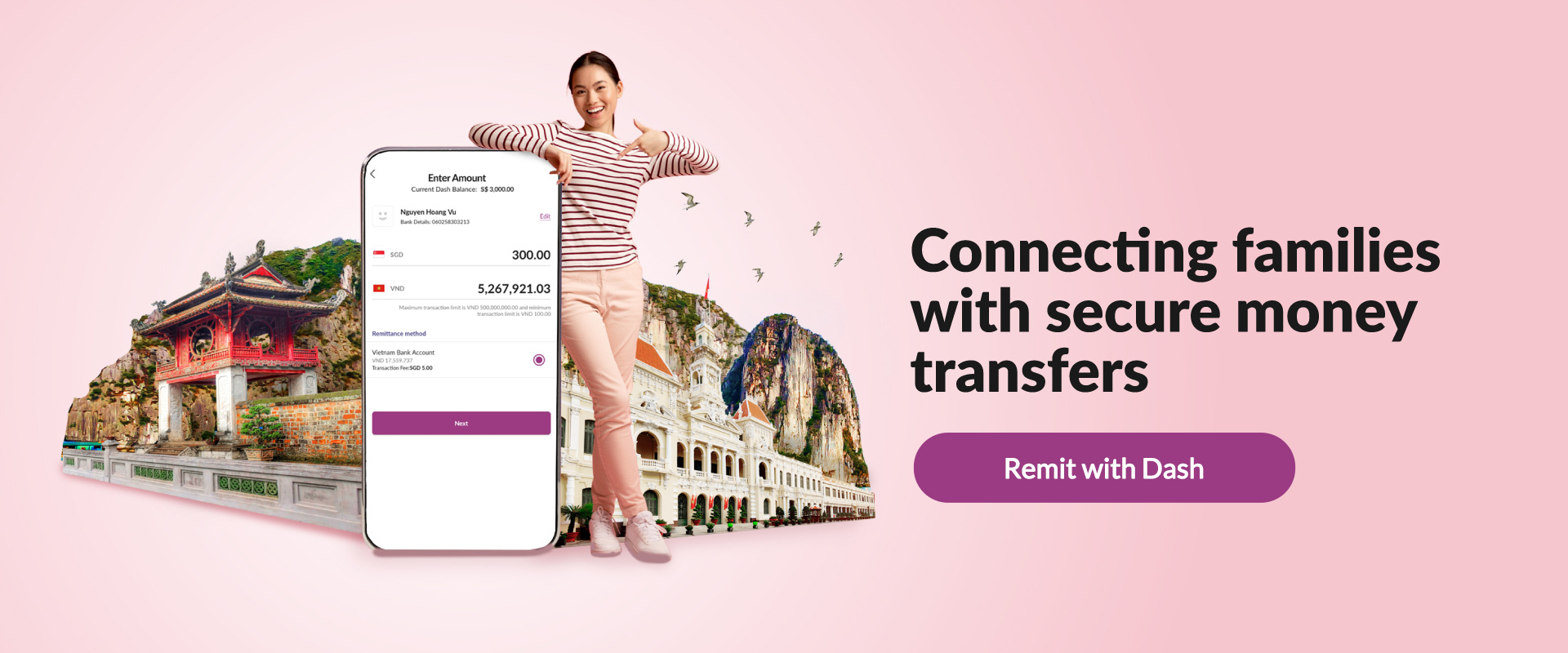

Connecting families with secure money

transfers to Vietnam by Dash Remit

Make 24/7 money transfers

to 41 banks in Vietnam

Disclaimer: Trademarks, trade names and logos (“Trademarks”) displayed are registered trademarks of their

respective owners. No affiliation or endorsement of Singtel Dash should be implied, nor shall the

Trademarks of Singtel be used in connection with any company, product or service that does not belong to

Singtel in any way that discredits Singtel or confuses the customers.

