Why remit to GCash?

Faster

Real-time transfer.

Anytime, anywhere

Cheaper

Spend less per transfer

Safer

Avoid crowds, remit using your mobile phone

Remit to anyone with a verified GCash account. All you need is to be registered for remittance on the Dash app.

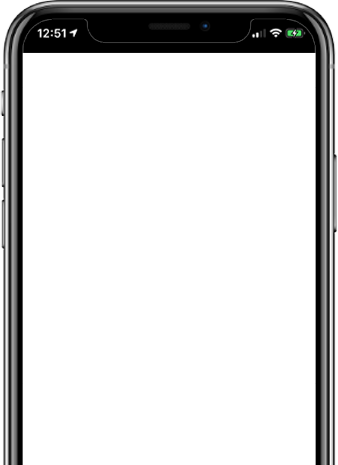

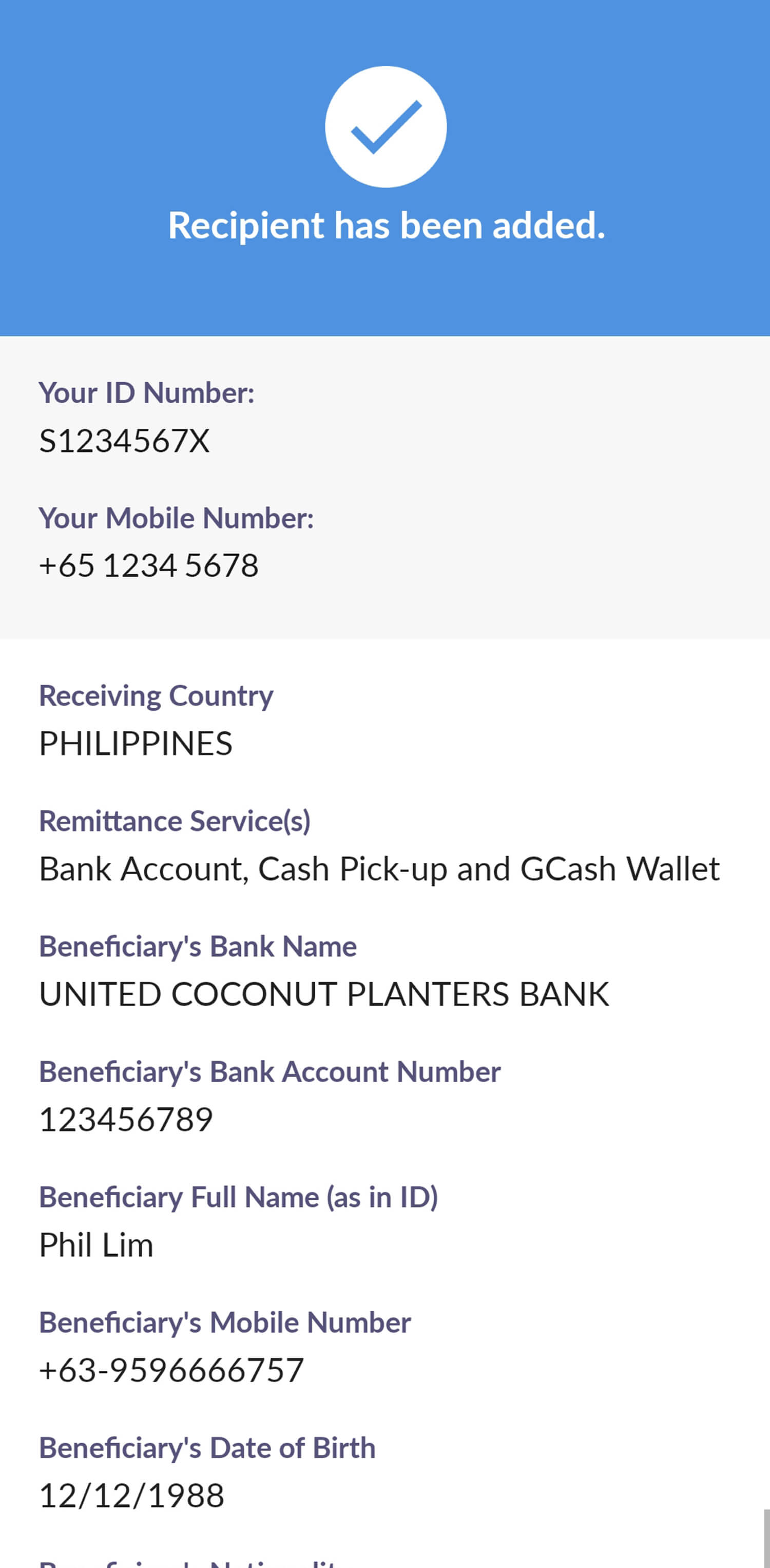

How to add GCash beneficiary on the Singtel Dash app

Step 1

Tap on Send Money > OVERSEAS > Add A Recipient

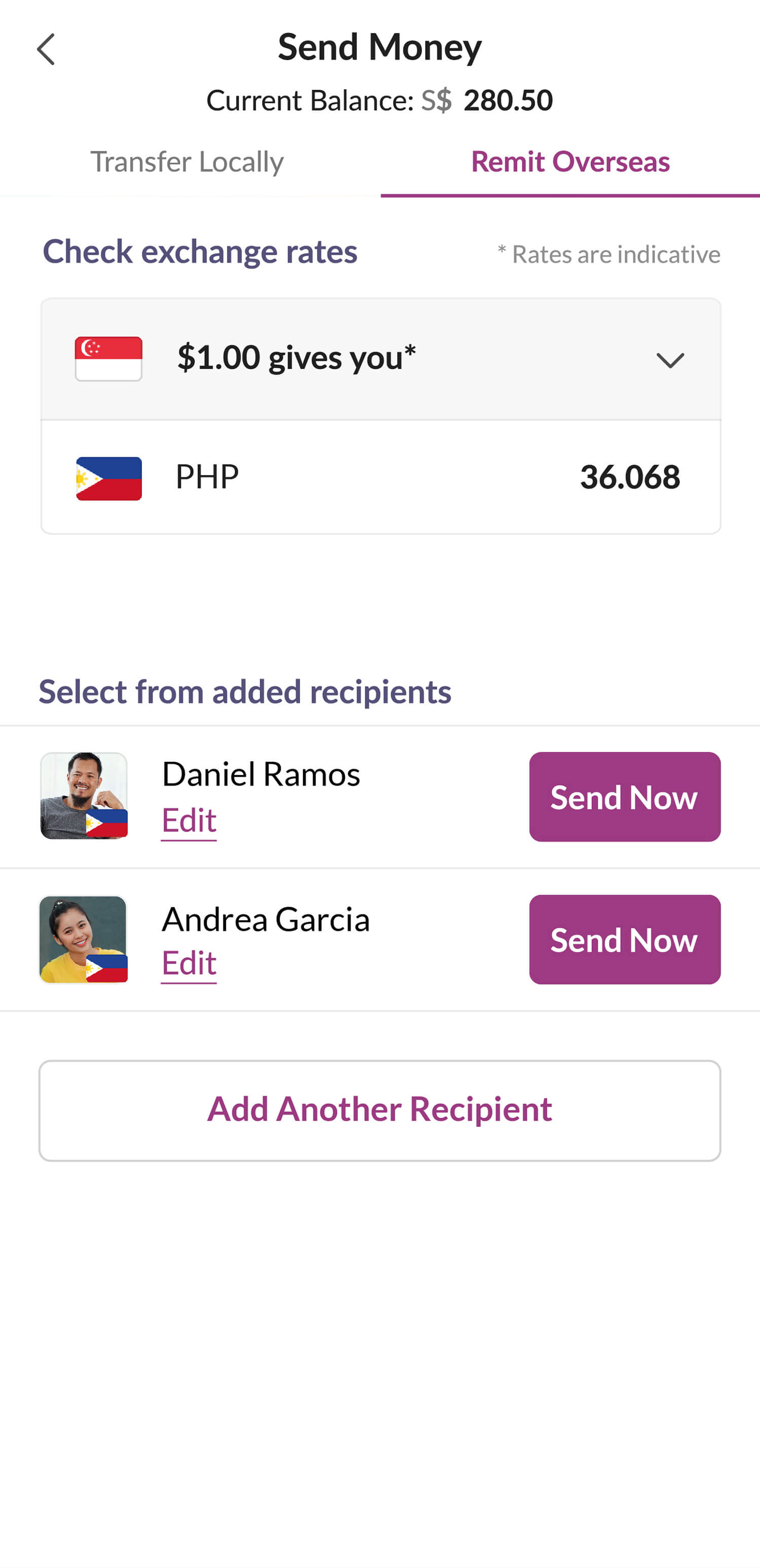

Step 2

Select either option as the recipient’s pay-out option:

- Bank Account, Cash Pick-up and GCash Wallet

- Cash Pick-up and GCash Wallet

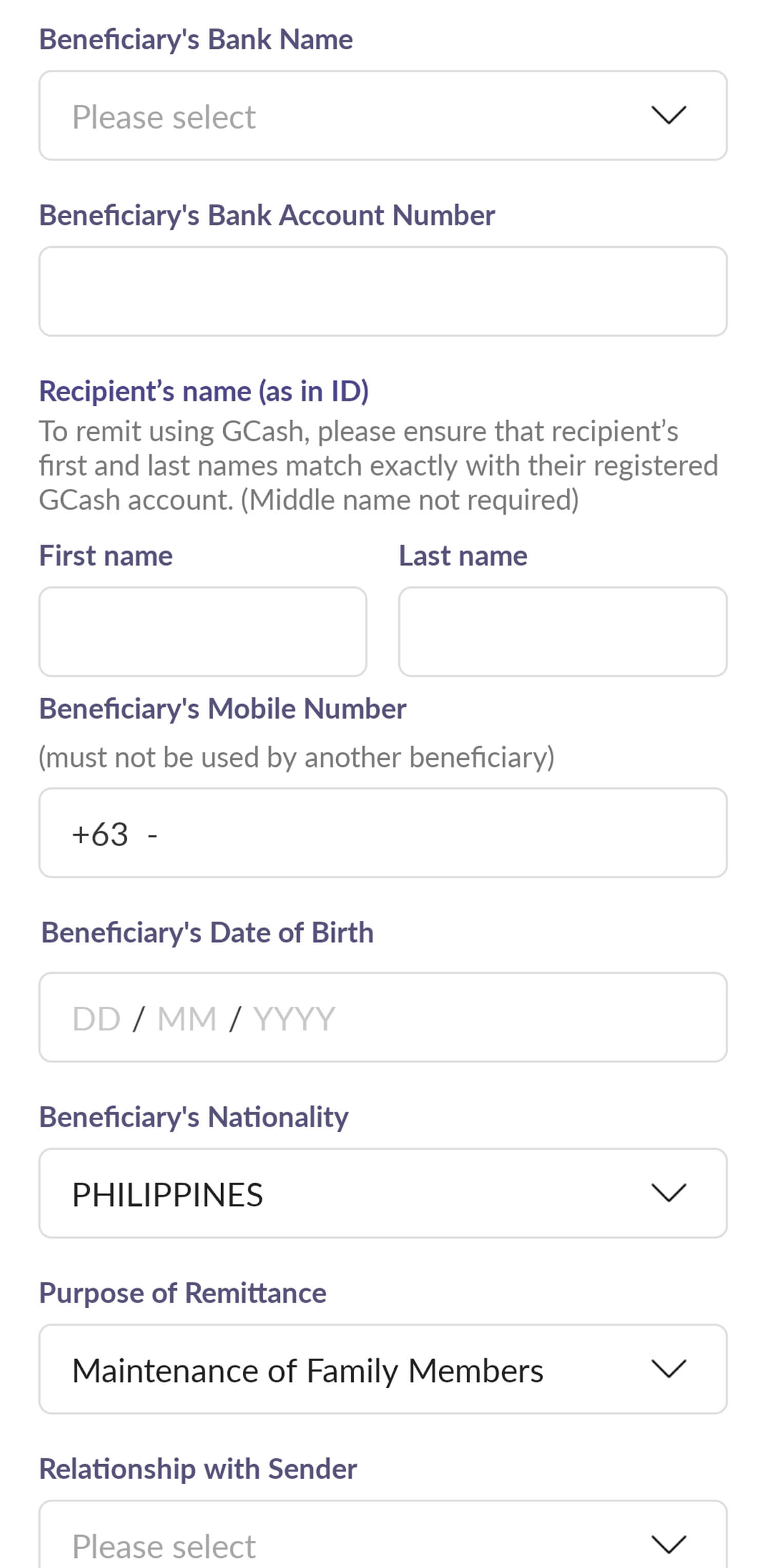

Step 3

Add the recipient's GCash number and select ‘Register’ to proceed

- The beneficiary's name must match their GCash-registered name

- The account number is the GCash-registered mobile number (in the appropriate 09XXXXXXXXX format)

