How Auto-Rebalancing your Portfolio Works on UOBAM Robo-Invest

Managing your finances can be a complex process especially when you are time-poor and don’t have extensive

expertise.

UOBAM Robo-Invest offers a simple and sustainable way to grow your wealth. Featuring hybrid portfolios tailored to

your financial goals and risk appetite, you require minimal knowledge and time invested on your end.

In a nutshell:

- Robo-advisory service managed by experts from award-winning1 asset manager, UOB Asset Management (UOBAM)

- Combination of machine algorithms and human expertise that aims to offer you reliable financial advice and portfolio recommendations

- Opt for a sustainable future with Environmental, Social and Governance (ESG) integrated portfolio

- Easy to start - from just S$1, enjoy low advisory fees from 0.6% p.a.**

1Please visit www.uobam.com.sg for details on the full list of our awards.

Start reaching your financial goals with UOBAM Robo-Invest

What sets UOBAM Robo-Invest apart is that it combines the insights and experience of UOB Asset Management’s

experts, with advanced digital algorithms. UOBAM Robo-Invest uses a proprietary smart algorithm to build a portfolio tailored to your needs.

Figure 1. UOBAM Robo-Invest’s key investment inputs by UOBAM’s investment and product committees

UOBAM Robo-Invest is the first robo-adviser to be exclusively available on a mobile wallet - Singtel Dash.

Singtel Dash app is available on the Google Play Store or Apple

App Store.

Rebalancing your portfolio with UOBAM Robo-Invest

Too much weightage on a particular portfolio asset might provide over-exposure while too little weightage might

lead to underperformance. How can you maintain your optimal portfolio diversification throughout your journey

while still staying within your risk appetite? Here’s where rebalancing can help. Let’s explore this strategy.

Each portfolio in UOBAM Robo-Invest has a target allocation based on recommendation by UOBAM experts and the

proprietary algorithm. Due to market fluctuations, your asset allocation can drift from your target allocation.

Rebalancing is the action of returning your portfolio to the original target allocation to maintain the same risk

level that your portfolio is exposed to.

Keeping your portfolio balanced ensures that you do not deviate from the financial goals you’ve originally set.

How does portfolio rebalancing work?

Your UOBAM Robo-Invest portfolio consists of a mix of different assets, configured to match your risk assessment

and desired financial outcome. This is referred to as asset allocation.

Over your investment horizon, as different assets perform at different rates, the value of your assets will change

which may alter the intended asset allocation.

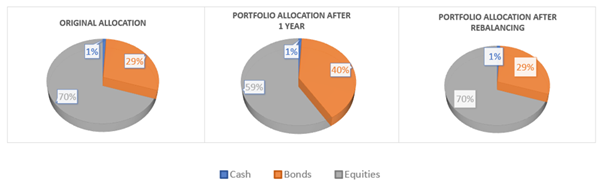

For example, consider a portfolio with a total value of S$50,000. The asset allocation is planned as follows:

- 70% Equities (S$35,000)

- 29% Bonds (S$14,500)

- 1% in cash (S$500)

Figure 2. Sample of how Portfolio Allocation changes from before rebalancing to after rebalancing

All references to any asset class are for illustration or information only and should not be relied upon or

construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or

likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of

the principal amount invested.

After one year:

The value of the equities falls slightly, from S$35,000 to S$32,450.

The value of the bonds grows from S$14,500 to S$22,000, while the cash grows from S$500 to S$550.

While the portfolio’s total value has grown to S$55,000, the original 70-29 equity-to-bond asset allocation has

been lost. The equities now account for just 59% of the portfolio, while bonds account for 40%. The portfolio has

a heavier weightage on lower-risk assets and may not gain as much if equities performed better in the near-term.

For the individual holding on to this portfolio, he/she may desire greater rewards and thus this portfolio should

be rebalanced to the original target allocation to maintain desired reward/risk levels.

This could mean selling off assets that account for too much of the portfolio, while buying assets that have

dropped below their intended weightage (e.g. in the example above, it might mean liquidating some bond assets and

buying more equities).

How does UOBAM Robo-Invest rebalance your portfolio?

UOBAM Robo-Invest automatically rebalances your portfolio at no additional cost

regularly by smart algorithm that identifies the difference between the targeted asset allocation, and the current

weightage of existing assets. It then executes orders to buy or sell the relevant assets, without requiring manual

input from you.

