Grow your Wealth Seamlessly via UOBAM Robo-Invest Regular Savings Plan

There's a life saying that goes, “consistency is more powerful than perfection”. This applies not just to life,

but to how we grow our long-term wealth! Market changes are part and parcel of investment, and fund or equity

price movements may be hard to time. With the recent black swan events like the COVID-19 pandemic, global supply

chain crisis, the conflict in Ukraine and inflation - how does one grow wealth sustainably while staying

rational and disciplined?

UOBAM Robo-Invest can help you achieve stable and sustainable returns and grow your portfolio with a long-term

view - via the Regular Savings Plan (RSP) option. The RSP feature leverages a well-known strategy, called

Dollar-Cost Averaging (DCA), which can be used to stay invested by funding similar amounts on a regular

basis. By entering the market when it is both up and down, one can take advantage of ‘buying cheap’ when prices

are low, achieving potentially lower average prices and higher profits in the long term.

UOBAM Robo-Invest’s Regular Savings Plan allows users to carry out regular funding by automatically transferring

funds from Dash wallet to their UOBAM Robo-Invest accounts. Find out how you can use this feature to achieve DCA

using RSP.

What is UOBAM Robo-Invest?

Managing your finances can be a complex process, especially when you are time-poor and don’t have extensive

expertise.

Featuring hybrid portfolios tailored to your financial goals and risk appetite, UOBAM Robo-Invest offers a simple

and sustainable way to grow your wealth with minimal knowledge and time invested on your end.

In a nutshell:

- Robo-advisory service managed by experts from award-winning1 asset manager, UOB Asset Management (UOBAM)

- Combination of machine algorithms and human expertise that aims to offer you reliable financial advice and portfolio recommendations

- Opt for a sustainable future with Environmental, Social and Governance (ESG) integrated portfolio

- Easy to start - from just S$1, enjoy low advisory fees from 0.6% p.a.**

1Please visit www.uobam.com.sg for details on the full list of our awards.

Start reaching your financial goals with UOBAM Robo-Invest

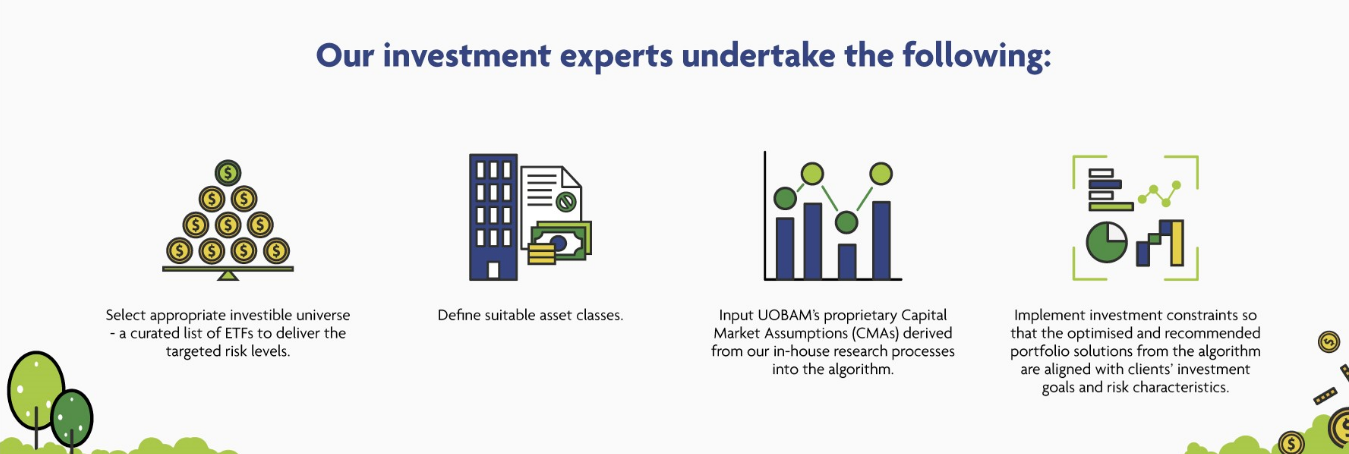

What makes UOBAM Robo-Invest unique is that it combines the insights and experience of UOB Asset Management’s

experts with our advanced proprietary smart algorithm to build a portfolio tailored to your

needs.

Figure 1. UOBAM Robo-Invest’s key investment inputs by UOBAM’s investment and product committees

UOBAM Robo-Invest is the first robo-adviser to be exclusively available on a mobile wallet - Singtel Dash.

Singtel Dash app is available on the Google Play store or Apple

App Store.

What is DCA and how does UOBAM Robo-Invest’s Regular Savings Plan take advantage of this strategy?

