5 Key Features of UOBAM Robo-Invest you should know

Managing one’s portfolio should be simple and insightful. UOBAM Robo-Invest has been designed to ease users into

their foray into robo-advisory service by keeping an easy-to-understand dashboard and management tools. In this

article, we delve into 5 key features in UOBAM Robo-Invest.

- Dashboard: Key portfolio details at a glance

- Review portfolio performance (to-date, projected returns)

- Review portfolio details (allocation, fact sheet)

- Review transactions

- Get monthly statement and tax invoices

What is UOBAM Robo-Invest?

Managing your finances can be a complex process especially when you are time-poor and don’t have extensive

expertise.

UOBAM Robo-Invest offers a simple and sustainable way to grow your wealth. Featuring hybrid portfolios tailored to

your financial goals and risk appetite, you require minimal knowledge and time invested on your end.

In a nutshell:

- Robo-advisory service managed by experts from award-winning asset manager, UOB Asset Management (UOBAM)

- Combination of machine algorithms and human expertise to offer you reliable financial advice and portfolio recommendations

- Contribute to a sustainable future with Environmental, Social and Governance (ESG) integrated portfolio

- Easy to start - from just S$1, enjoy low advisory fees from 0.6% p.a.**

Start reaching your financial goals with UOBAM Robo-Invest

What sets UOBAM Robo-Invest apart is that it combines the insights and experience of UOB Asset Management’s experts, with advanced digital algorithms. UOBAM Robo-Invest uses a proprietary smart algorithm to build a portfolio tailored to your needs.

Fig. 1 UOBAM Robo-Invest’s key investment inputs by UOBAM’s investment and product committees

UOBAM Robo-Invest is the first robo-adviser to be exclusively available on a mobile wallet - Singtel Dash.

Singtel Dash app is available on the Google Play store or Apple App Store.

