Start Funding your UOBAM Robo-Invest Account

By now you’ve heard about the importance of planning your finances to achieve your retirement, lifestyle, and

financial goals. But like many working adults, you may not have the time or expertise to pore over hundreds of

options. UOBAM Robo-Invest offers a simple and effective alternative – use the Singtel Dash app to customise and

build a portfolio which you can track at any time:

- Robo-advisory service managed by experts from award-winning1 asset manager, UOB Asset Management (UOBAM)

- Combination of machine algorithms and human expertise that aims to offer you reliable financial advice and portfolio recommendations

- Opt for a sustainable future with Environmental, Social and Governance (ESG) integrated portfolio

- Easy to start - from just S$1, enjoy low advisory fees from 0.6% p.a.**

1Please visit www.uobam.com.sg for details on the full list of our awards.

Start reaching your financial goals with UOBAM Robo-Invest

What sets UOBAM Robo-Invest apart is that it combines the insights and experience of UOB Asset Management’s experts, with advanced digital algorithms. UOBAM Robo-Invest uses a proprietary smart algorithm to build a portfolio tailored to your needs.

Figure 1. UOBAM Robo-Invest’s key investment inputs by UOBAM’s investment and product committees

UOBAM Robo-Invest is the first robo-adviser to be exclusively available on a mobile wallet - Singtel Dash.

Singtel Dash app is available on the Google Play store or Apple

App Store.

UOBAM Robo-Invest helps you access a portfolio customised to your risk level and financial goals. You can create

your UOBAM Robo-Invest portfolio in minutes. Once your account has been approved, you can start by funding your

account.