Since the rebalancing is done automatically at no cost, you save both time and money. The only fees charged are

for the usual sale of funds, at the point of rebalancing.

The brokerage cost of performing the rebalancing is included in the annual fee, with the exception of small SEC

fees of 0.00051% of the value sold.

When is your portfolio rebalanced?

UOBAM Robo-Invest will rebalance your portfolio under three circumstances:

- Quarterly re-balancing- UOBAM Robo-Invest checks to ensure the correct asset allocation is maintained and restored, every three months#.

- When you make a top-up

- When you make a withdrawal

When you top up or withdraw from your portfolio, UOBAM Robo-Invest will automatically rebalance the portfolio to

the desired allocation mix based on your latest account value.

You can learn how to top-up and withdraw from UOBAM Robo-Invest here.

#Quarterly re-balancing takes place on the last business day of each quarter. Kindly take note that

if rebalancing has been done within 31 days of the scheduled quarterly rebalancing, due to top ups or

withdrawals performed, the quarterly re-balancing will not be conducted again.

What is the purpose of auto-rebalancing?

Auto-rebalancing helps to ensure you keep pace with your financial goals. It ensures you maintain an asset allocation that matches your risk appetite, and that you grow your portfolio in a disciplined, periodic manner over time.

- Saves on time and effort

- Mitigates undue risk and optimises asset allocation

- Removes the emotional aspect of investing

- Offers more flexibility in your investments

1. Saves on time and effort

Manually rebalancing a portfolio can be time intensive. It requires you to track changing asset values, and

manually make decisions to buy or sell. If you use the services of a financial professional you may be charged a

fee, on top of the usual fees to purchase and sell assets on various platforms.

With auto-rebalancing, you can enjoy the sheer convenience of having the heavy lifting work of manual rebalancing

off your hands.

2. Mitigates undue risk and optimises asset allocation

When your asset allocation no longer matches the original risk profile, you may be taking on more risk than

intended.

For example, if you are a low-risk investor, you may want more of your portfolio allocation to be under actively

managed funds. But if your portfolio has not been rebalanced in a long time, and the weightage of equities has

grown to 70% or 80%, you will actually be exposed to more risk than desired.

Likewise, you may find that your portfolio is failing to meet financial targets, because of over or under-exposure

to the wrong asset classes resulting in too much risk or too conversative a portfolio.

Rebalancing your portfolio is essential to maintaining the level of diversification you are comfortable with

across multiple asset classes.

3. Removes the emotional aspect of investing

If you rebalance manually, there can be strong emotional temptation to deviate from the intended plan.

For example, if your equities are meant to constitute 70% of the portfolio, and perform well that they now make up

80%, it can feel tempting to hold on to more of these higher-risk assets that exceed your risk appetite and result

in losses you cannot stomach. However, an expected sudden market condition that negatively impacts your equity

funds will affect 80% of your portfolio, 10% more than the original intended allocation.

With automated rebalancing by UOBAM Robo-Invest, the robo-adviser can aim to take profit of better-performing

assets and minimising unnecessary additional risks from over-exposure in specific funds. Overtime, this helps

optimise your portfolio to be aligned with your financial goals objectively and avoid emotional biases.

4. Offers more investment flexibility

When you make a top-up, the funds are used to buy asset classes that are currently under-weight, returning them to

the correct allocation. This can also eliminate the need to sell other assets to rebalance, if the top-up amount

is sufficient.

When you make a withdrawal, the money first comes from the sale of assets that are already overweight, so you

maintain the right asset allocation with minimal disruption or costs.

After rebalancing, you can continue to track the performance of your portfolio against your savings, or financial goals.

Auto-rebalancing does involve some potential drawbacks

When an asset class outperforms and grows beyond its allocated weightage, auto-rebalancing may trigger a sale of

the asset. For example, if your portfolio is meant to be 70% equities, but the equities grow in value and exceed

70% of the total portfolio, auto-rebalancing may sell off more equities to shrink the weightage back to 70%. This

may result in a loss of potential returns from an outperforming asset.

Auto-rebalancing may also incur costs, through the repeated transactions involved in rebalancing the portfolio.

Read more on how to start funding your UOBAM Robo-Invest account.