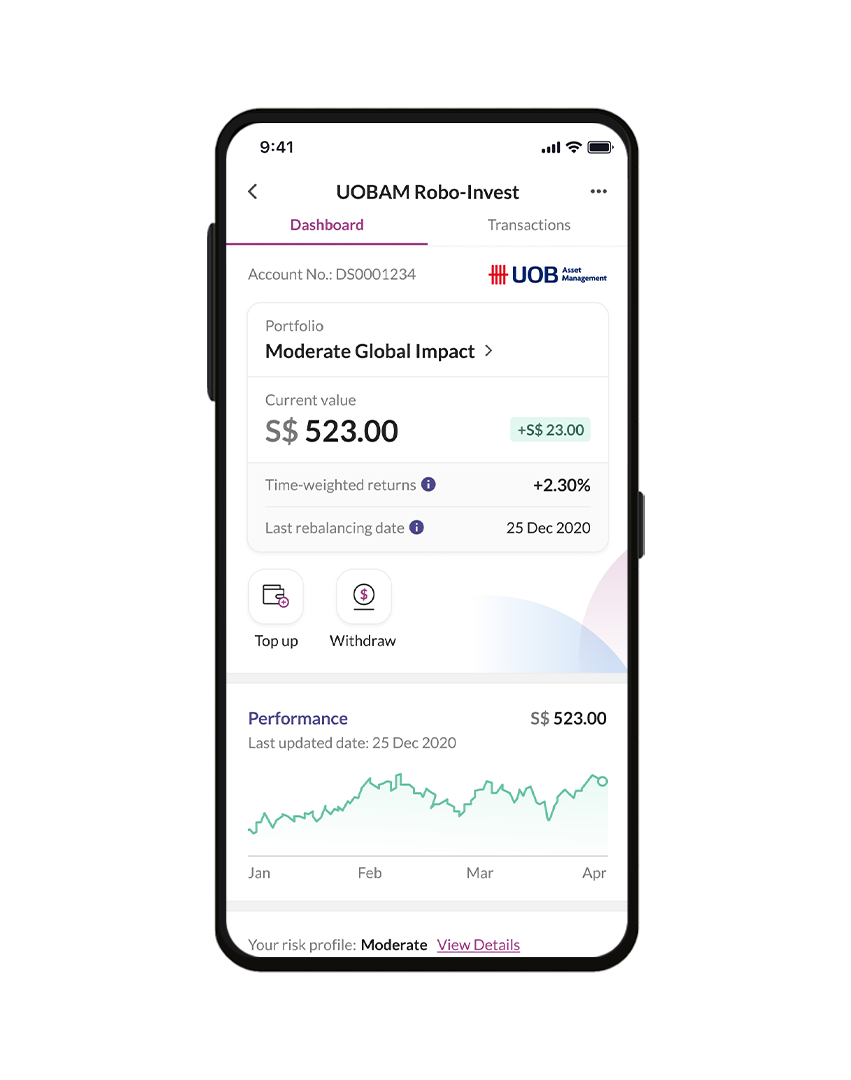

1. Dashboard: Key portfolio details at a glance

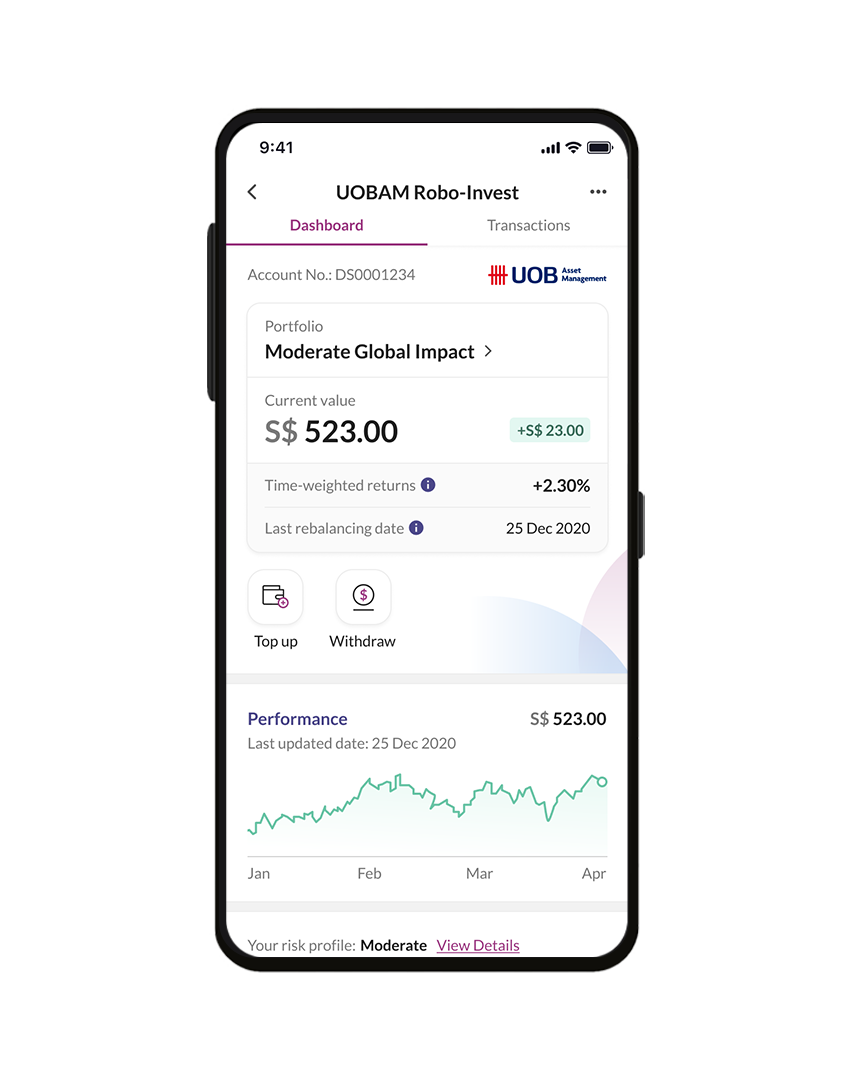

Fig. 2 UOBAM Robo-Invest dashboard showing an overview of the portfolio details, transactions and top-up and withdrawal functions

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of the principal amount invested.

On your dashboard, you’ll have an overview of your portfolio to understand important details like performance and

transactions in a single view.

Your current portfolio value is shown, along with unrealised* gains or losses highlighted in red or

green.

* Unrealised gains or losses reflect the appreciation or depreciation of the market value of your

assets. These gains or losses are not actualised, until the assets are actually sold.

You can also make top-ups and withdrawals by tapping on the respective shortcut icons.

Tap the portfolio name to enter “My Portfolio”, where you get a detailed breakdown of your current portfolio.

2. Review your portfolio performance

Fig. 3 Portfolio Performance across various time periods

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of the principal amount invested.

You can review your portfolio’s overall performance, over fixed time periods of the past three months, six months,

12 months, or from the inception date.

Want to view your portfolio value at a specific point in time? Just tap on the chart, or scroll left or right, to

pick out overall trends and patterns.