Dollar-Cost Averaging is a widely practiced strategy that involves contributing your capital in small, fixed

amounts on a regular basis. If you are a beginner to investing, time-strapped or prefer not to contribute

your capital in one lump sum, DCA can be a cost-effective approach. Take steady steps towards building a

robust portfolio with UOBAM Robo-Invest’s RSP top-up feature, which enables you to make small and consistent

contributions, similar to the DCA strategy. For example, you can use the RSP feature to top-up your portfolio from

as low as S$50 to S$100 a month over a long-term horizon (i.e. from 12 months to 3 years or more).

What makes funding your account via UOBAM Robo-Invest’s RSP feature a more seamless and less risky approach as

compared to other top-up options? It focuses on long-term results and uses natural market cycles to reduce your

average purchase cost per unit in the long run.

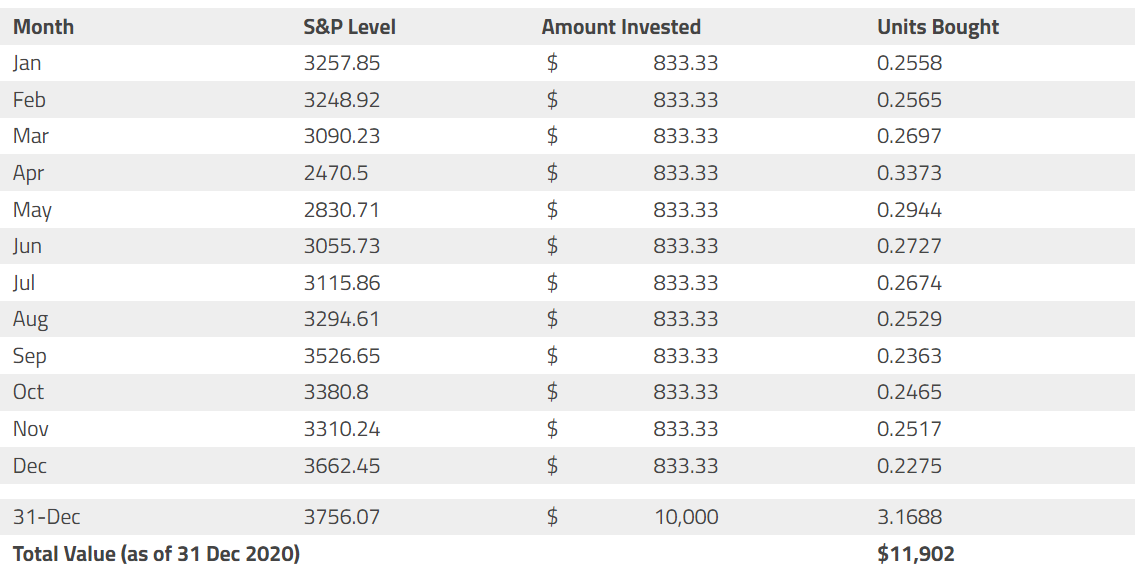

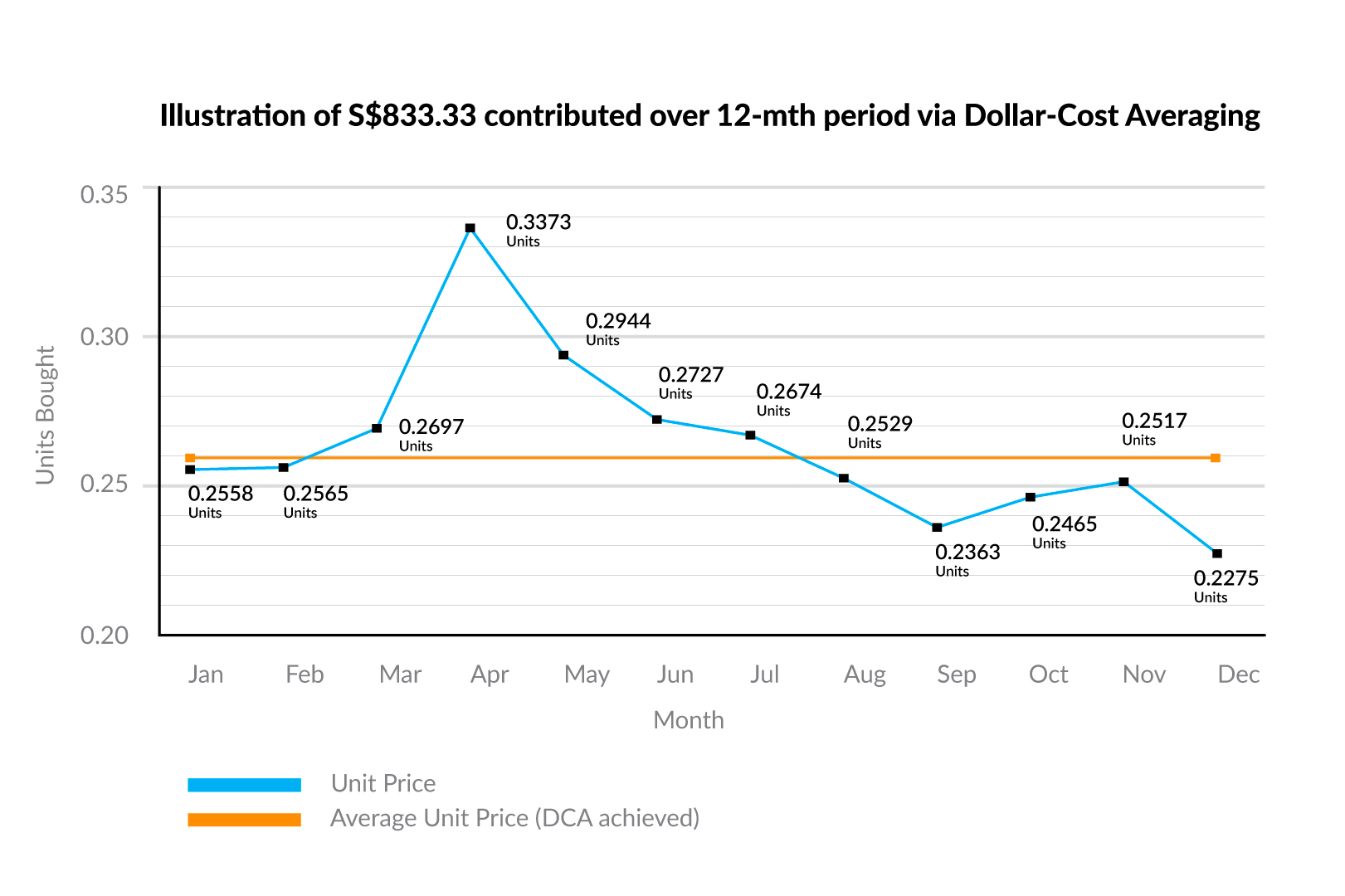

Source: DollarsandSense.sg

Source: DollarsandSense.sg

Figure 2. Comparison of S$833.33 regularly invested every month over 1 year using DCA vs lump-sum investment.

For illustration or information only and should not be relied upon or construed as a recommendation of specific

model portfolios. Projections shown are not indicative of future or likely performance of any portfolio.

Investments in any portfolio involve risks, including the possible loss of the principal amount invested.

In Figure 2, you can see a real-world example of how DCA works by comparing an S$10,000 investment over a 12-month

period to a lump sum investment in terms of total units purchased and total value.

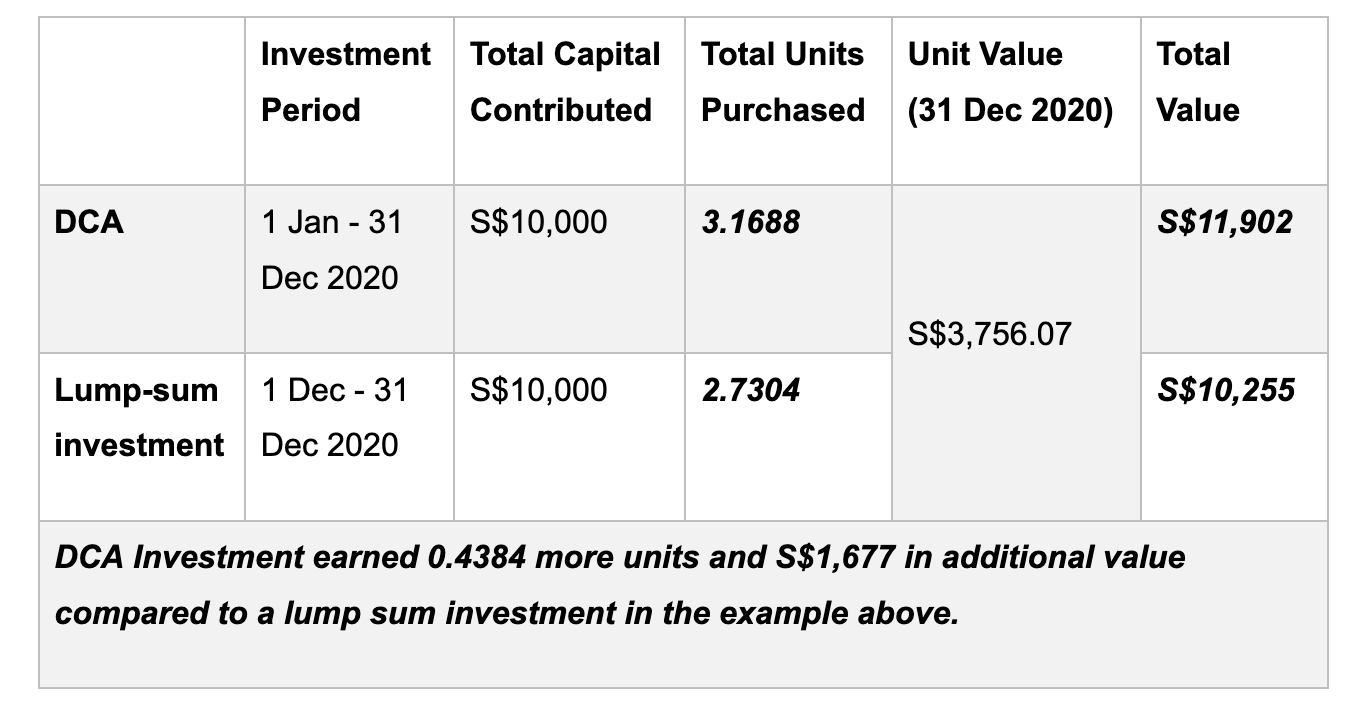

Figure 3. Comparison of Total Portfolio Value between different funding methods - DCA/lump-sum using fixed