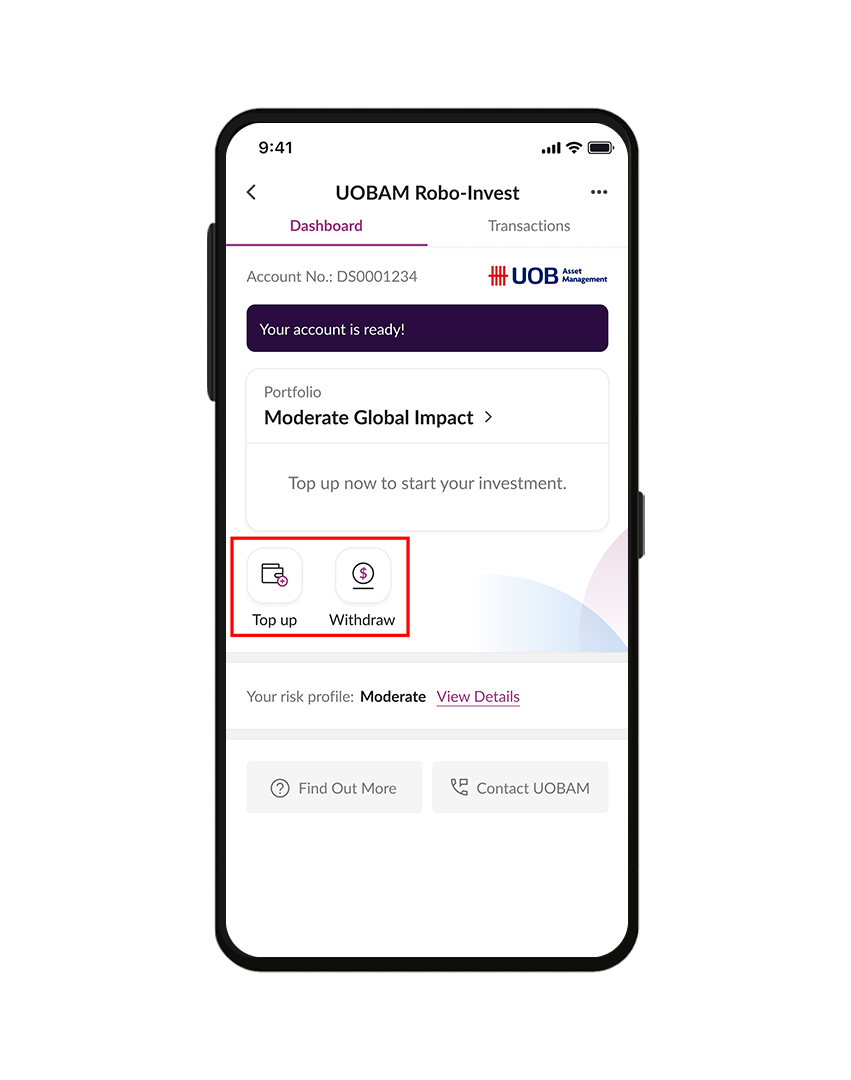

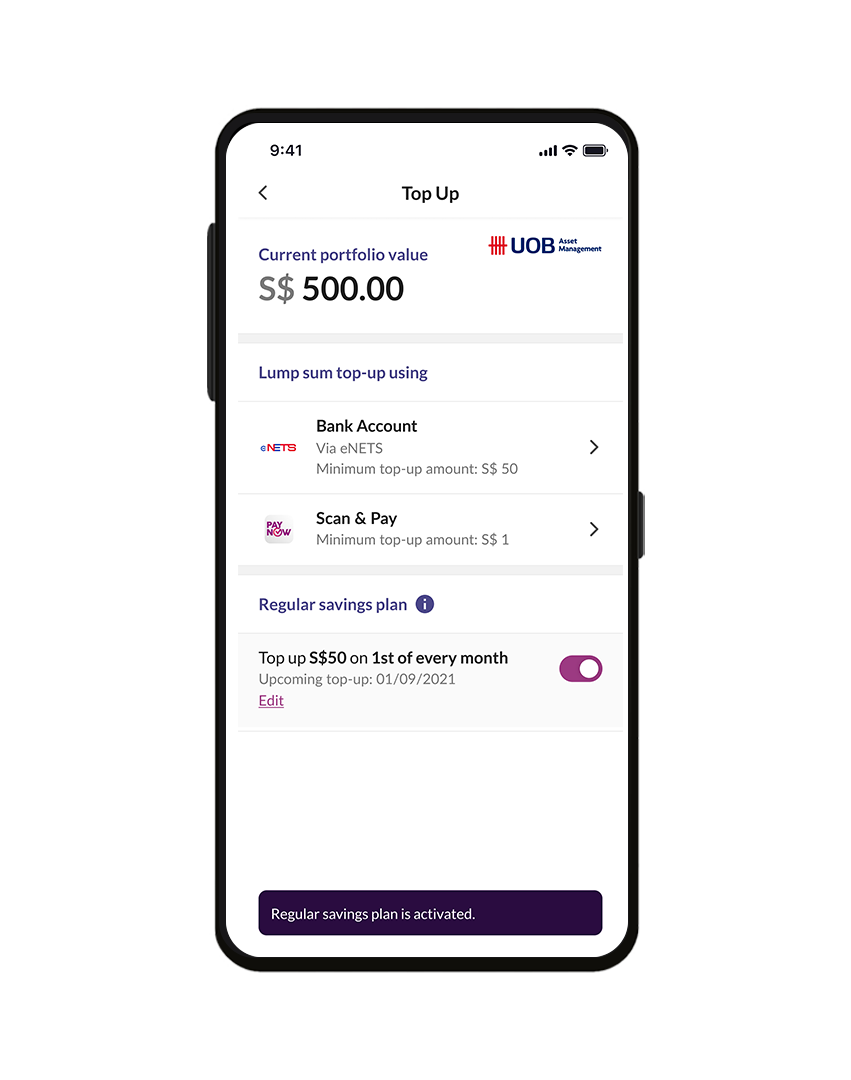

Top up your UOBAM Robo-Invest account

Figure 2. Top up and Withdraw options on UOBAM Robo-Invest dashboard

All screens shown and reference to any asset class are for illustration or information only and should not be

relied upon or construed as a recommendation of specific model portfolios.

UOBAM Robo-Invest gives you the flexibility to top up your investments, whenever you feel it’s appropriate. You

can choose between manual lump-sum top-ups to your account, or automatic top-ups via a regular savings plan.

On the UOBAM Robo-Invest dashboard, tap on “Top Up”. You can then choose one of the three methods to top-up:

-

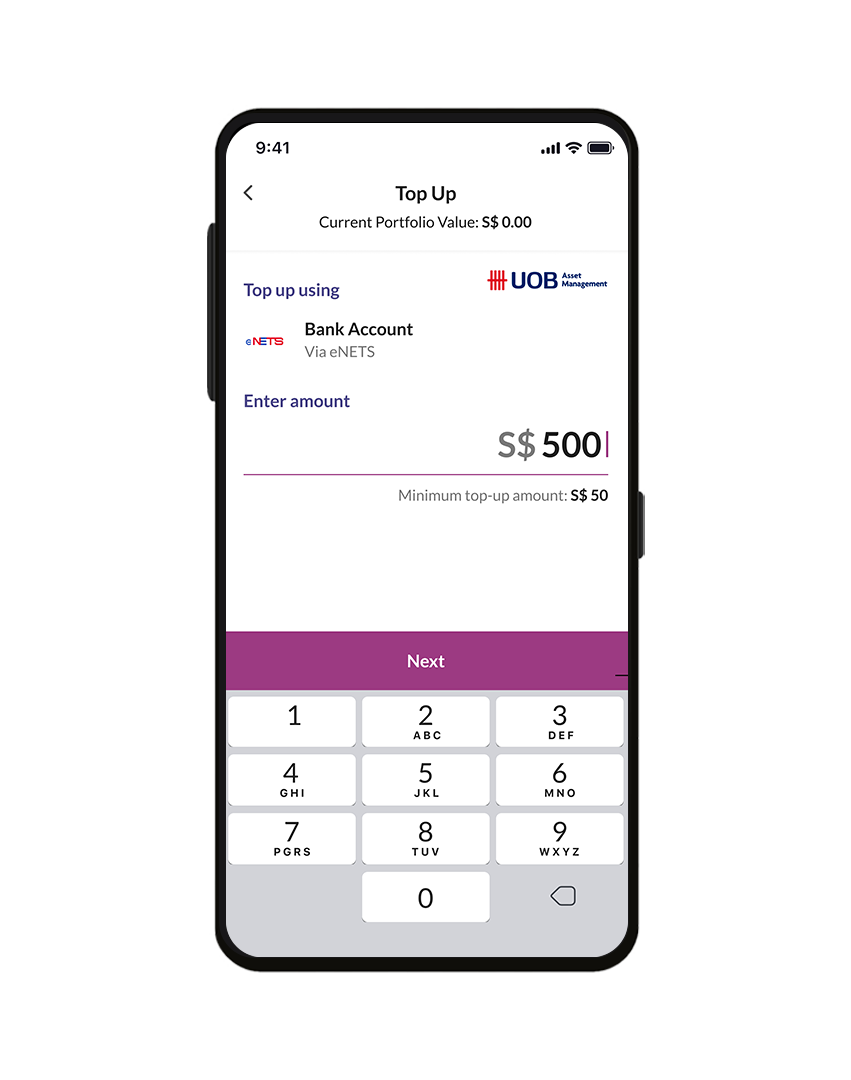

1. Lump-sum top-up via eNETS

Figure 3. Lump-sum top-up from bank account via eNETS (minimum top-up of S$50)

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios.Simply get your iBanking details ready and ensure your daily eNETS transfer limit is set to the appropriate amount to allow a smooth transfer.

Allow for 1-3 business days for the top-up amount to be reflected in your account.