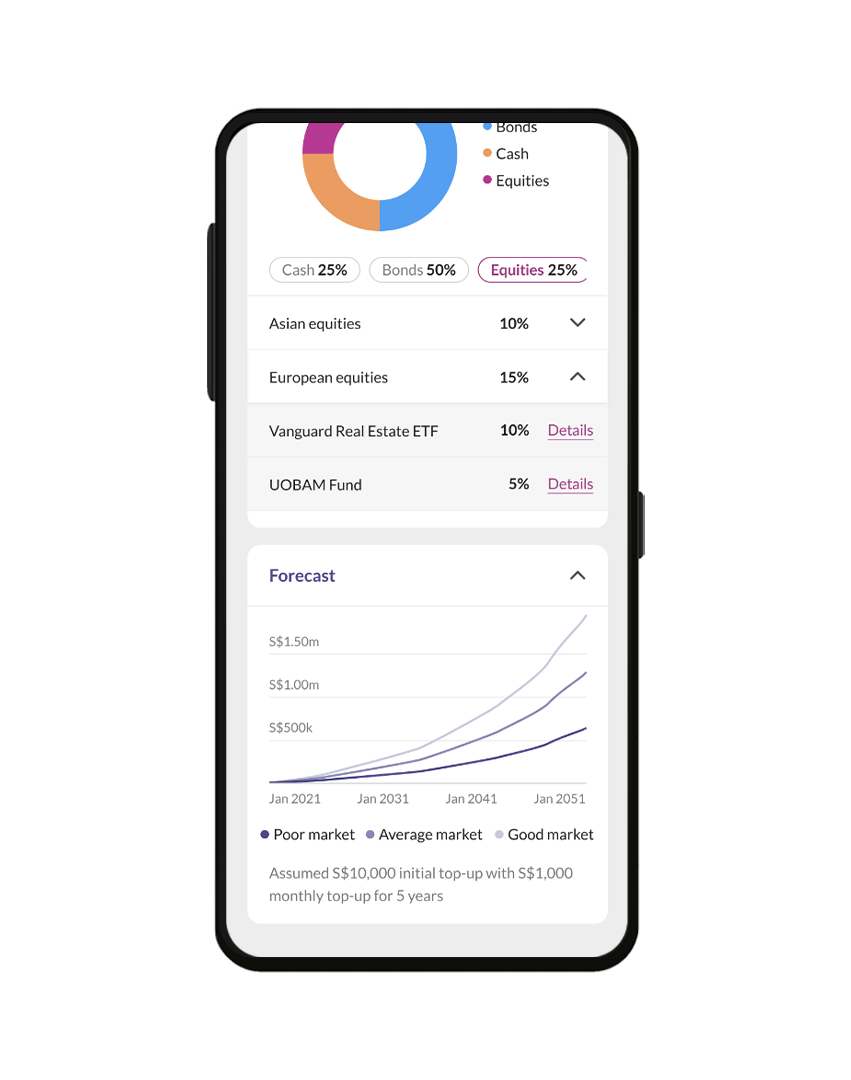

Fig. 4 Sample Projection of Portfolio Performance in 3 market conditions

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of the principal amount invested.