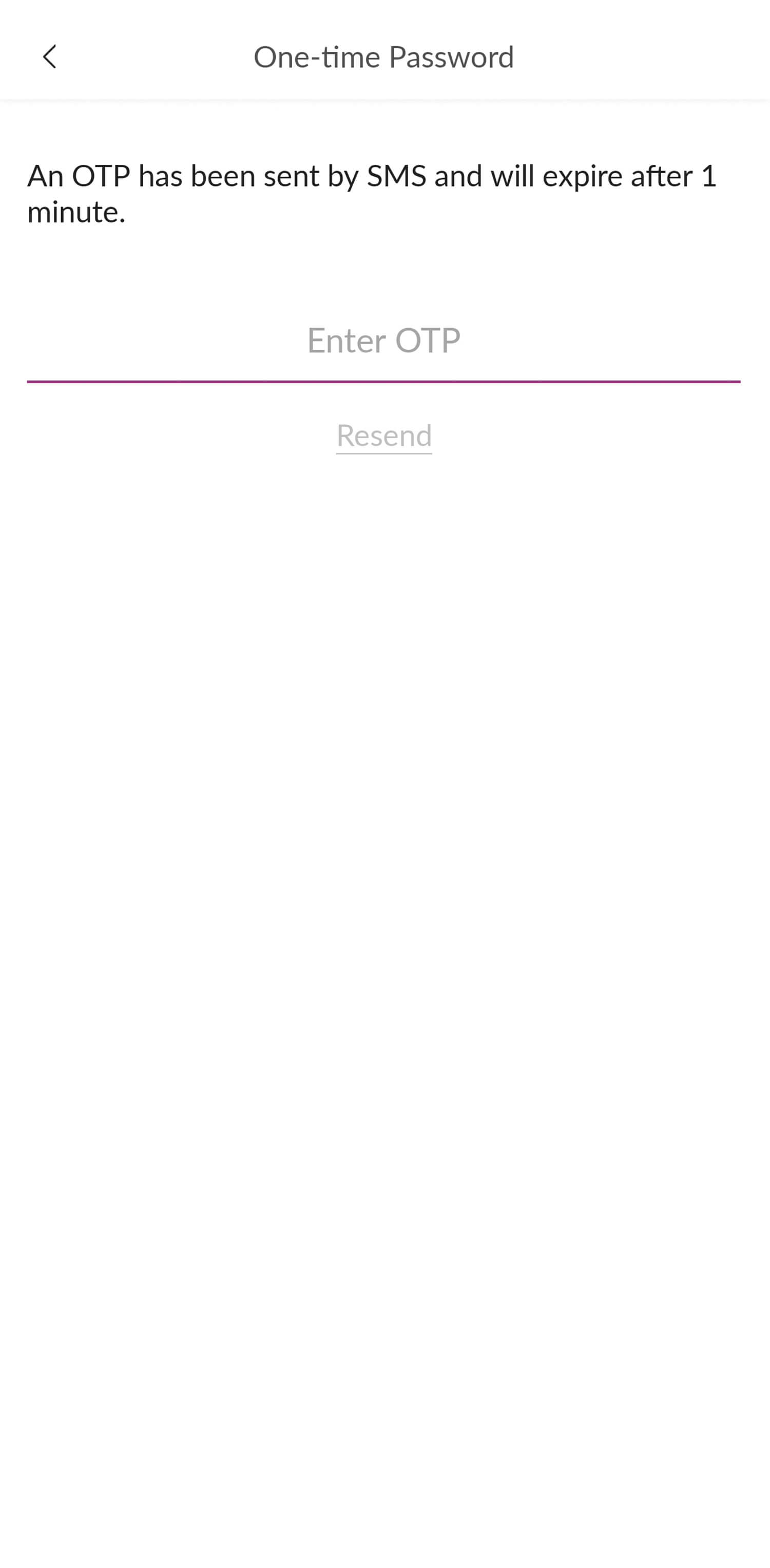

Step 4

OTP will be sent to you (sender) via SMS

Step 5

Enter the OTP

Once successful, screen will show that beneficiary has been added

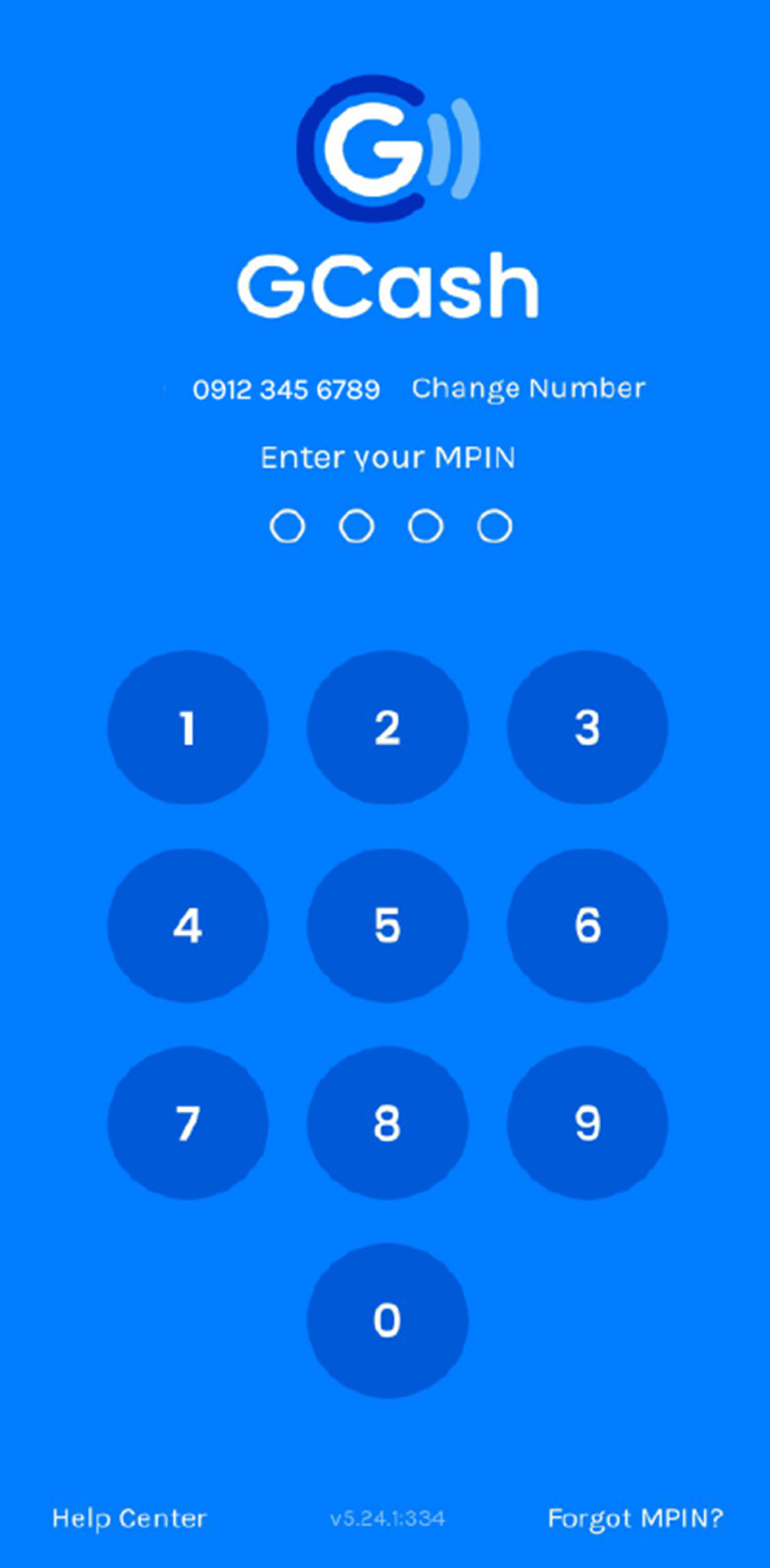

How to get your recipient’s to verify