investment period and capital contributed

Important Note: This table is not intended to be and does not constitute financial advice. It is solely for

the purpose of illustrating the DCA principle. All references to any asset class is for illustration or

information only and should not be relied upon or construed as a recommendation of specific model portfolios.

Projections shown are not indicative of future or likely performance of any portfolio. Investments in any

portfolio involve risks, including the possible loss of the principal amount invested.

In Figure 3, you can see how using the DCA method over a 12-month period (i.e. from 1 January 2020 to 1 December

2020) instead of paying a single lump-sum at the end of the year (i.e. on 31 January 2020) would have led to

0.4384 more total units purchased - and S$1,677 in additional value.

Figure 4. Illustration of how DCA can reduce average purchase cost/unit

All references to any asset class is for illustration or information only and should not be relied upon or

construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or

likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of

the principal amount invested.

In Figure 4, you can see DCA lessens the shock of market dips by buying more units when the unit price falls and

less units when the unit price rises. The lowest point in the market occurred when the unit price dropped from

S$3,090.23 in March to S$2,470.50 in April 2020 (see Figure 2). As a result, the number of units bought rose from

0.2697 to 0.3373 respectively. From May to December 2020, the unit price rose from S$2830.71 to S$3662.45 (see

Figure 2), recovering from the March/April 2020 downturn - leading to greater overall portfolio value from the

additional units purchased during the drop.

As illustrated in Figure 4, having an RSP that uses the DCA strategy can help you take advantage of purchasing a

higher number of units at a cheaper price - which can lead to potentially lower average unit purchase costs! Using

the RSP method paves the way for steady portfolio growth as you reduce the risk of maximum negative returns during

market downturns and avoid panic selling or holding.

How can UOBAM Robo-Invest’s Regular Savings Plan help with long-term financial planning?

UOBAM Robo-Invest enables you to achieve DCA by automating fixed contributions at regular intervals to an RSP,

which can give you more flexibility and liquidity in managing your portfolio.

Here are some key benefits to using UOBAM Robo-Invest’s RSP:

- Make regular contributions with small capital: invest small sums on a regular basis that match your financial needs and risk appetite.

- No need to ‘time’ the market: spend less time and energy constantly monitoring market fluctuations by automating RSP top-ups

- Intelligent, non-impulsive investing: staying the course with RSP takes the guesswork and stress out of monitoring market fluctuations.

- Reduce long-term investment costs: avoid the risk of paying peak prices for funds during highly volatile market conditions

While RSP makes it easier for you to achieve DCA with RSP, it carries some degree of risk just like any other investment. Here are four investment risk factors that you should always be aware of:

- Company risk: a company’s poor performance causes its market value to drop.

- Volatility and market risk: market downturns can cause stock prices to plummet.

- Opportunity cost: missed opportunities to pursue better performing investments.

- Liquidity risk: some investments may be difficult or take time to convert into cash.