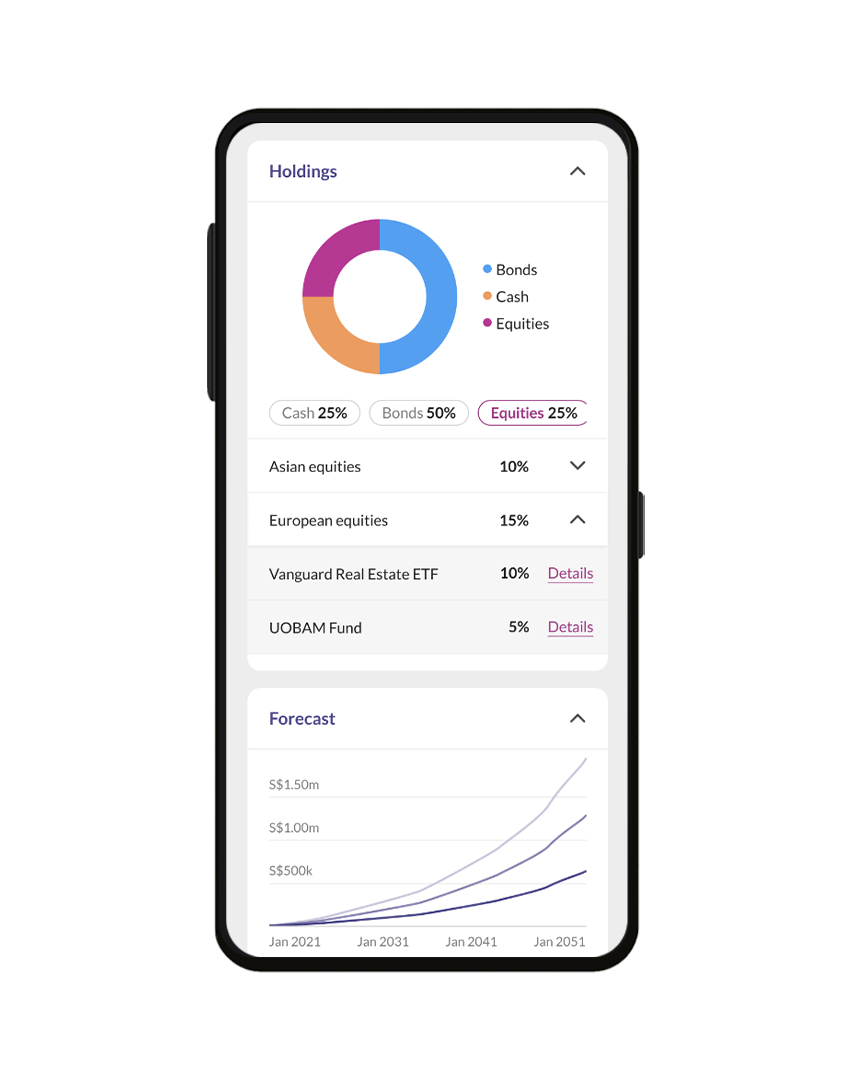

To understand how the portfolio may perform under various market conditions, UOBAM Robo-Invest provides projections

based on three different conditions:

You can see how well your portfolio is projected to perform in a poor market (downturn), good market (upturn), or

normal market conditions.

Disclaimer: Portfolio performance is subject to market volatilities, and past performance is not an indicator

of future performance. The rate of return and risks varies across different assets and time periods.

3. View your portfolio details

Fig. 5 Sample Asset Allocation within Portfolio

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of the principal amount invested.

Under Holdings, you can view the allocation of different assets that make up your portfolio. This asset allocation

mix reflects your portfolio and its changes over time.

Each portfolio is designed with an asset allocation mix tailored to your risk preferences, and financial goals.

As your portfolio value changes, the weightage of different assets may shift. For example, when certain funds

outperformed and other funds underperformed, the % allocation of the performing funds may go up while the

underperforming funds shrink in the allocation.

UOBAM Robo-Invest provides automatic portfolio rebalancing to retain the intended asset allocation, on a quarterly

basis. UOBAM Robo-Invest will also rebalance your portfolio when you make a top-up or withdrawal, to restore the

asset allocation mix to its intended, optimised ratio.

You can inspect further details for each specific fund, at any time

Under the “Details” for each Fund, you can view the individual fund factsheets.