-

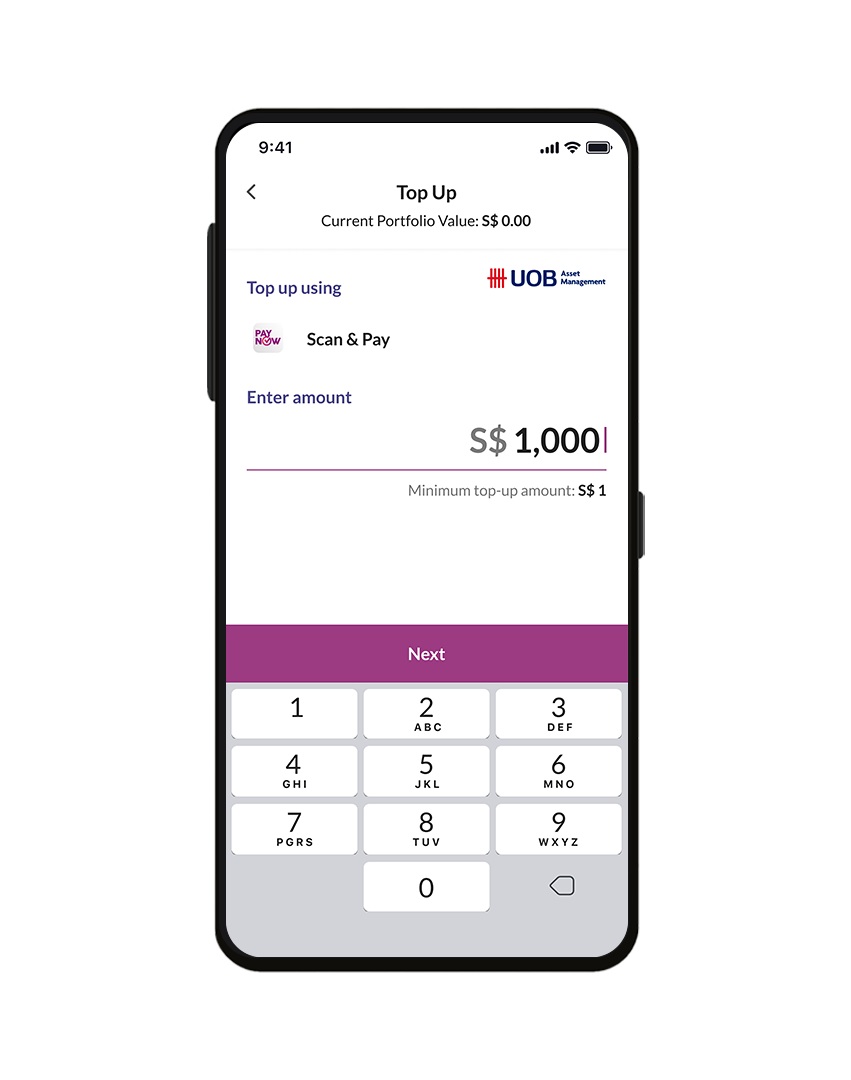

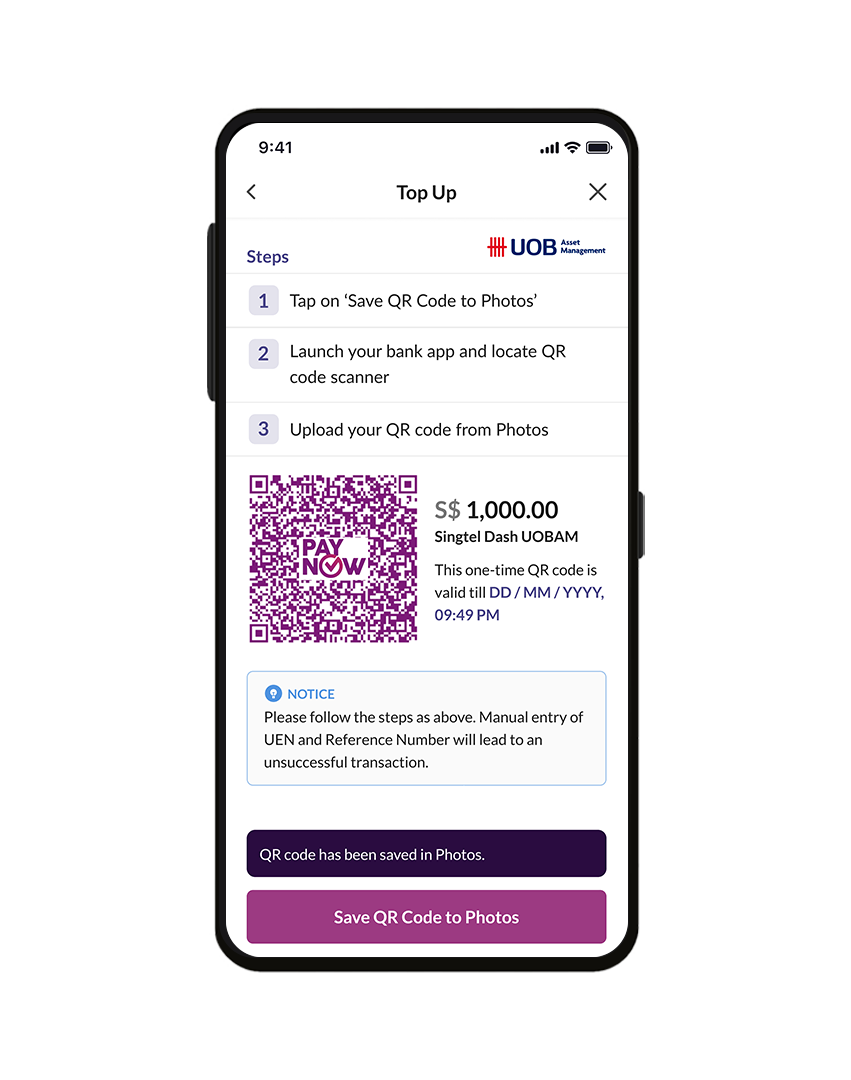

2. Lump-sum top-up via PayNow

Figure 4. Lump-sum top-up from bank account via PayNow QR code (minimum top-up of S$1)

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios.To use Scan and Pay, you will need to access a mobile banking app that supports PayNow.