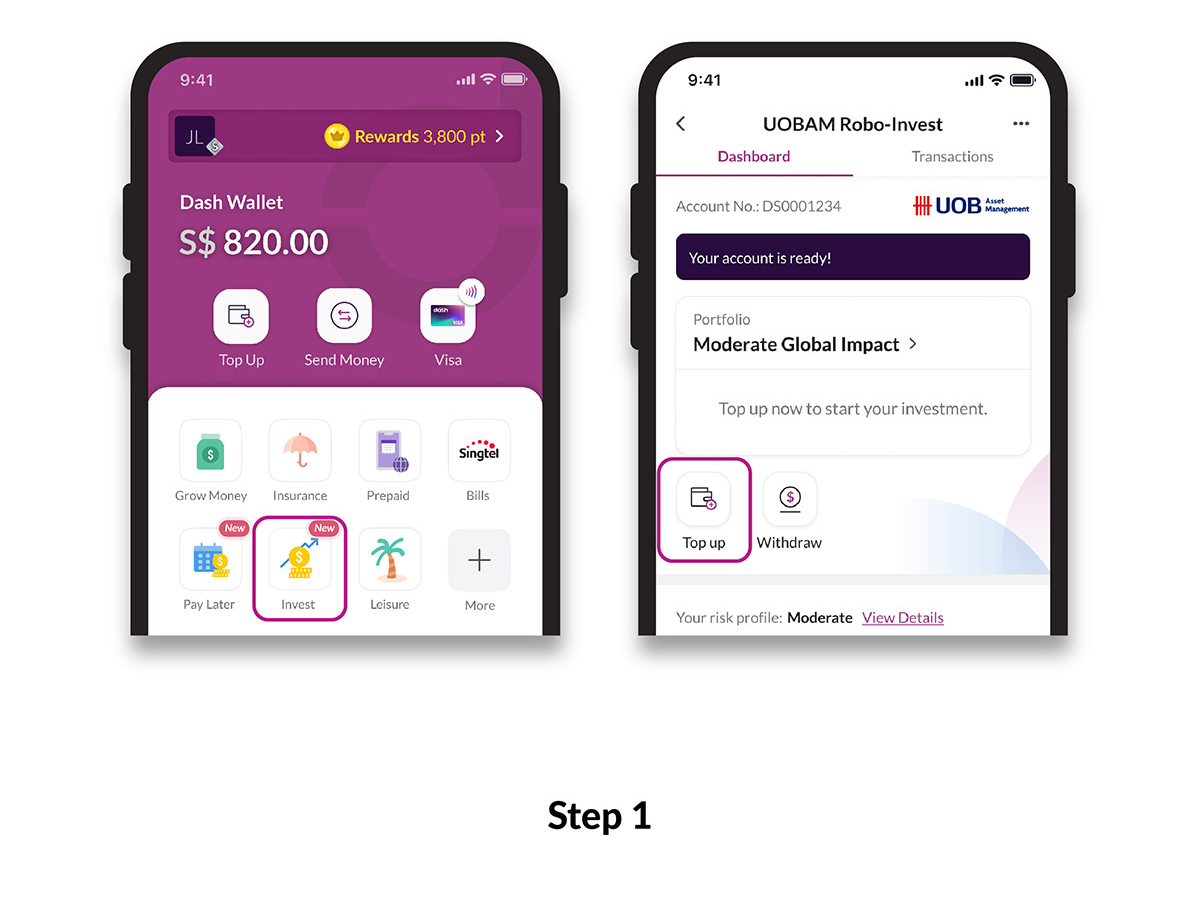

How to set up a Regular Savings Plan using UOBAM Robo-Invest

Activating top-ups via the Regular Savings Plan feature on UOBAM Robo-Invest is quick and easy. You can download/launch the Singtel Dash on your iOS or Android device and take the 4 quick steps below to start growing your wealth using the Dollar-Cost-Averaging method.

Step 1: Launch the Singtel Dash App and tap the ‘Invest’ button on the home screen |