their GCash accounts for international remittance

Step 1

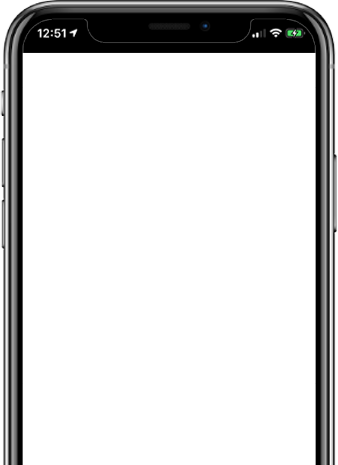

Log in to your GCash account

Step 2

Tap the burger icon found on the top-left corner

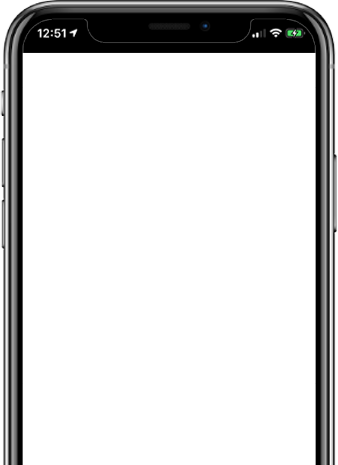

Step 3

Tap on 'Verify now'