- Type in the desired amount to top-up, then tap “Next”, and you will usually receive a QR code

- Tap on “Save QR code to Photos”

- Launch the mobile banking app and open the QR code reader on the app

- Upload the QR code from your Photos folder

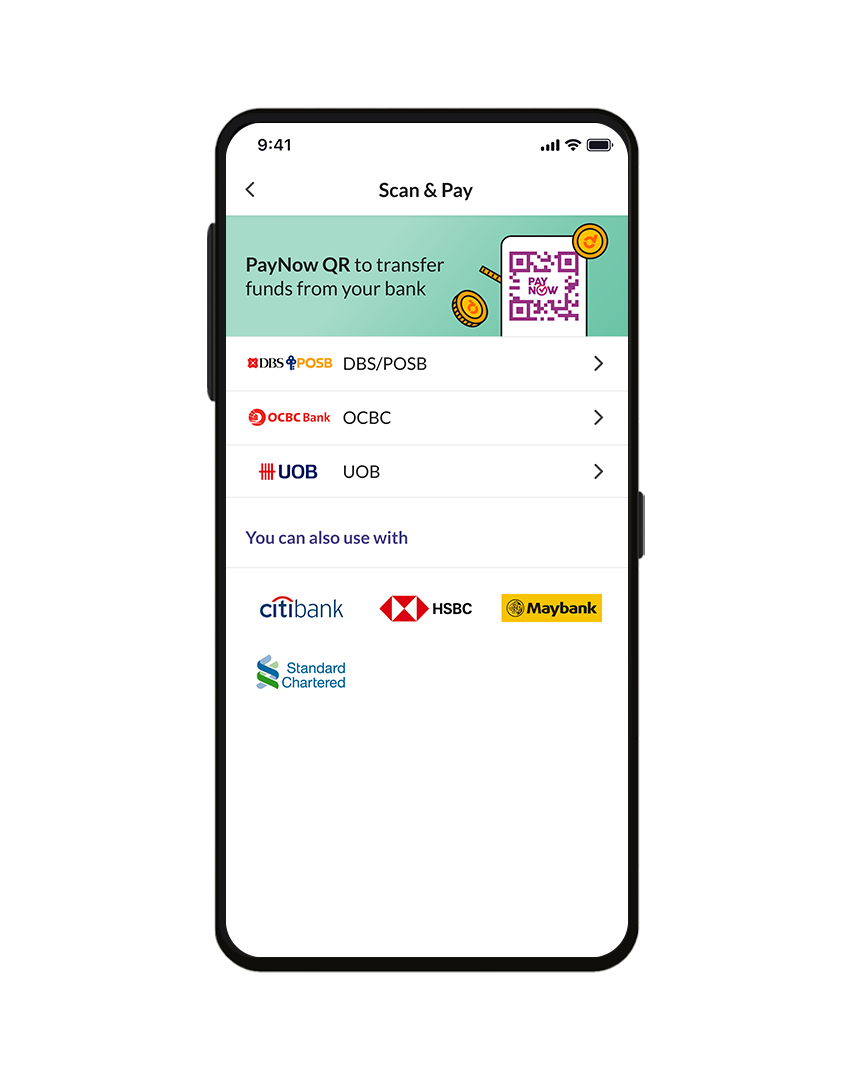

Find out if your bank is supported

Tap on “Find Out More” below, to view banks that support the “Scan and Pay” function. For DBS / POSB, OCBC, and UOB, you can view transaction tutorials for more instructions.- DBS/POSB