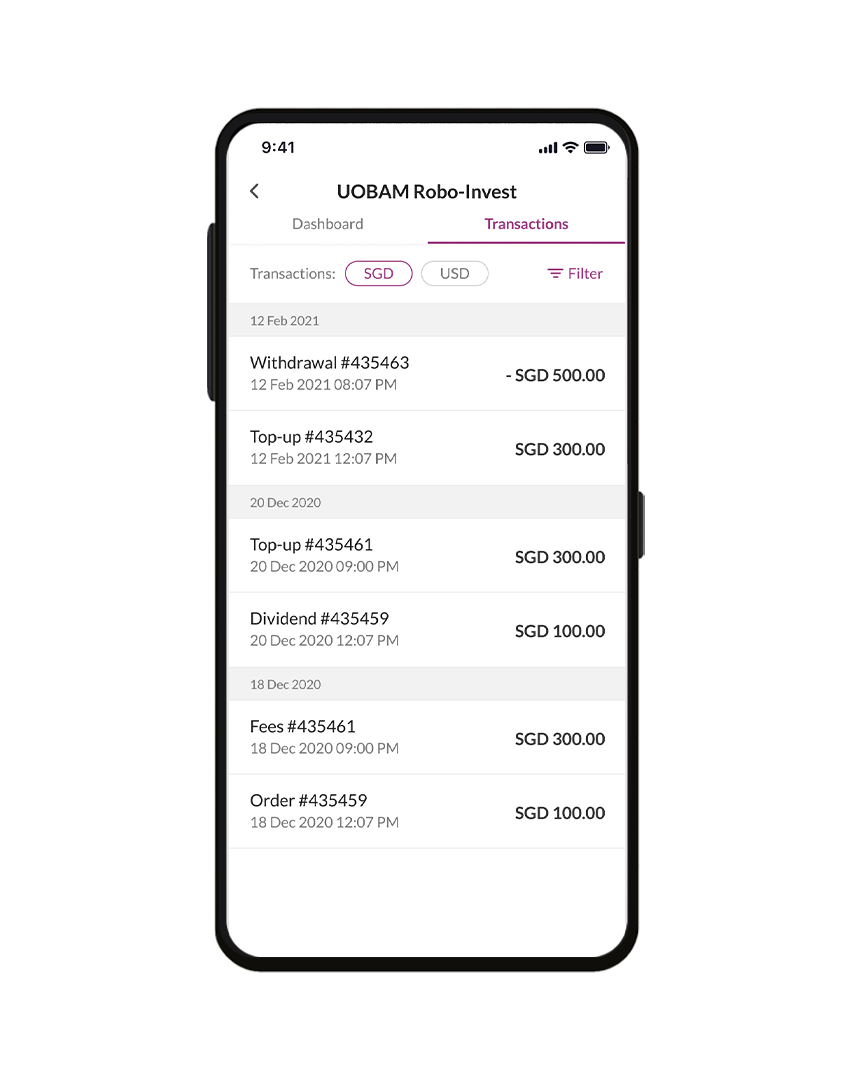

4. Track your transactions with a tap

Fig. 6 List of Transactions with filter options by date, currency and type

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or likely performance of any portfolio.

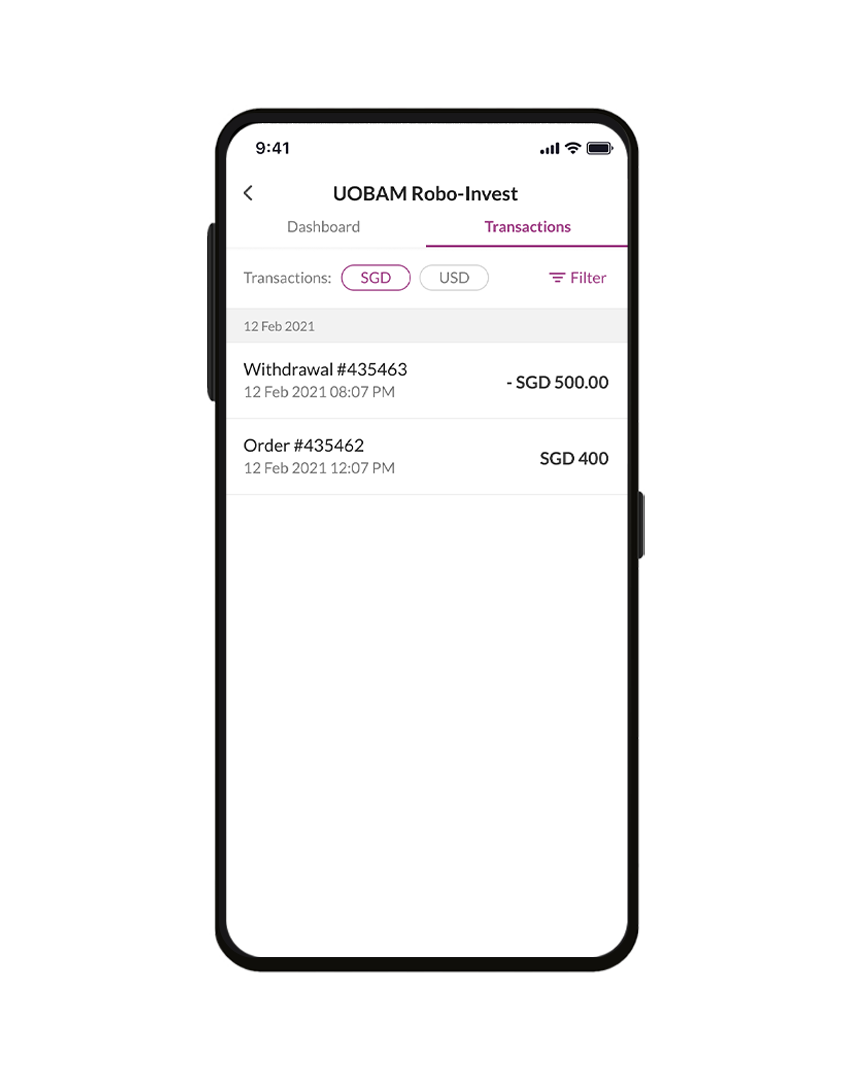

Under the “Transactions” tab (see Fig. 6), you can view the history of all successful transactions to date. These

include transactions made by yourself, as well as transactions made automatically by UOBAM Robo-Invest to

rebalance or optimise your portfolio through its algorithm.