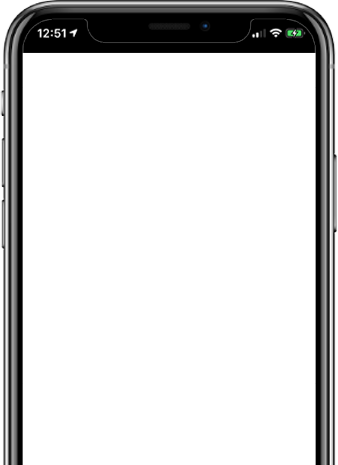

Step 4

Choose 'Get Fully Verified' to access all GCash features

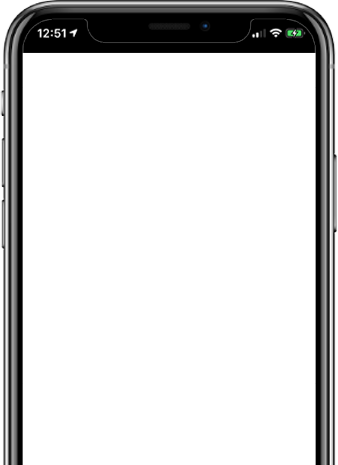

Step 5

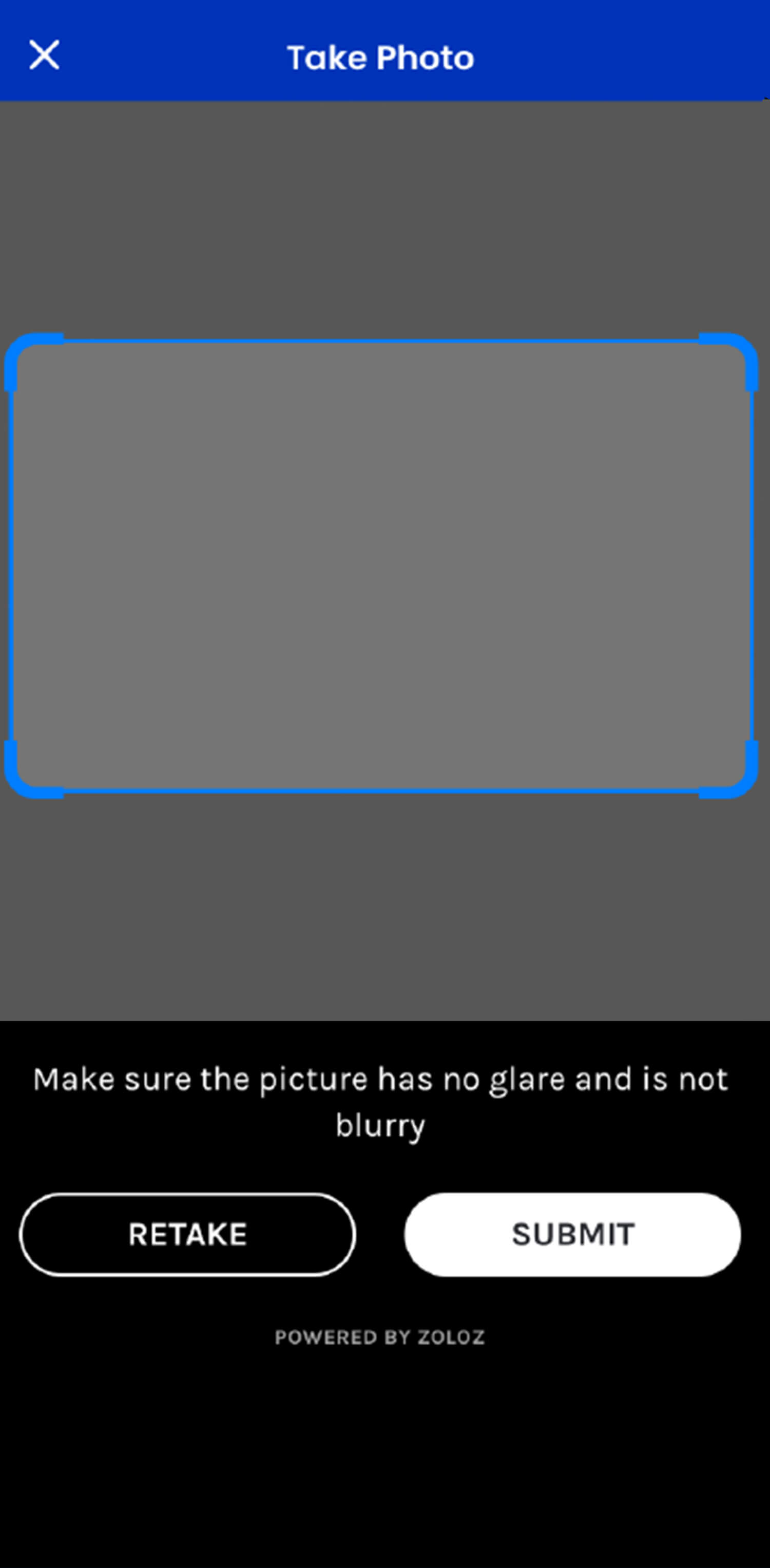

Choose a valid ID from the options

Step 6

Take a clear photo of the ID that you chose

Make sure to take a photo of your actual ID

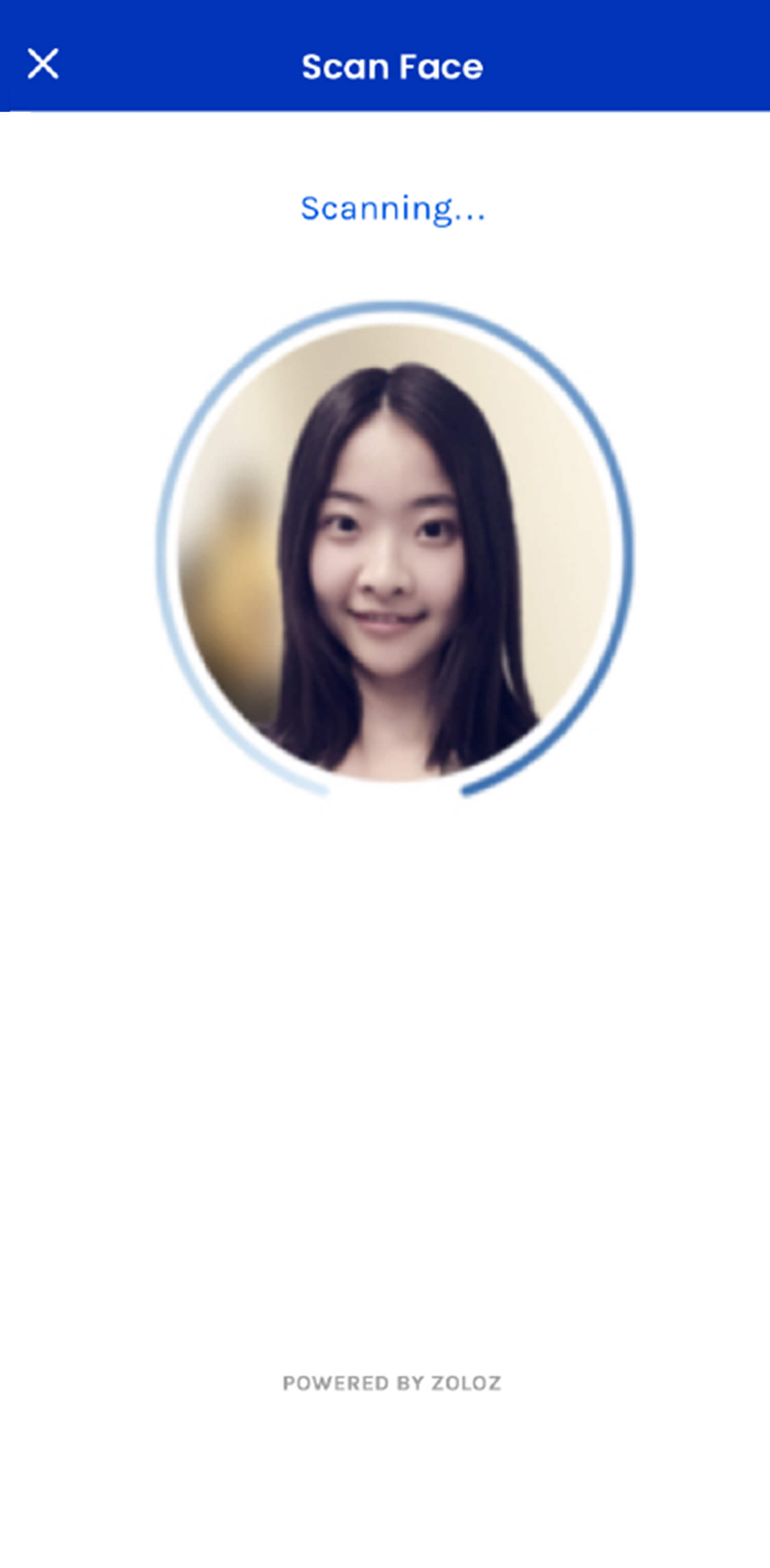

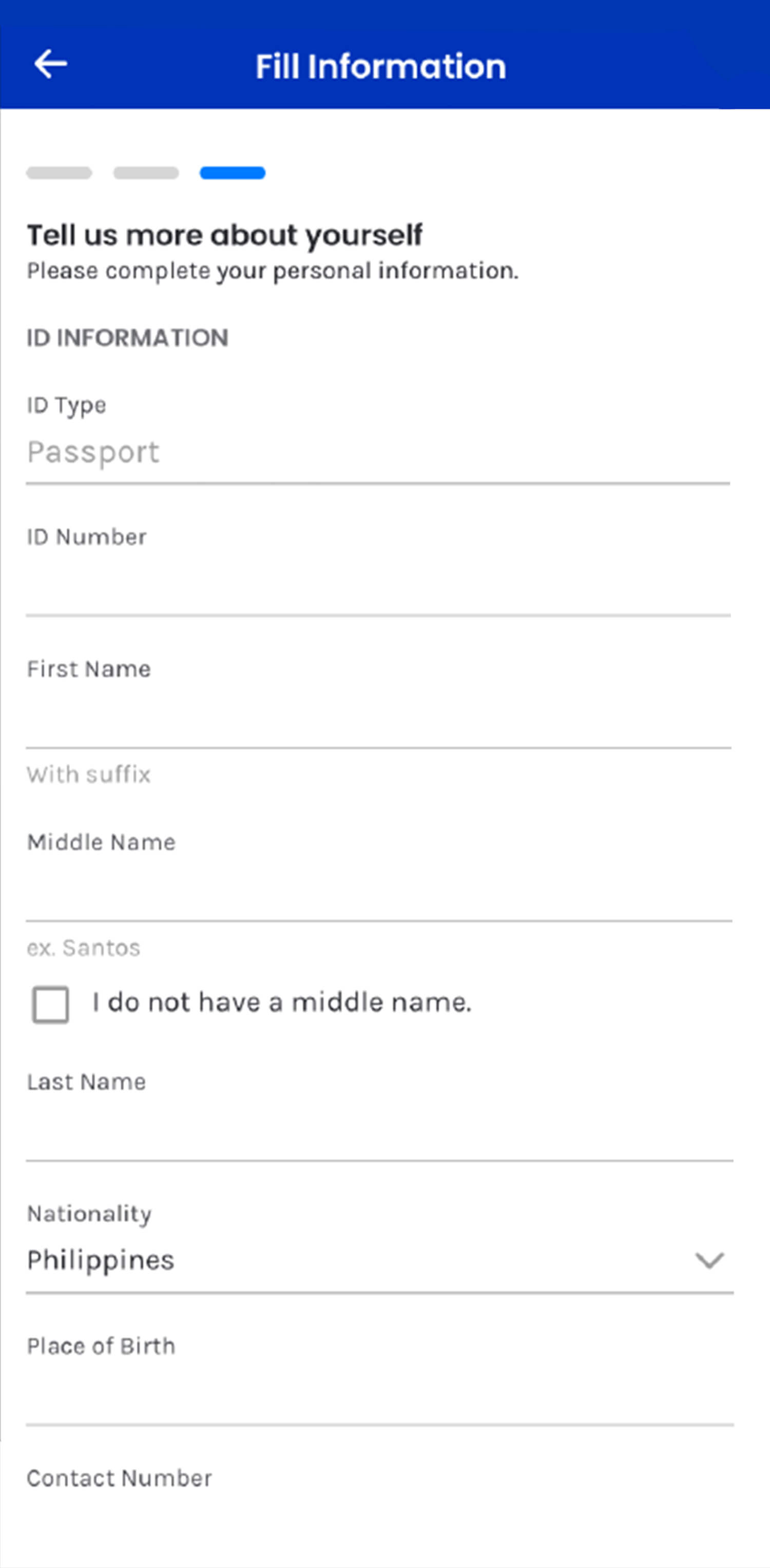

Step 7

Tap ‘Next’ and take a selfie

Step 8

Fill in the required information

Review and confirm

Frequently Asked Questions (FAQ)

What is the transaction fee to remit money to GCash with Singtel Dash?