- OCBC

- UOB

- Citibank

- HSBC

- Maybank

- Standard Chartered

-

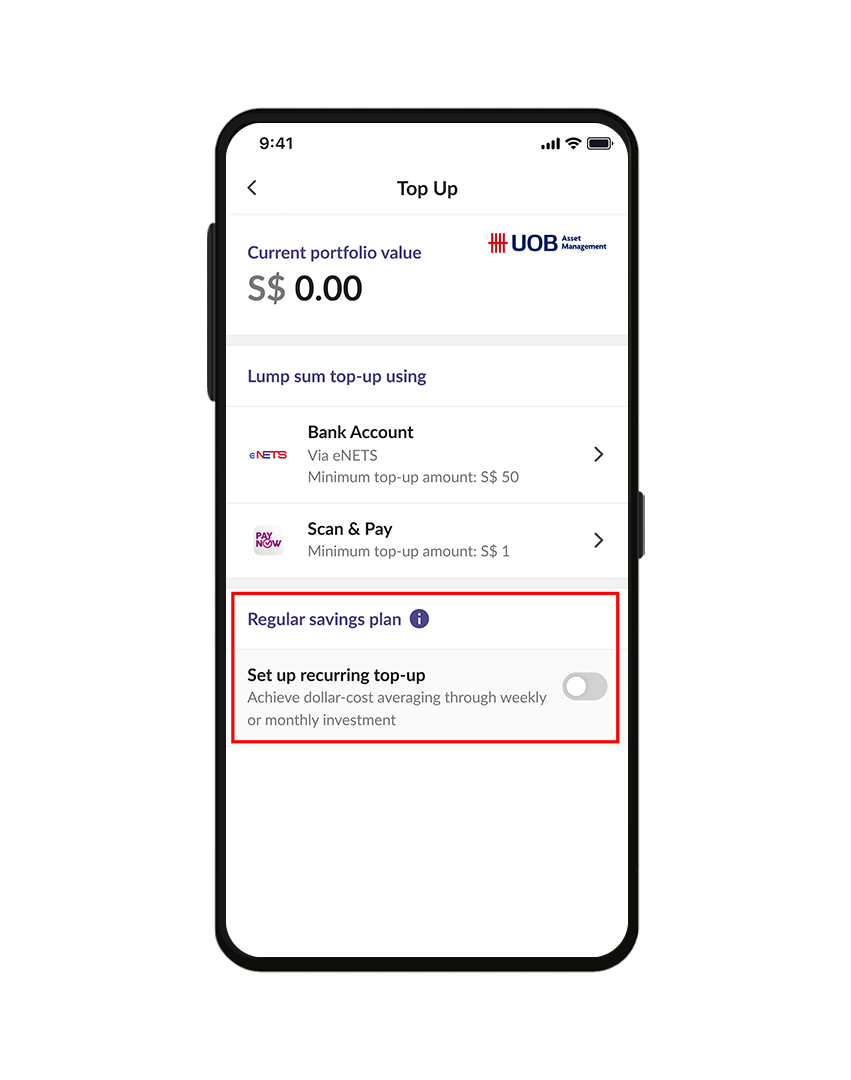

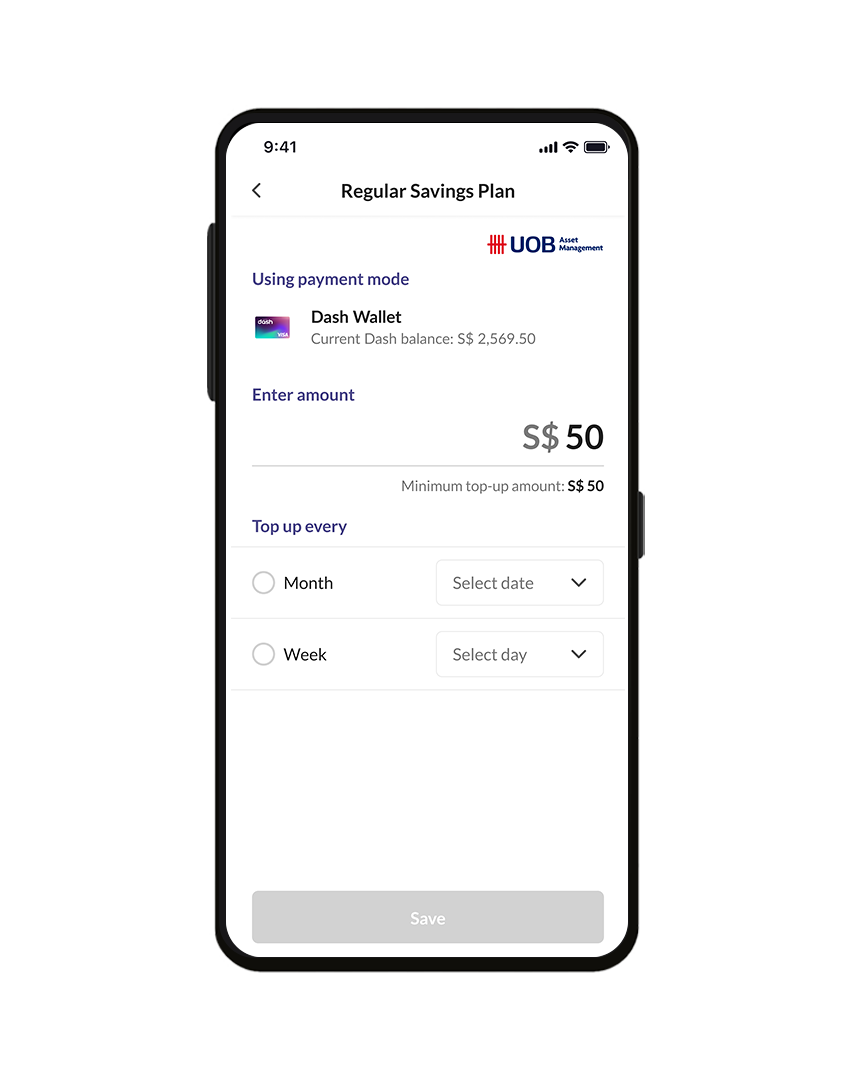

3. Regular Savings Plan (RSP)

Figure 5. How to activate regular top-ups on a monthly or weekly basis via Regular Savings Plan

All screens shown and reference to any asset class are for illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios.

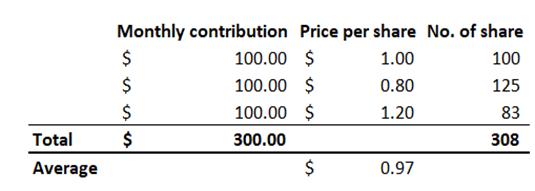

A regular savings plan allows you to automatically contribute consistent amounts at regular intervals (e.g. S$100 per month) to achieve Dollar-Cost Averaging (DCA).

DCA is an approach that uses top-ups in equal amounts, but which are made regularly regardless of market conditions. DCA helps you avoid emotional decision-making on a security’s short-term performance or direction, such as panic-buying or panic-selling during highly volatile market ups and downs.

By apportioning your top-ups in small sums, you can enjoy more flexibility and liquidity in managing your cash flow, without having to commit large amounts of capital at one go.

When you set aside a fixed budget of say, S$100 a month, you may end up buying shares at different quantities and price per share. In the long term, this approach lowers the impact of price volatility.

For example, if you set aside S$100 monthly for RSP top-up, you will end up with 100 shares of Security A when the current price is S$1 per share.

But if the price happens to drop to S$0.80 next month, and you still top-up S$100, you will end up buying 125 shares. But if the price increases to S$1.20, you will end up buying around 83 shares.

Over these 3 months, you will end up with an average price per share of S$0.97.

Figure 6. Illustration of average purchase costs using DCA approach

For illustration or information only and should not be relied upon or construed as a recommendation of specific model portfolios.

Over the long-term horizon, Regular Savings Plan helps you reduce average investment costs and avoid the risks of timing the market. Especially for time-strapped users, you can enjoy a more hands-off approach with this automated funding feature.