|

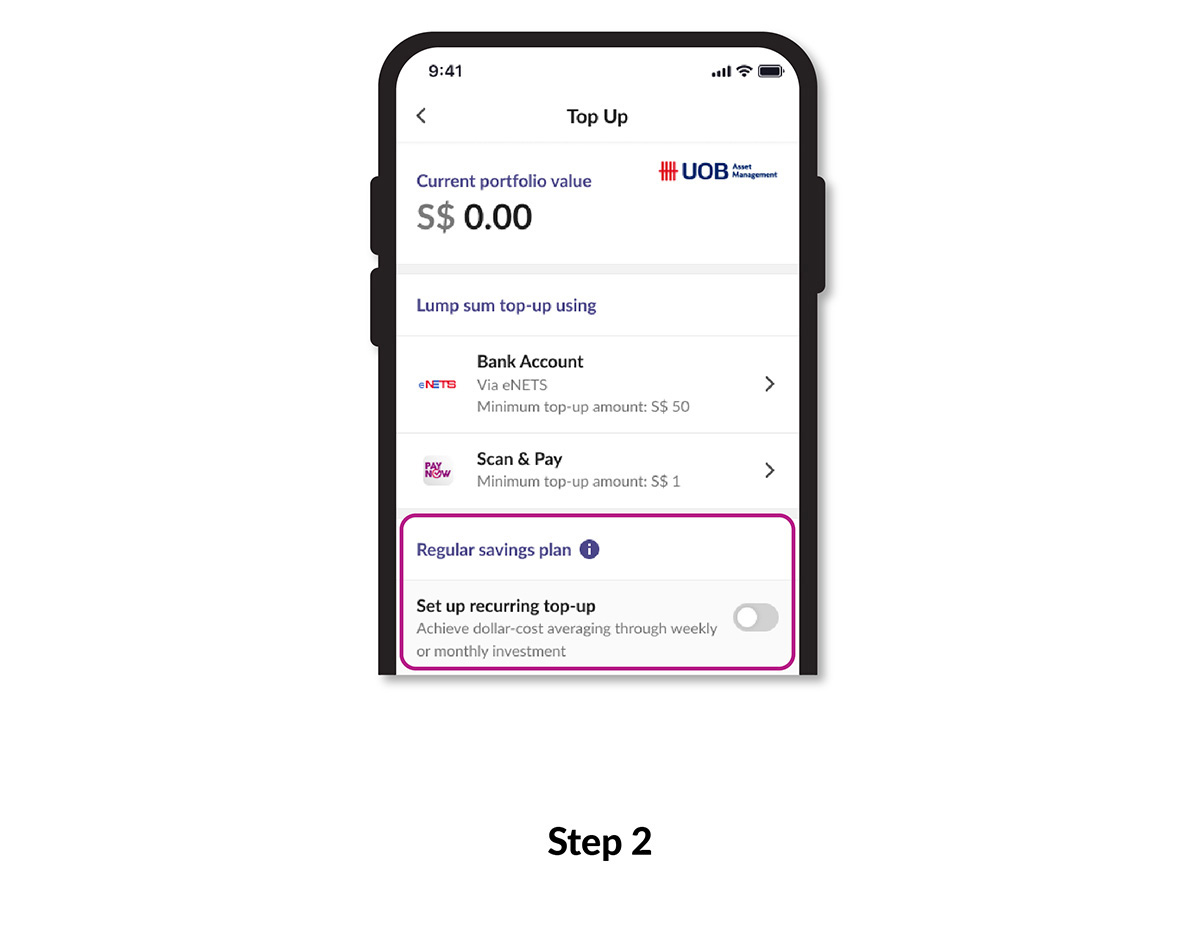

Step 2: Toggle the ‘Set up recurring top-up’ slider to the right and tap ‘agree’ to activate |