An Binh Commercial Joint Stock Bank (AnBinh Bank)

Asia Commercial Bank (ACB)

Bank for Investment and Development of Vietnam Joint Stock Commercial Bank (BIDV)

BaoViet Commercial Joint Stock Bank (BaoViet Bank)

Cimb Bank (Vietnam) Limited

Dong A Joint Stock Commercial Bank (DongA Bank)

Global Petro Sole Member Limited Commercial Bank (GPBank)

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank)

Hong Leong Bank Vietnam

Indovina Bank

Industrial Bank Of Korea Ha Noi Branch

Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank)

Kien Long Commercial Joint Stock Bank (KienLong Bank)

Lien Viet Post Joint Stock Commercial Bank (LienViet Bank)

Military Commercial Joint Stock bank (MB)

Modern Bank of Vietnam (MBV)

Nam A Commercial Joint Stock Bank (NamA Bank)

National Citizen Commercial Joint Stock Bank (NCB)

Orient Commercial Bank (OCB)

Petrolimex Group Commercial Joint Stock Bank (PG Bank)

Public Bank Vietnam Limited (Public Bank)

Saigon - Hanoi Commercial Joint Stock Bank (SHB)

Saigon Bank for Industry and Trade (SaigonBank)

Saigon Commercial Bank (SGCB)

Saigon Thuong Tin Commercial Joint Stock Bank (SacomBank)

Shinhan Bank Vietnam (SHBVN)

Southeast Asia Commercial Joint Stock Bank (SeaBank)

Tienphong commercial Joint Stock Bank (TienPhong Bank)

United Overseas Bank (Vietnam) Limited

Viet A Joint Stock Commercial Bank (Viet A Bank)

Viet Capital Joint Stock Commercial Bank (Viet Capital Bank)

Vietnam Bank for Agriculture and Rural Development (AgriBank)

Vietnam Export Import Commercial Joint Stock Bank (EximBank)

Vietnam International Commercial Joint Stock Bank (VIB)

Vietnam Joint Stock Commercial Bank for Intrustry and Trade (VietinBank)

Vietnam Maritime Commercial Joint Stock Bank (Maritime Bank)

Vietnam Prosperity Joint Stock Commercial Bank (VPBank)

Vietnam Public Joint Stock Commercial Bank (PVcomBank)

Vietnam Technological and commercial Joint Stock Bank (Techcom Bank)

Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank)

Woori Bank

A hassle-free and rewarding experience

when you use Dash Remit to send money to Vietnam.

Enjoy preferential exchange rates

Send more to get preferential exchange rates at low fees.

Real-time* money transfer

Receive your money almost instantly each time you remit.

Safe and secure with

money-back guarantee

Licensed and regulated by Monetary Authority of Singapore

Register

- Prepare your Singapore-issued ID card, proof of address (example: telco bill, bank statement, dormitory card, employment letter from MOM, water or electricity bill), and selfie.

- Launch the Dash app and select Remit.

- Select Register for Remittance.

- Enter your personal details and address.

- Upload a photo of your Singapore-issued ID card and selfie, then select Continue.

- After reading terms, select Done.

- You'll be notified of your registration status within 2 working days.*

* Kindly ensure you submit accurate information during registration to avoid any delay in processing.

Top up

Select Top Up to add funds to your account or you can visit the following:

- 7-Eleven

- AXS machine

- Sheng Siong $TMs (Simple Teller Machines)

- Singtel shops

- Singtel Exclusive Retailers

- Select your preferred top up method.

If you’re using your bank account, select your preferred bank, enter your email address for eRECEIPT notification, then press submit.

Add Recipient

- Select Remit then Add a Recipient.

- Select the receiving country and preferred remittance service. Enter the recipient details and select Register.

- Enter the OTP sent to you via SMS.

Screenshot to keep a record of your added recipient details.