Learn more about the Regular Savings Plan top-up approach here.

How to activate a Regular Savings Plan with your Dash Wallet2 (see Figure 5)

- Toggle the slider to the right, to set up your recurring top-up amount.

- Enter the desired top-up amount (from S$50 to S$100) and select the start date and frequency of the plan

- Tap “Save” once you are ready.

- Enter the One Time Password (OTP) sent via SMS to confirm your Regular Savings Plan.

You will be redirected to the “Top Up” page once done, to view your saved top-up schedule. Notifications on

upcoming top-ups will be sent one day prior to the deduction date.

You may choose to stop the Regular Savings Plan at any time, or withdraw the funds, at no cost**.

2If there are insufficient funds in your Dash wallet, the recurring top-up will not be made. Dash

will attempt to make the required deduction again, on the following day.

How to make withdrawals from your UOBAM Robo-Invest account

You can withdraw any amount from your current portfolio into your bank account via PayNow linked to your account.

On the UOBAM Robo-Invest dashboard, tap on “Withdraw” (see Figure 2)

Allow 3-9 business days for the final withdrawal amount to reach your bank account.

Important notes for withdrawals:

- Your PayNow must be linked to the ID number registered for UOBAM Robo-Invest. Withdrawal to any other PayNow account will not be allowed.

- The maximum withdrawal limit for PayNow is S$200,000.

- If your withdrawal is 95 percent of your current portfolio value3 or higher, the full portfolio value will be withdrawn instead.

3Based on estimated portfolio value before deducting prevailing fees.

Your UOBAM Robo-Invest account is rebalanced with every top-up and withdrawal

When you make any top-up or withdrawal, your account value changes and the algorithm will automatically rebalance

your portfolio based on your selected portfolio.

Upon successful receipt of top-ups, you will be notified via app and email notification.

Do note that only ONE top-up or withdrawal transaction is allowed at any time. You may make another transfer

request

when your previous request has been successfully processed.

