone is easy. Open the Singtel Dash app and sign-up for an account. Follow the required steps to register for remittance. Once your account is approved for remittance, you can add a recipient and start remitting.

How can I top-up my Dash balance?

You can top up your Dash balance from the Singtel Dash app, PayNow VPA / FAST/ PayNow QR, PayAnyone OCBC,

Dash PET, or credit/debit* cards. You can also choose to visit

7-Eleven*, AXS machines, Sheng Siong $TM*, Singtel Shops,

Singtel Exclusive Retailers and Singtel Prepaid Retailers* for

quick and easy top-ups.

* Convenience fees applicable

What documents can be used as proof of address?

Examples of proof of address:

- Singtel, M1, Starhub bill or any other telco bill

- Bank statement

- Dormitory card/pass

- Employment Letter with company letterhead and customer’s full name

- Tenancy agreement

- Letter from Singapore government agency (Eg. MOM)

- Water or Electricity bill