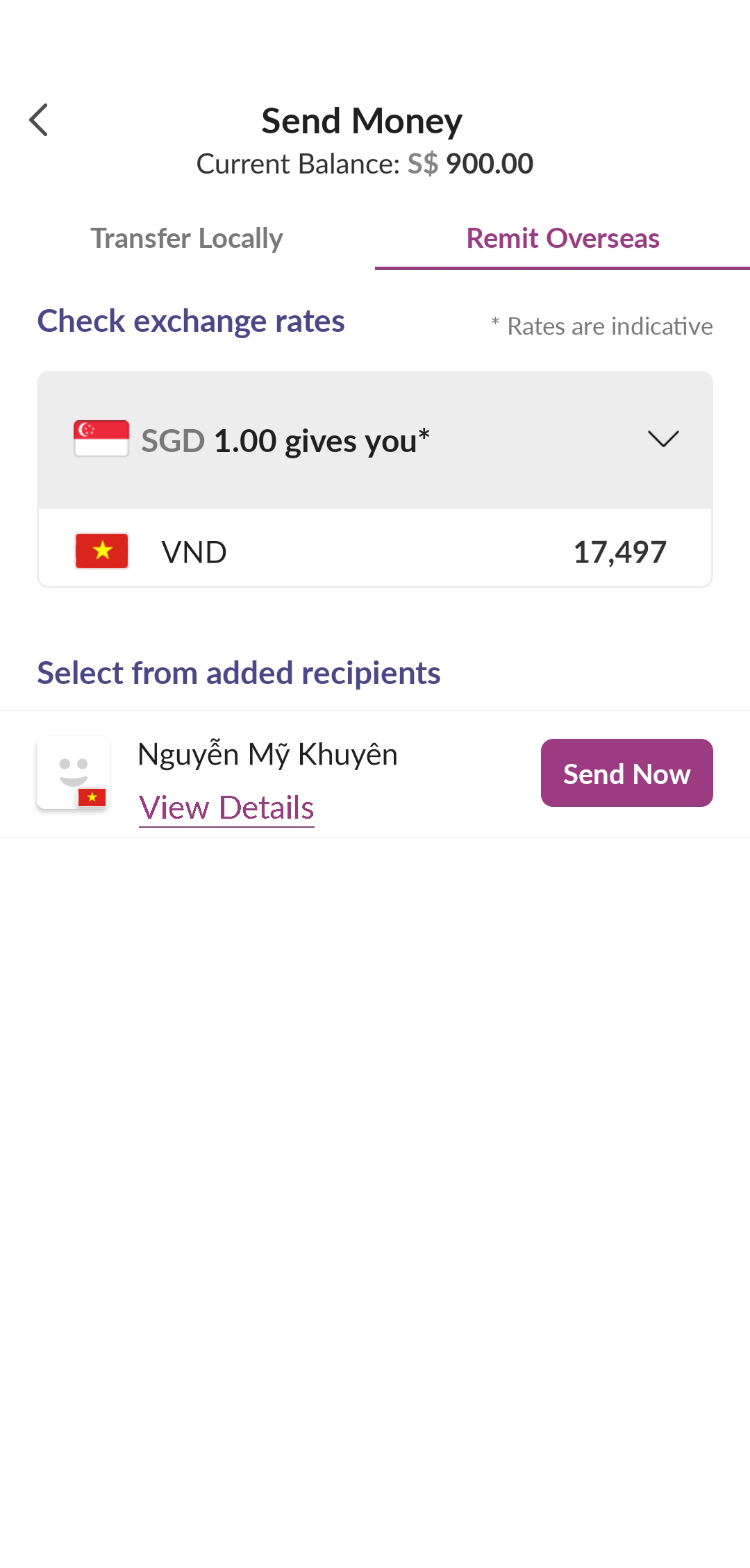

Remit now

- Select Remit, then Recipient, then select the Send Money button.

- Enter the amount and select your preferred service.

- Check that the amount and service details are correct.

- Remember to select your FREE 30-Day Dash Protect Insurance then select Confirm.

- Enter your 6-digit pin then select Next.

- Select Okay!

And you’re done!

Unlock new user & referral benefits with Singtel Dash – transfer money and earn cashback!

Frequently Asked Questions (FAQs)

Where in Vietnam can I remit money to with Singtel Dash?