Be it novice or seasoned investor, UOBAM Robo-Invest enables you to diversify across multiple geographies and

sectors via its unique portfolio mix of actively managed funds and Exchange-Traded funds (ETFs). With a hybrid

investing strategy designed to mitigate risk and riding out short-term market fluctuations, you can aim for stable

and long-term returns.

All screens shown and reference to any asset class are for illustration or information only and should not be

relied upon or construed as a recommendation of specific model portfolios.

Launch the Singtel Dash app and tap on the ‘Invest’ tile to start growing your wealth sustainably via UOBAM

Robo-Invest today. Get S$10 worth of credits* by simply opening an account by 30 June 2023, and

an additional S$20 worth of credits^ & 1,000 Dash reward points with a minimum top-up of S$500.

Singtel Dash app is available on the Google Play Store or Apple

App Store.

Please note that there are no charges for each top-up and withdrawal. However, the sale of assets will incur other

underlying fund-related fees such as trustee fees, valuation fees, US Securities and Exchange Commission (SEC)

fees (applies to sell trades for US-listed ETFs).

UOBAM Robo-Invest terms and conditions apply.

Important Notice & Disclaimers:

*UOBAM Robo-Invest S$10 worth of credits Sign-up Promotion is valid from 1 Jan 2023 to 30 June

2023 only. View full terms and conditions here.

^UOBAM Robo-Invest S$20 worth of credits Top-up Promotion is valid from 1 Jan 2023 to 30 June

2023, both dates inclusive, and open to all new and existing UOBAM Robo-Invest users. Limited to the first 500

UOBAM Robo-Invest users who meet the promotional criteria, excluding users who have qualified for the Lunar New

Year Promotion.

View here for full promotional terms and conditions.

**Other US SEC fees, taxes and underlying fund-related fees apply. Visit dash.com.sg/uobam-roboinvest for details.

Fees are calculated and accrued daily and will be charged at the end of every calendar quarter. The quarter ends

on the last day of March, June, September and December.

This document is for your general information only. It does not constitute investment advice, recommendation or an

offer or solicitation to deal in Exchange Traded Funds (“ETFs”) or in units in any Unit Trusts (“Unit Trusts”,

ETFs and Unit Trusts shall together be referred to as “Fund(s)”) nor does it constitute any offer to take part in

any particular trading or investment strategy. This document was prepared without regard to the specific

objectives, financial situation or needs of any particular person who may receive it. The information is based on

certain assumptions, information and conditions available as at the date of this document and may be subject to

change at any time without notice. If any information herein becomes inaccurate or out of date, we are not obliged

to update it. No representation or promise as to the performance of the Fund or the return on your investment is

made. Past performance of any Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction,

projection or forecast of the economic trends or securities market are not necessarily indicative of the future

or likely performance of the Fund or UOBAM. The value of any Fund and the income from them, if any, may fall as

well as rise, and may have high volatility due to the investment policies and/or portfolio management techniques

employed by the Fund. Investments in any Fund involve risks, including the possible loss of the principal

amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited

(“UOB”), UOBAM, or any of their subsidiaries, associates or affiliates (“UOB Group”) or distributors of the Fund.

Market conditions may limit the ability of the platform to trade and investments in non-Singapore markets may be

subject to exchange rate fluctuations. The Fund may use or invest in financial derivative instruments and you

should be aware of the risks associated with investments in financial derivative instruments which are described

in the respective Fund's prospectus. The UOB Group may have interests in the Funds and may also perform or seek to

perform brokering and other investment or securities-related services for the Fund. Investors should read the

Fund's prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or

distributors, before investing. Notwithstanding the digital advisory services that will be provided to you through

UOBAM Robo-Invest, you may wish to seek advice from a financial adviser before making a commitment to invest

with UOBAM Robo-Invest, and in the event that you choose not to do so, you should consider carefully whether

investing through UOBAM Robo-Invest is suitable for you. Any reference to any specific country, financial

product or asset class is used for illustration or information purposes only and you should not rely on it for any

purpose. We will not be responsible for any loss or damage arising directly or indirectly in connection with, or

as a result of, any person acting on any information provided in this document. Services offered by UOBAM

Robo-Invest are subject to the UOBAM

Robo-Invest Terms and Conditions.

All screens shown and reference to any asset class are for illustration or information only and should not

be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative

of future or likely performance of any portfolio. Investments in any portfolio involve risks, including the

possible loss of the principal amount invested.

UOB Asset Management Ltd Co. Reg. No. 198600120Z