There is a transaction fee of S$3.50 charged for each remittance to GCash, regardless of amount.

How long does it take for the remitted amount to reach the recipient’s GCash wallet?

It takes about 5 minutes for the remitted amount to reach the recipient’s GCash wallet.

What can I or my beneficiary do with GCash?

With GCash, your phone becomes a mobile wallet. You can use GCash to pay merchants, shop online, pay bills, top up mobile airtime, and even invest. Check out GCash.com/services for more information.

How can my recipient’s cash out?

- Cash out via ATM/MasterCard: GCash MasterCard holders can cash-out at any BancNet or MasterCard affiliated ATM. Use your GCash MPIN as the ATM PIN.

-

Cash out via GCash Partner Outlets (over the counter):

- Puregold

- Robinsons Department Store

- Posible

- SM

- Tambunting

- TrueMoney

- Villarica

How much are the cash-out fees the recipient’s has to pay?

- For ATM withdrawal, the fee is PHP20 per transaction (PHP150 per transfer outside of the Philippines)

- For cash out at partner outlets (Over the counter), there is no fee charged if the amount is below PHP8,000 (S$220). Beyond PHP8,000, there will be a 2% charge.

What is the maximum transaction limit to a GCash account?

Maximum per month PHP 100,000 (regular GCASH user)

Maximum per month PHP 500,000 (bank account-linked GCASH user)