You can remit directly into the bank accounts of the following banks in Vietnam:

- Asia Commercial Bank (ACB)

- Bank for Investment and Development of Vietnam Joint Stock Commercial Bank (BIDV)

- BaoViet Commercial Joint Stock Bank (BaoViet Bank)

- Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank)

- Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank)

- Lien Viet Post Joint Stock Commercial Bank (LienViet Bank)

- Military Commercial Joint Stock bank (MB)

- National Citizen Commercial Joint Stock Bank (NCB)

- Orient Commercial Bank (OCB)

- Petrolimex Group Commercial Joint Stock Bank (PG Bank)

- Saigon - Hanoi Commercial Joint Stock Bank (SHB)

- Saigon Bank for Industry and Trade (SaigonBank)

- Saigon Thuong Tin Commercial Joint Stock Bank (SacomBank)

- Tienphong commercial Joint Stock Bank (TienPhong Bank)

- Vietnam Bank for Agriculture and Rural Development (AgriBank)

- Vietnam Export Import Commercial Joint Stock Bank (EximBank)

- Vietnam International Commercial Joint Stock Bank (VIB)

- Vietnam Joint Stock Commercial Bank for Intrustry and Trade (VietinBank)

- Vietnam Maritime Commercial Joint Stock Bank (Maritime Bank)

- Vietnam Prosperity Joint Stock Commercial Bank (VPBank)

- Vietnam Technological and commercial Joint Stock Bank (Techcom Bank)

What is the transaction fee to remit money to Vietnam with Singtel Dash?

Remittance fee starts from SGD2.50 for each transfer to Vietnam and may change based on amount sent.

What is the SGD to VND exchange rate offered when I remit to Vietnam with Singtel Dash?

Our exchange rates are competitive so that you can get the best value. In addition, exchange rates are

subject to market fluctuations and the amount sent.

You will be able to see the applicable exchange rate when you key in the amount you wish to send to your

recipient on the Dash app. Enjoy preferential exchange rates when you send more.

How long does it take for the remitted amount be available to the recipient in Vietnam?

Remittances are transferred real-time in about 15 minutes for transfers up to VND500,000. For larger amounts, money will arrive in 3 Vietnam banking days (weekdays only with cut-off at 4.30pm GMT+7, subject to banking holiday).

How do I get started?

Once you have downloaded the Singtel Dash app, sign up for an account within the app.

Upon completion, you can register for remittance; Within the Dash app, select Remit > Register for

remittance and follow the required steps thereafter and submit.

When your account is approved for remittance, select add a recipient and start remitting.

For transfer to bank account, please ensure you add the correct bank account number of your recipient.

What documents can be used as proof of address?

Examples of proof of address:

- Singtel, M1, Starhub bill or any other telco bill

- Bank statement

- Dormitory card/pass

- Employment Letter with company letterhead and customer’s full name

- Tenancy agreement

- Letter from Singapore government agency (Eg. MOM)

- Water or Electricity bill

What is Preferential FX rate?

You can enjoy better exchange (FX) rates when you send more money to Australia, supported countries in Europe (including the United Kingdom), South Korea or Vietnam.

What are the associated transaction fees?

Transaction fees range from SGD2 to SGD7 depending on the selected country, and according to the remittance amount which falls within the following ranges:

- Send amount: SGD 1 - 499.99

- Send amount: SGD 500 - 1,999.99

- Send amount: SGD 2,000 or more

To obtain the final transaction fee, launch your Dash app and select your recipient from any of these receiving destinations: Australia, Europe (including the United Kingdom), South Korea or Vietnam, and enter your send amount.

How do I find out the actual FX rate applied to my remittance transaction?

The exchange (FX) rates displayed on the remittance page of the Dash app are indicative rates and are subject to market fluctuations in the day. The final FX rate applied to your remittance transaction will be shown on the remittance confirmation page of the Dash app.

Do I need to update my Dash app to enjoy the preferential FX rate when I send money to Australia, countries in Europe, South Korea, the United Kingdom or Vietnam?

Do ensure your Dash app is updated to minimum app version 6.12, applicable for iOS and Android. To check your app version, launch your Dash app, go to “Account” and the app version is displayed at the bottom of the page.

How often do the FX rates change?

A live exchange (FX) rate is quoted when a remittance transaction is initiated. The FX rate may change according to market conditions. The final FX rate applied for a remittance transaction is displayed on the remittance confirmation page of the Dash app.

Can I cancel a remittance transaction after payment confirmation?

We provide real-time processing of every remittance request. Once a remittance transaction is processed, it cannot be cancelled.

Are there changes to the transaction or wallet limit?

No. The transaction and wallet limit remain the same.