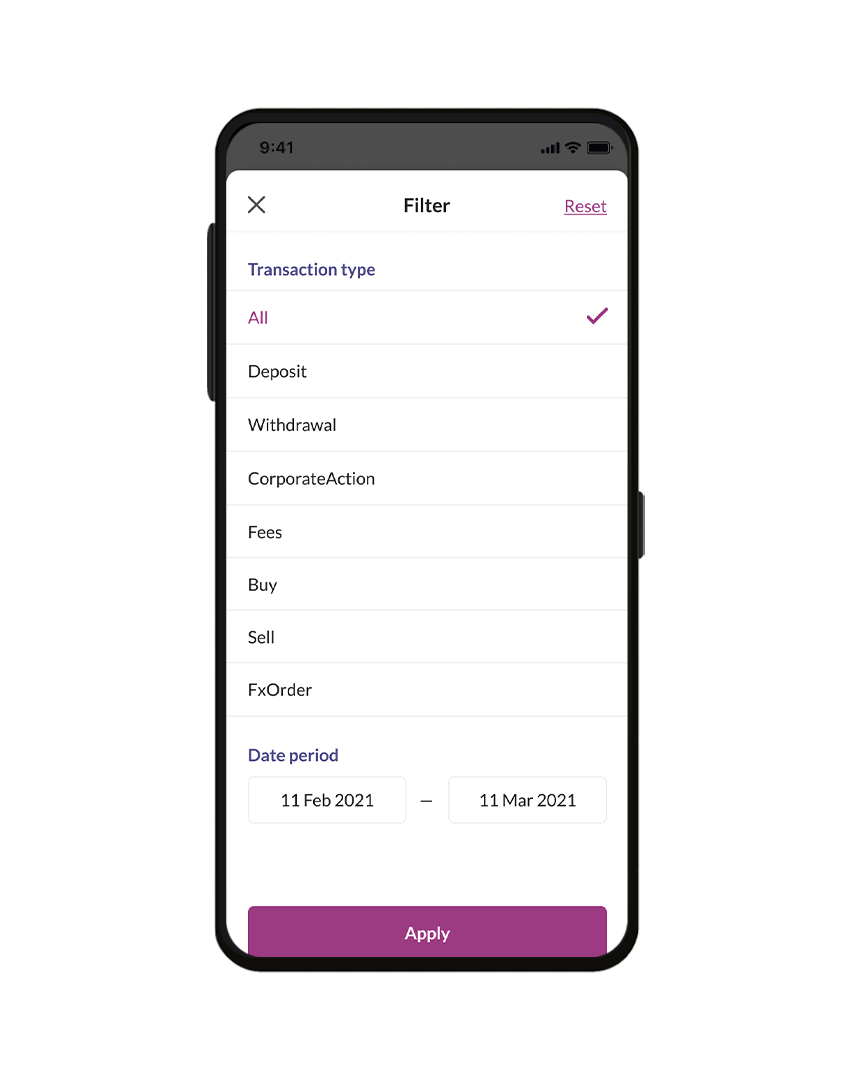

You can also use the filter button (see Fig. 7), to quickly find a transaction based on a certain date, or by the

nature of a transaction (deposit, withdrawal, fee, etc.)