|

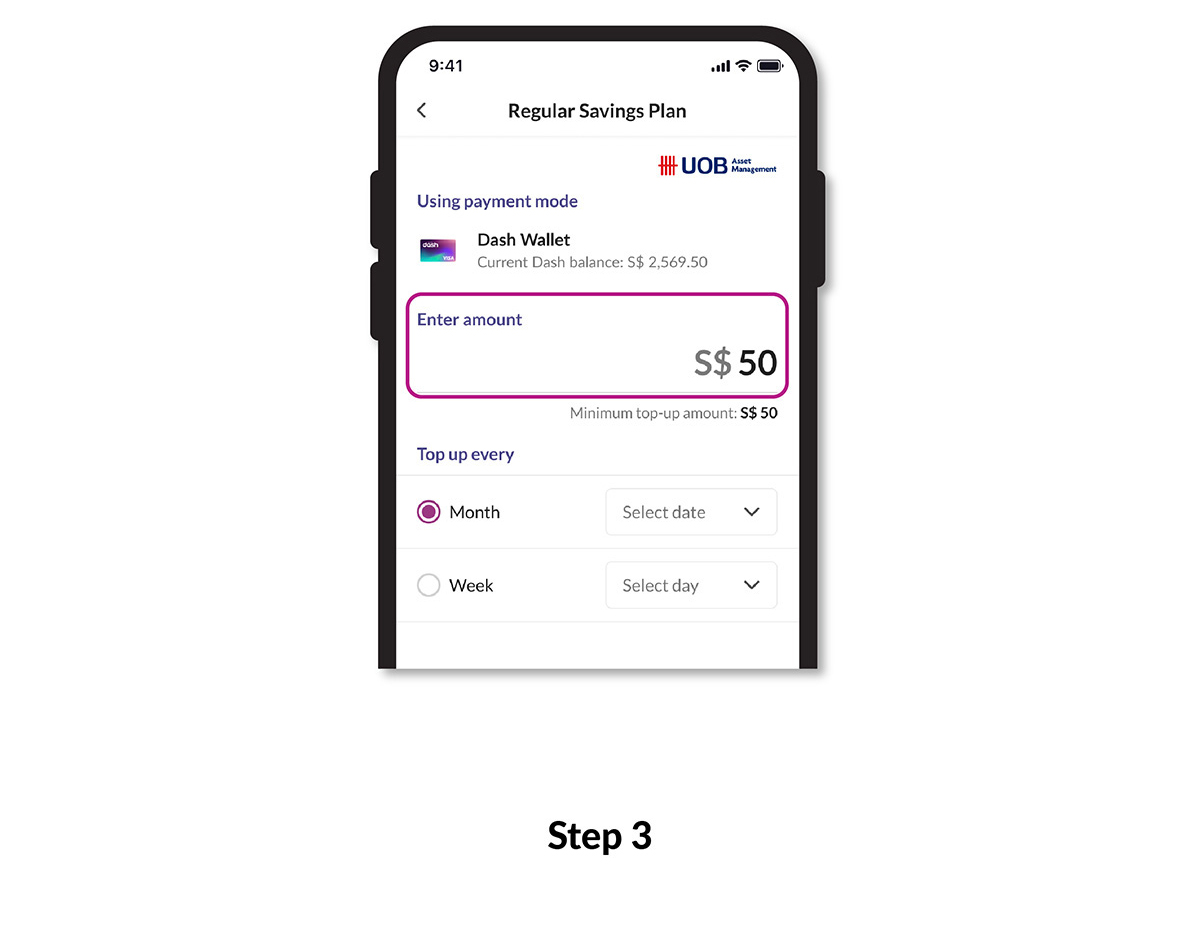

Step 3: Enter the top-up amount, select the top-up date and tap ‘Save’ |

|

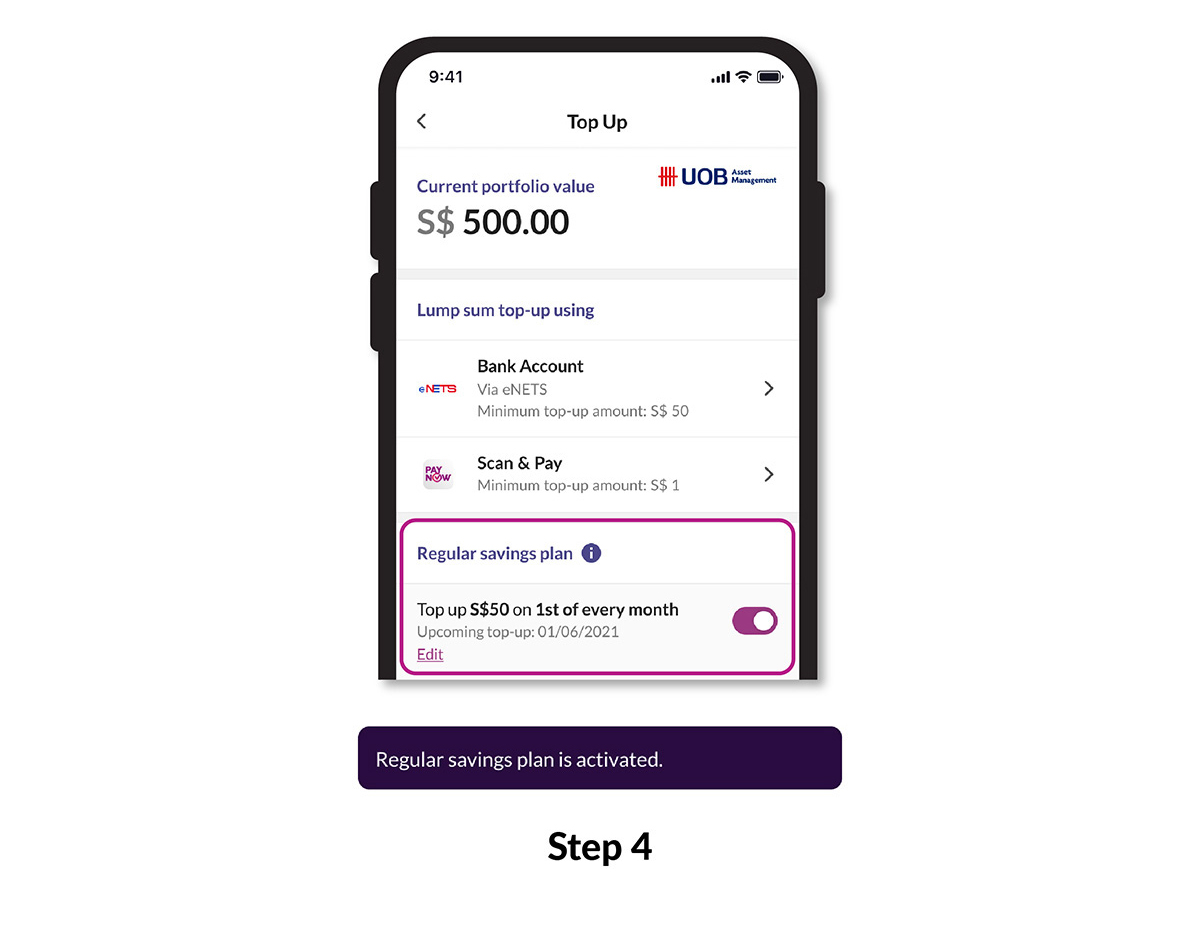

Step 4: Enjoy automated, recurring top-ups with the activated Regular Savings Plan |

|

All screens shown and reference to any asset class are for illustration or information only and should not be

relied upon or construed as a recommendation of specific model portfolios. Projections shown are not

indicative of future or likely performance of any portfolio. Investments in any portfolio involve risks,

including the possible loss of the principal amount invested.

Note: Your RSP will be funded through your Dash wallet. You can use PayNow and Dash PET to add funds to

your Dash wallet.

Stay on track with your long-term financial goals via Regular Savings Plan!

With your Regular Savings Plan activated, you can contribute consistently to your portfolio, with funds being

invested on a weekly or monthly basis. If you are new to investing or prefer making small yet regular

increments, using the RSP top-up option to fund your account can help kickstart your investment journey.

The best part is that you can start topping up your RSP from as little as S$50 (minimum) every

week/month! You can also expect to receive notifications on RSP deduction one day prior to the deduction

date.