Funding your portfolio with UOBAM Robo-Invest is simple and easy, with automatic deposits and no charges on

top-ups

and withdrawals**. That’s not all – you can now grow your wealth sustainably with UOBAM Robo-Invest’s hybrid

portfolio strategy optimised for stable returns.

All screens shown and reference to any asset class are for illustration or information only and should not be

relied upon or construed as a recommendation of specific model portfolios.

Launch the Singtel Dash app and tap on the ‘Invest’ tile to start growing your wealth sustainably via UOBAM

Robo-Invest today. Get S$10 worth of credits* by simply opening an account by 30 June 2023 and an additional S$20 worth

of credits^ & 1,000 Dash reward points with a minimum top-up of

S$500.

Singtel Dash app is available on the Google Play store or Apple

App Store.

Please note that there are no charges for each top-up and withdrawal. However, the sale of assets will incur other

underlying fund-related fees such as trustee fees, valuation fees, US Securities and Exchange Commission (SEC)

fees (applies to sell trades for US-listed ETFs).

UOBAM Robo-Invest terms and conditions apply.

Important Notice & Disclaimers:

*UOBAM Robo-Invest S$10 worth of credits Activation Promotion is valid from 1 Jan 2023 to 30 June 2023 only. View full terms and conditions here.

^UOBAM Robo-Invest S$20 worth of credits Top-up Promotion is valid from 1 Jan 2023 to 30 June 2023, both dates inclusive, and open to all new and existing UOBAM Robo-Invest users. Limited to the

first 350 UOBAM Robo-Invest users who meet the promotional criteria, excluding users who have qualified for the

Lunar New Year Promotion.

View here for full promotional terms and conditions.

**Other US SEC fees, taxes and underlying fund-related fees apply. Visit dash.com.sg/uobam-roboinvest for details.

Fees are calculated and accrued daily and will be charged at the end of every calendar quarter. The quarter ends

on the last day of March, June, September and December.

This document is for your general information only. It does not constitute investment advice, recommendation or an

offer or solicitation to deal in Exchange Traded Funds (“ETFs”) or in units in any Unit Trusts (“Unit Trusts”,

ETFs and Unit Trusts shall together be referred to as “Fund(s)”) nor does it constitute any offer to take part in

any particular trading or investment strategy. This document was prepared without regard to the specific

objectives, financial situation or needs of any particular person who may receive it. The information is based on

certain assumptions, information and conditions available as at the date of this document and may be subject to

change at any time without notice. If any information herein becomes inaccurate or out of date, we are not obliged

to update it. No representation or promise as to the performance of the Fund or the return on your investment is

made. Past performance of any Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction,

projection or forecast of the economic trends or securities market are not necessarily indicative of the future

or likely performance of the Fund or UOBAM. The value of any Fund and the income from them, if any, may fall as

well as rise, and may have high volatility due to the investment policies and/or portfolio management techniques

employed by the Fund. Investments in any Fund involve risks, including the possible loss of the principal

amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited

(“UOB”), UOBAM, or any of their subsidiaries, associates or affiliates (“UOB Group”) or distributors of the Fund.

Market conditions may limit the ability of the platform to trade and investments in non-Singapore markets may be

subject to exchange rate fluctuations. The Fund may use or invest in financial derivative instruments and you

should be aware of the risks associated with investments in financial derivative instruments which are described

in the respective Fund's prospectus. The UOB Group may have interests in the Funds and may also perform or seek to

perform brokering and other investment or securities-related services for the Fund. Investors should read the

Fund's prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or

distributors, before investing. Notwithstanding the digital advisory services that will be provided to you through

UOBAM Robo-Invest, you may wish to seek advice from a financial adviser before making a commitment to invest

with UOBAM Robo-Invest, and in the event that you choose not to do so, you should consider carefully whether

investing through UOBAM Robo-Invest is suitable for you. Any reference to any specific country, financial

product or asset class is used for illustration or information purposes only and you should not rely on it for any

purpose. We will not be responsible for any loss or damage arising directly or indirectly in connection with, or

as a result of, any person acting on any information provided in this document. Services offered by UOBAM

Robo-Invest are subject to the UOBAM

Robo-Invest Terms and Conditions.

All screens shown and reference to any asset class are for illustration or information only and should not

be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative

of future or likely performance of any portfolio. Investments in any portfolio involve risks, including the

possible loss of the principal amount invested.

UOB Asset Management Ltd Co. Reg. No. 198600120Z