5. Retrieve monthly statement and tax invoices

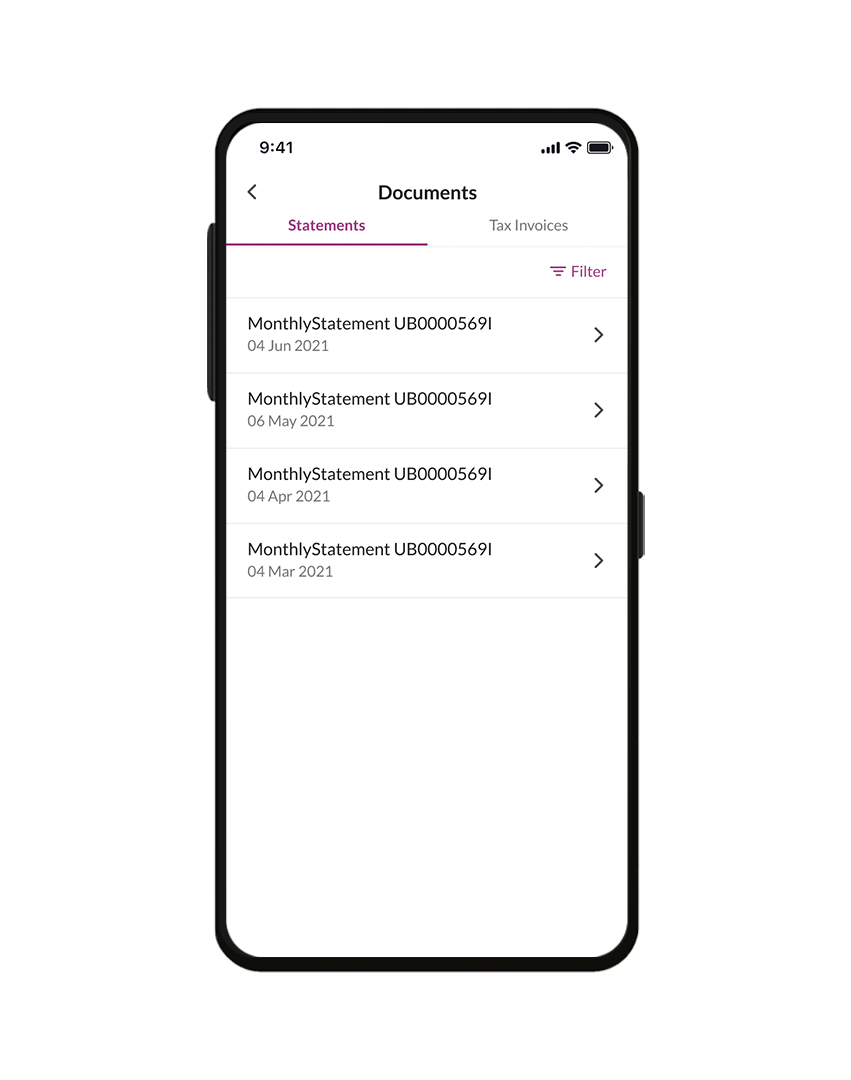

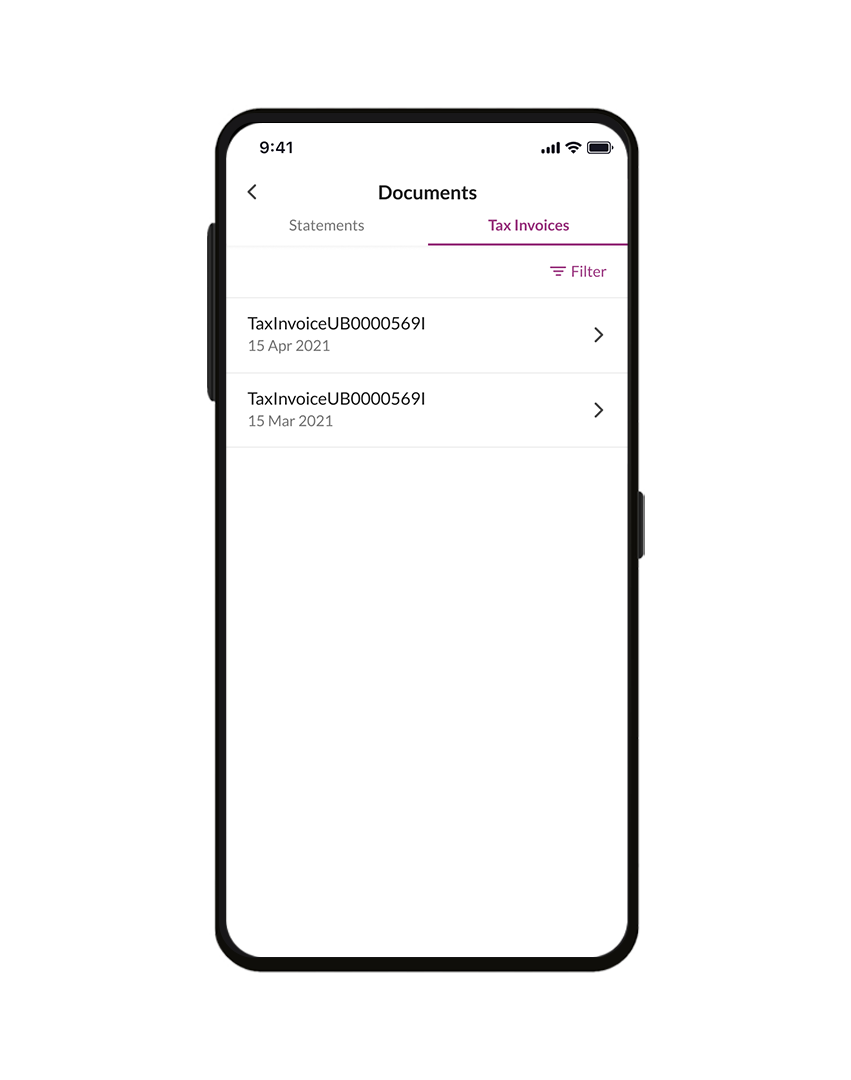

Fig. 7 List of Monthly Statements and Tax Invoices

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of the principal amount invested.