With the Regular Savings Plan feature, you can focus on your financial goals objectively, without emotional

biases - achieving dollar-cost averaging through a seamless wealth accumulation journey! Enjoy a simpler

way to grow your wealth with automated recurring, fixed contributions to your portfolio. Plus, ride out the

impact of short-term market fluctuations on an equity or investment fund’s performance to achieve long-term

growth.

UOBAM Robo-Invest provides simple tools to manage your portfolio and a fuss-free way to start your robo-adviser

journey. You can also choose between different portfolios, including one that contributes to a sustainable

future through investing in ESG-aware companies, UOBAM Robo-Invest is designed to help both novice and seasoned

investors power up their idle cash.

All screens shown and reference to any asset class are for illustration or information only and should not be

relied upon or construed as a recommendation of specific model portfolios.

Launch the Singtel Dash app and tap on the ‘Invest’ tile to start growing your wealth sustainably via

UOBAM Robo-Invest today. Get S$10 worth

of credits* by simply opening an account by 30 June 2023, and

an additional S$20 worth of credits^ & 1,000

Dash reward points

with a minimum top-up of S$500.

Singtel Dash app is available on the Google Play store or Apple

App Store.

Please note that there are no charges for each top-up and withdrawal. However, the sale of assets will incur

other underlying fund-related fees such as trustee fees, valuation fees, US Securities and Exchange Commission

(SEC) fees (applies to sell trades for US-listed ETFs).

UOBAM Robo-Invest terms and conditions apply.

Important Notice & Disclaimers:

*UOBAM Robo-Invest S$10 worth of credits Activation Promotion is valid from 1 Jan 2023 to 30 June 2023 only. View full terms and conditions here.

^UOBAM Robo-Invest S$20 worth of credits Top-up Promotion is valid from 1 Jan 2023 to 30 June 2023, both dates inclusive, and open to all new and existing UOBAM Robo-Invest users. Limited to the

first 350 UOBAM Robo-Invest users who meet the promotional criteria, excluding users who have qualified for the

Lunar New Year Promotion.

View here for full promotional terms and conditions.

**Other US SEC fees, taxes and underlying fund-related fees apply. Visit dash.com.sg/uobam-roboinvest for details.

Fees are calculated and accrued daily and will be charged at the end of every calendar quarter. The quarter ends

on the last day of March, June, September and December.

This document is for your general information only. It does not constitute investment advice, recommendation or

an offer or solicitation to deal in Exchange Traded Funds (“ETFs”) or in units in any Unit Trusts (“Unit

Trusts”, ETFs and Unit Trusts shall together be referred to as “Fund(s)”) nor does it constitute any offer to

take part in any particular trading or investment strategy. This document was prepared without regard to the

specific objectives, financial situation or needs of any particular person who may receive it. The information

is based on certain assumptions, information and conditions available as at the date of this document and may be

subject to change at any time without notice. If any information herein becomes inaccurate or out of date, we

are not obliged to update it. No representation or promise as to the performance of the Fund or the return on

your investment is made. Past performance of any Fund or UOB Asset Management Ltd (“UOBAM”) and any past

performance, prediction, projection or forecast of the economic trends or securities market are not

necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of any Fund and the

income from them, if any, may fall as well as rise, and may have high volatility due to the investment

policies and/or portfolio management techniques employed by the Fund. Investments in any Fund involve

risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or

guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiaries, associates

or affiliates (“UOB Group”) or distributors of the Fund. Market conditions may limit the ability of the platform

to trade and investments in non-Singapore markets may be subject to exchange rate fluctuations. The Fund may use

or invest in financial derivative instruments and you should be aware of the risks associated with investments

in financial derivative instruments which are described in the respective Fund's prospectus. The UOB Group may

have interests in the Funds and may also perform or seek to perform brokering and other investment or

securities-related services for the Fund. Investors should read the Fund's prospectus, which is available and

may be obtained from UOBAM or any of its appointed agents or distributors, before investing. Notwithstanding the

digital advisory services that will be provided to you through UOBAM Robo-Invest, you may wish to seek advice

from a financial adviser before making a commitment to invest with UOBAM Robo-Invest, and in the event that

you choose not to do so, you should consider carefully whether investing through UOBAM Robo-Invest is suitable

for you. Any reference to any specific country, financial product or asset class is used for illustration

or information purposes only and you should not rely on it for any purpose. We will not be responsible for any

loss or damage arising directly or indirectly in connection with, or as a result of, any person acting on any

information provided in this document. Services offered by UOBAM Robo-Invest are subject to the UOBAM

Robo-Invest Terms and Conditions.

All screens shown and reference to any asset class are for illustration or information only and should

not be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not

indicative of future or likely performance of any portfolio. Investments in any portfolio involve risks,

including the possible loss of the principal amount invested.

UOB Asset Management Ltd Co. Reg. No. 198600120Z