You can retrieve a consolidated monthly statement, by tapping the menu bar “…” on the top-right of your dashboard

(see Fig. 2) to select the relevant documents. This will show the full monthly statement, along with relevant tax

invoices.

UOBAM Robo-Invest provides a simple way for you to start your robo-adviser journey, as well as the tools to manage

your portfolio. From low advisory fees to opportunities to contribute to a sustainable future through investing in

ESG-aware companies, UOBAM Robo-Invest is designed for both novice and seasoned investors to power up their idle

cash.

Launch the Singtel Dash app and tap on “Invest” tile to start growing your wealth sustainably via UOBAM

Robo-Invest today. Get S$10 worth of credits* by simply opening an account by 30 June 2023, and an additional S$20 worth of credits^ & 1,000 Dash reward points when you top up min. S$500.

Singtel Dash app is available on the Google Play store or Apple

App Store.

Important Notes & Disclaimers:

*UOBAM Robo-Invest Activation Promotion is valid from 1 Jan 2023 to 30 June 2023 only. View full terms and conditions here.

^UOBAM Robo-Invest S$20 worth of credits Promotion is valid from 1 Jan 2023 to 30 June 2023, both dates inclusive, and open to all new and existing UOBAM Robo-Invest users. Limited to the

first 350 UOBAM Robo-Invest users who meet the promotional criteria, excluding users who have qualified for the

Lunar New Year Promotion. View here for full

promotional terms and conditions.

**Other US SEC fees, taxes and underlying fund-related fees apply. Visit dash.com.sg/uobam-roboinvest for details.

Fees are calculated and accrued daily and deducted after the end of every quarter. The quarter ends on the last

day of March, June, September and December.

This document is for your general information only. It does not constitute investment advice, recommendation or an

offer or solicitation to deal in Exchange Traded Funds (“ETFs”) or in units in any Unit Trusts (“Unit Trusts”,

ETFs and Unit Trusts shall together be referred to as “Fund(s)”) nor does it constitute any offer to take part in

any particular trading or investment strategy. This document was prepared without regard to the specific

objectives, financial situation or needs of any particular person who may receive it. The information is based on

certain assumptions, information and conditions available as at the date of this document and may be subject to

change at any time without notice. If any information herein becomes inaccurate or out of date, we are not obliged

to update it. No representation or promise as to the performance of the Fund or the return on your investment is

made. Past performance of any Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction,

projection or forecast of the economic trends or securities market are not necessarily indicative of the future

or likely performance of the Fund or UOBAM. The value of any Fund and the income from them, if any, may fall as

well as rise, and may have high volatility due to the investment policies and/or portfolio management techniques

employed by the Fund. Investments in any Fund involve risks, including the possible loss of the principal amount

invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited

(“UOB”), UOBAM, or any of their subsidiaries, associates or affiliates (“UOB Group”) or distributors of the

Fund. Market conditions may limit the ability of the platform to trade and investments in non-Singapore

markets may be subject to exchange rate fluctuations. The Fund may use or invest in financial derivative

instruments and you should be aware of the risks associated with investments in financial derivative instruments

which are described in the respective Fund's prospectus. The UOB Group may have interests in the Funds and may

also perform or seek to perform brokering and other investment or securities-related services for the Fund.

Investors should read the Fund's prospectus, which is available and may be obtained from UOBAM or any of its

appointed agents or distributors, before investing. Notwithstanding the digital advisory services that will be

provided to you through UOBAM Robo-Invest, you may wish to seek advice from a financial adviser before making a

commitment to invest with UOBAM Robo-Invest, and in the event that you choose not to do so, you should consider

carefully whether investing through UOBAM Robo-Invest is suitable for you. Any reference to any specific

country, financial product or asset class is used for illustration or information purposes only and you should not

rely on it for any purpose. We will not be responsible for any loss or damage arising directly or indirectly in

connection with, or as a result of, any person acting on any information provided in this document. Services

offered by UOBAM Robo-Invest are subject to the UOBAM Robo-Invest Terms and Conditions.

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of the principal amount invested.

UOB Asset Management Ltd Co. Reg. No. 198600120Z